Keynote speech by Bank of Greece Deputy Governor John (Iannis) Mourmouras entitled: “Fin-RegTech: Regulatory challenges with emphasis on Europe” in New York at a Cornell University conference

28/02/2019 - Speeches

New York, Cornell University, 28 February 2019

Introduction

It is a great pleasure for me to be in New York upon the invitation of Citigroup to speak at Cornell University’s “Tech Day”, at such a ground-breaking seminar, entitled “Big Data and FinTech Innovation”. As you know, the University which hosts us today was founded 150 years ago by Ezra Cornell, the inventor of the electric telegraph and founder of Western Union. His motto – which became the University’s founding principle, “an institution where anyone can find instruction in any study” – has formed the basis for Cornell University’s countless contributions across all fields of knowledge, prioritising public engagement to help improve quality of life worldwide. At this University, founded by such a revolutionary spirit, I have the opportunity to share my thoughts and exchange views with you on what economists have called a major catalyst in the “fourth industrial revolution”, the FinTech industry, due to its significant transformative impact on financial services. And let me draw your attention to another parallel: the term FinTech first appeared in the public domain, introduced in the early 1990s by Citigroup, the main organiser of today’s event!

My speech today will be structured as follows: After offering some introductory remarks to clarify technical jargon and some remarks on FinTech’s current landscape, I will then move on to an overview of FinTech’s current state-of-play in the European Union (EU), focusing on its potential impact on the established financial sector, as well as the risks and challenges ahead. Finally, I will take a look into the regulation gap as far as FinTech activities are concerned and possible ways to fill this gap.

2. The FinTech landscape today

2.1 What is Fintech?

Despite its widespread usage, FinTech does not have a broadly and formally accepted definition. In general terms, FinTech stands for Financial Technology and describes technologically enabled financial innovations that could result in new business models, applications, processes or products with an associated material effect on financial markets and institutions and the provision of financial services.

A term associated with FinTech is RegTech, a commonly recognised term for technologies that can be used by market participants, to follow regulatory and compliance requirements more effectively and efficiently, and by competent authorities, for supervisory purposes. RegTech is not entirely new, but is rapidly developing (in line with other technological applications), fuelled by growing computing power, emerging technology’s diminishing cost and the data explosion. In 2018, RegTech investment reached the amount of US $2 billion and is forecasted to exceed $ 76 billion by 2022. RegTech provides senior executives with an opportunity to introduce new capabilities that are designed to leverage existing systems and data to produce regulatory data and reporting in a cost-effective, flexible and timely manner without taking the risk of replacing / updating legacy systems. Having said this, my intention today is to focus on the regulatory challenges surrounding FinTech and how to close the regulatory gap I mentioned earlier.

2.2 FinTech landscape

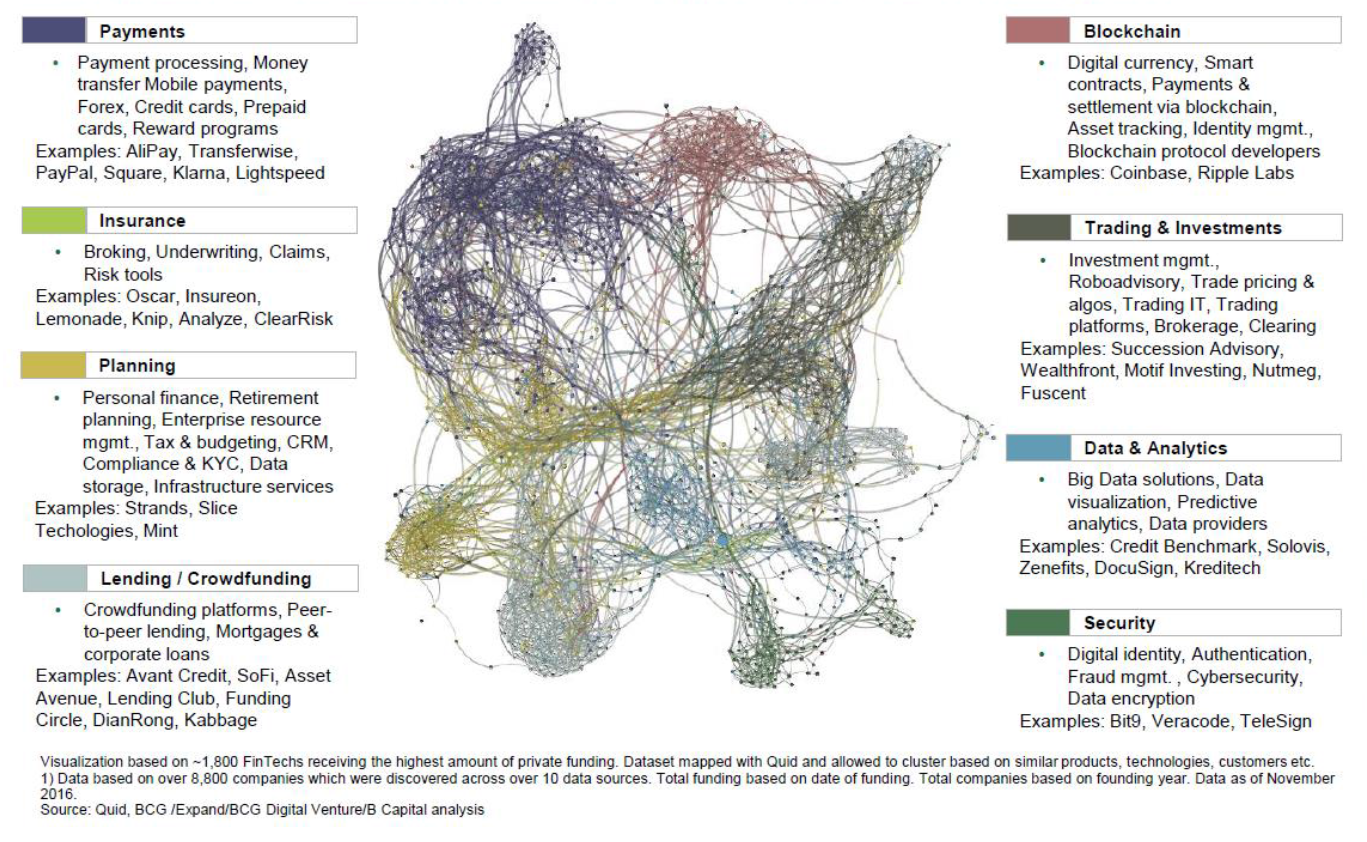

The global FinTech landscape can be mapped across eight distinct categories: payments, insurance, financial planning, lending and crowdfunding, blockchain, trading and investment, data and analytics, and cybersecurity (see Chart 1).

Chart 1 FinTech landscape used by IOSCO (International Organization of Securities Commissions)

In more detail, blockchain, also known as distributed ledger technology or DLT, became widely known as the technology that underlies Bitcoin, which holds 60% of the cryptocurrency market. Of course, numerous potential applications of DLT to financial services other than digital currencies are lately becoming apparent such as robo-advice and peer-to-peer insurance.

Another category in the FinTech landscape is data & analytics. As you know, advances in digital technology such as Artificial Intelligence (AI) and Big Data have greatly increased the usability of advanced analytics in the financial services sector. This development can lead to better suited products and services, but it also poses the question whether a limit should be put on the profiling of individuals. In this respect, the expanded availability and broader use of consumer data raises issues relating to data ownership and data usage and their implications for consumer privacy. A small digression on AI may be in order here. It is said that the world’s most valuable resource is no longer oil, but data and AI has the capability to unlock and leverage data, transforming our lives. I don’t have to mention the list of world “firsts” AI has already achieved. AI ferryboats, AI hearing aids, aI toothbrush, AI ski instructor, financial reports, video games, etc. and in the near future autonomous driving which e.g. could reshape the trucking industry, resulting in fewer accidents, smart cities with less pollution and energy usage, smart farms with better quality products and so on.

A final category in the FinTech landscape is cybersecurity. While increased reliance on digital technology may heighten the risk of cybersecurity being compromised, digital technology also presents numerous opportunities to improve security of digital financial services. Data encryption to protect digitally stored data is improving with technological advances. Data analytics can be used to detect irregular patterns and fraud. DLT could increase the transparency of transactions, making them easier to track and control, improving Anti-Money Laundering (AML) regulations.

3. A look into the rise of FinTech in the EU

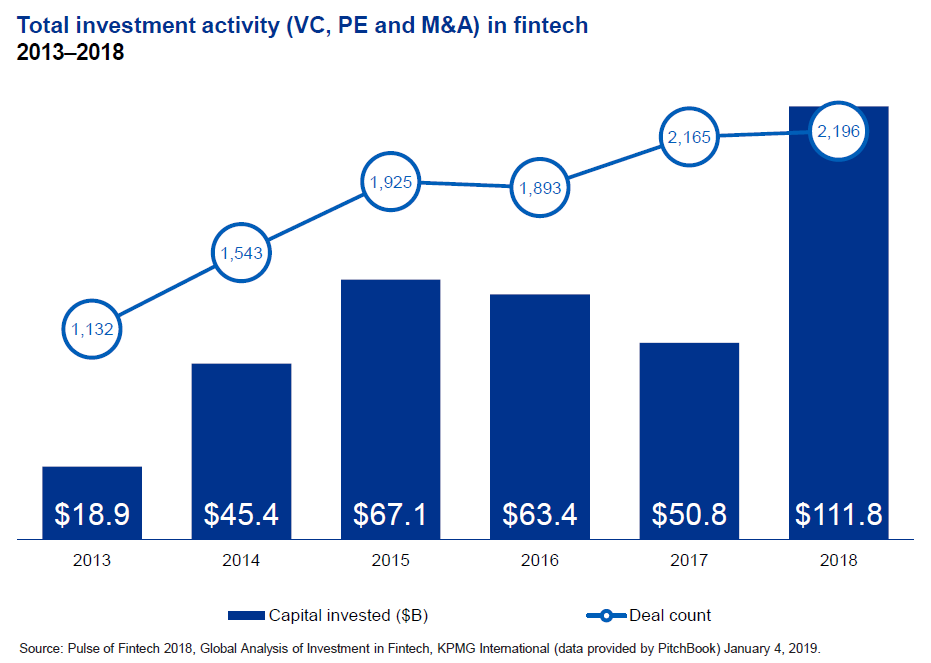

Over the last couple of years, global FinTech investment activity has been recording robust growth. While in 2012 total investment in this sector was less than US $12 billion, in 2018 global investment in FinTech companies reached approximately US $112 billion (with 2,200 deals), more than double its 2017 level of around US $51 billion (as you can see in Chart 2). Moreover, 2018 was a year in which Fintech investment, including Venture Capitals (VC), Mergers and Acquisitions (M&A) and Private Equities (PE), recorded a series of peaks. Emerging Fintech subsectors have seen the number of new startups rise rapidly, while highly mature sectors such as payments experienced a certain degree of consolidation.

Chart 2 Global investment and banks’ activity in FinTech

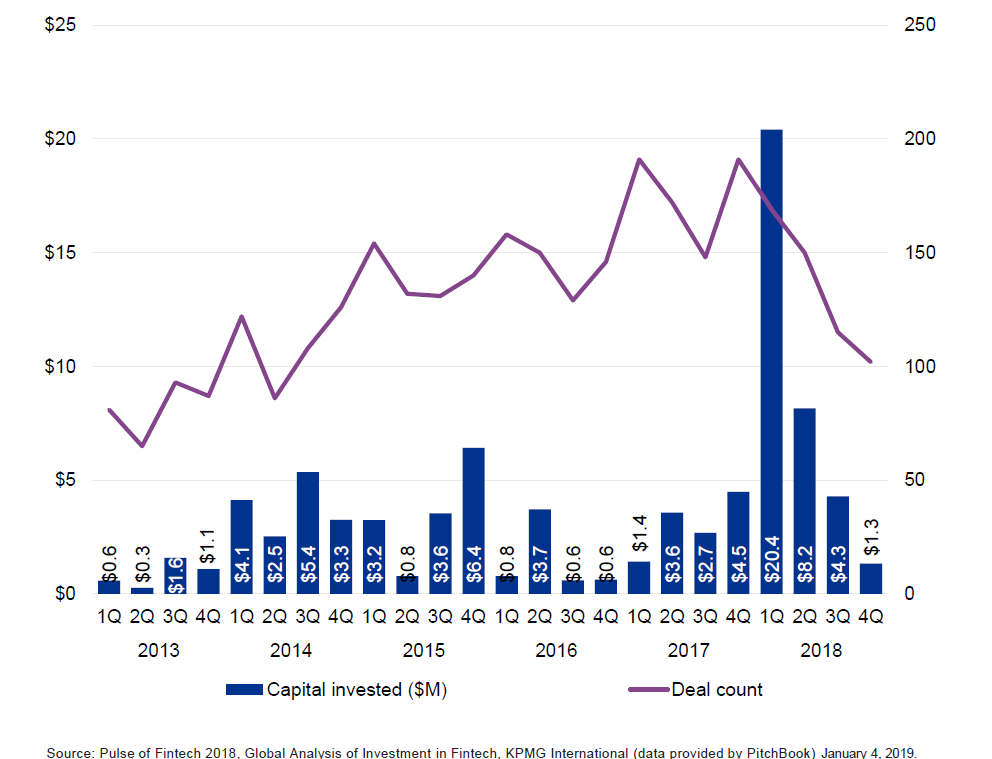

The US and Silicon Valley remain the world's biggest hubs for FinTech companies and have the lion’s share in terms of financing. In 2018, US FinTech investment reached US $55 billion across 1,245 deals. Europe’s FinTech sector has been catching up with US FinTech investment growth, with investment following an upward path since 2008, having reached US $34 billion with 536 deals in 2018, driven by big mergers and acquisitions (M&As) (see Chart 3). Venture Capital investment remains high in Europe and in 2018, it attracted the second largest amount ever of VC investment in FinTech.

Chart 3 Total investment activity (VC, PE and M&A) in FinTech in Europe (2013–2018)

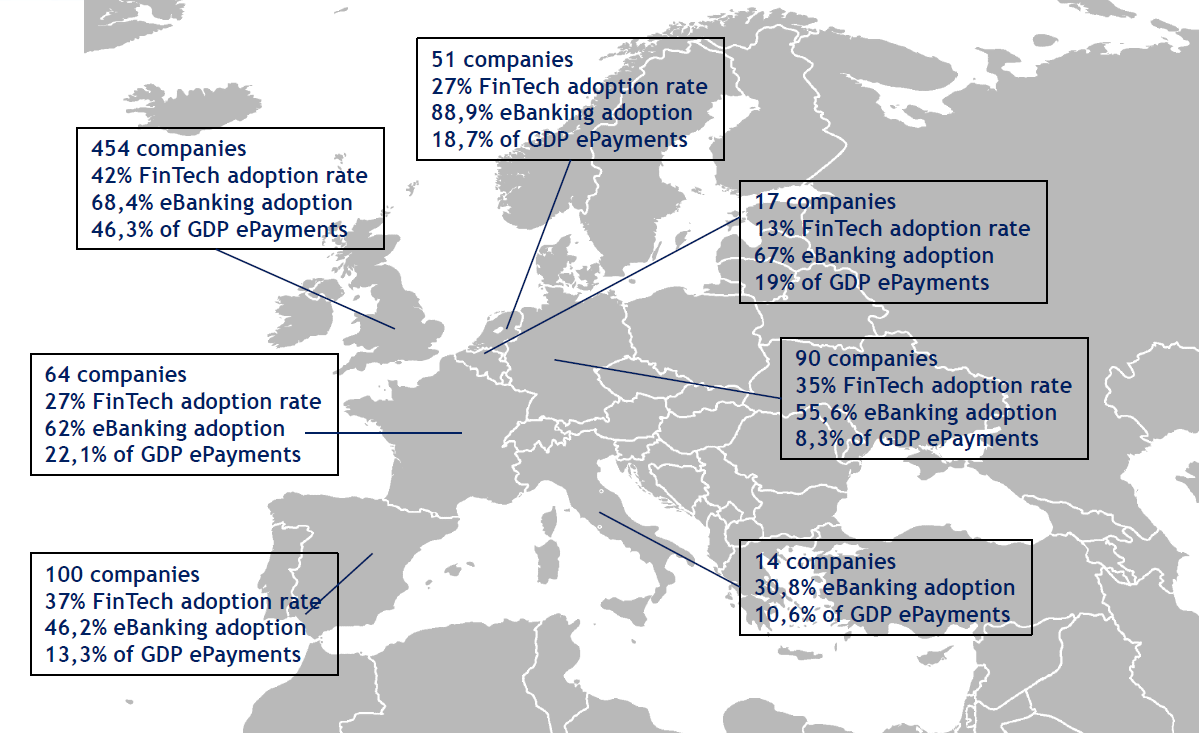

Despite concerns about Brexit, the UK remained a leader in FinTech in 2018 (see Chart 4 for the number of companies established in individual EU countries). The UK accounts for half of the region’s top VC deals, with last year’s total investment activity amounting to US $21 billion. Throughout 2018, the UK government continued to build FinTech bridges with other jurisdictions, so as to reduce regulatory barriers and support growth in a post-Brexit world. Ireland saw increasing interest from global FinTech companies and financial institutions, spurred by Brexit-related concerns. More precisely, 55 FinTech or financial services companies opted for establishment in Ireland last year, and their move is expected to bring more than 4,500 new jobs to the country (IDA, Ireland). Around 50 applications for authorization were submitted to the Central Bank of Ireland by year-end covering almost the entire spectrum of financial services including banking, insurance, asset management and payments. Multinational companies seem to be concerned about a no-deal Brexit and these moves in 2018 suggest their efforts to mitigate its impact.

Chart 4 Fintech sector development across European Union

Sources: Ernst and Young, Crunchbase, Digital Agenda Scoreboard, and European Central Bank.

This year, we are expecting more FinTech consolidation driven both by FinTech companies looking to buy in order to achieve greater scale and by conventional banks looking to buy FinTech in order to drive their own strategic objectives. Over the next few quarters, Fintech activity is expected to rise in terms of open banking, RegTech, the acquisition of FinTech by banks, insurance tech, and the creation of start-ups, given that Europe offers a start-up friendly regulatory environment that encourages young entrepreneurs to experiment with innovative FinTech services.

4. FinTech’s impact upon and interaction with the conventional financial system and monetary policy transmission mechanism

But what is FinTech’s estimated impact of and interaction with the conventional financial system? All the above developments of the financial technology infrastructure have non-negligible implications. Therefore, it is interesting to briefly discuss the main effects of FinTech revolutions on customers, competition among market players and, overall, the financial industry’s operation and structure.

Currently, five main drivers appear to be shaping and are expected to bring changes to the established financial sector:

The first driver is reduction of information asymmetry. The ability of new technology to capture and process a high amount of data in real time is improving the price discovery mechanism in several areas of the financial system such as the credit gap between borrowers and lenders, to the extent that clients’ information history becomes more transparent, improving borrower’s behaviour through competition and resilience.

The second driver is improvement of Communication Efficacy and the third is supporting lending for small- and medium-sized enterprises (SMEs). The fourth is supporting a sharing economy: Fintech facilitates sharing economy through digital platforms that enable the matching of buyers and sellers. Finally, the fifth driver is increasing financial inclusion. In other words, the sustainable provision of affordable financial services (mainly bank accounts) to more vulnerable people with limited economic means, as well as population groups living in underdeveloped areas and countries.

Last but not least, in terms of the transmission mechanism of monetary policy (this is the transmission of monetary policy to the real economy), FinTech has the potential to alter some of the transmission channels, thus affecting economic variables and inflation, mainly through two channels, firstly, the credit channel and secondly, the bank lending channel. On the one hand, an expansion of FinTech firms in the credit market could alter the functioning of the credit channel, mainly through softening information asymmetries in the credit market, when pricing borrower’s risk. On the other hand, FinTech companies have the potential to affect the pass-through of monetary policy to bank lending rates. In 2018, in the US the overall loans originated via alternative lending platforms reached about 5% of the value of newly issued consumer credit. Worldwide, the total value of transactions through alternative lending platforms climbed to an amount of US $196 billion, expected to grow by an annual rate of 10.7% in the period between 2019-2023, resulting in a total amount of $363 billion (Statista, 2018). China, and, to a minor extent, the US and Europe, fuelled the expansion of alternative lending, accounting for around 93% of the total value of transactions in 2018. The increasing importance of FinTech firms could threaten the informational content of money aggregates and credit supply, lessening potentially the ability of central banks to gather reliable information for conducting monetary policy and also affecting the interest rate pass-through.

5. Regulating FinTech

5.1 Risks from a regulatory point of view

Regulators and supervisors need to follow market developments to understand how the emergence of new players, infrastructures, products and distribution channels is going to transform the financial system. In this regard, a significant proportion of EU FinTech companies is not subject to any regulatory regime (31%) or is only subject to a national authorisation or registration regime (14%). From a prudential and regulatory point of view, I will try to briefly summarise the associated risks by order of importance:

First, risks arise when automating customer and investment services as competition becomes stronger with the entrance of new firms into the financial sector. The challenge for regulation is to keep a level-playing field between existing and new companies which promotes innovation and fosters competition, and, at the same time, preserves financial stability. In this context, since January 2018, the application of PSD2 (1) and the related set of guidelines and technical standards for the security of payment and investment services in the EU facilitate innovation, and efficiency preventing regulatory arbitrage and promoting equal competition. Furthermore, while a number of new propositions on automated investment recommendations have been launched in the recent years using extensively algorithms not many have been identified as offering automated investment advice in the context of MiFID/MiFID II.

Second, FinTech growth increases the financial system’s susceptibility operational and cyber risks. Higher reliance on third-party provision of services – such as communications and cloud storing – could entail higher operational risks. As far as cyber risks are concerned, as the technological systems of financial institutions are more interconnected, there are more possible entry points for potential attacks with more significant consequences. Finally, information use and storage by FinTechs raises important data privacy and security issues.

Third, the issue of risk misallocation arises here, because micro-transactions provide a layer of diversification, credit risk from the borrower to the creditor still passes through under-regulated and under-controlled channels compared to conventional financial services. The first principle of risk management applies to all banks, but also to high-flying FinTech companies: “if you owe 1 dollar to your lender, it’s your debt, if you owe 1 million, then it’s the lender’s problem”! For example, Ye’e Bao (translated as ‘hidden treasure’), associated with the biggest Chinese online retailer, is in practice the largest money market fund in the world, whose assets under management are worth close to US $265 billion, but the regulations affecting dedicated money market funds are not entirely binding Ye’e Bao, as it is not owned by, and does not legally constitute, a financial institution.

Fourth, another major issue in the debate regarding FinTech revolves around the risks it entails in terms of increasing financial discrimination through the extensive use of algorithms based on consumers’ demographic and personal information available online (collected by big tech companies) and, as a result, having the potential to give rise to greater income inequality. With the expansion of FinTech, it may become even harder for population groups of lower income, ethnic minority background, younger age, women or people with disabilities, etc. may be discriminated against in terms of consumer finance, so that only those financially better off, i.e. the richer ones, are chosen to have access to loans, investment products, etc.

Unlike regulated banks, FinTech companies are not subject to strict rules on consumer protection, e.g. to compensate consumers, offer deposit insurance and meet standards in order to prevent misleading vulnerable consumers into buying unsuitable or harmful financial products. We, therefore, need to pay particular attention to the risk that those who trust FinTech products lacking such a safety net are currently running, by relying on big FinTech providers to regulate themselves.

5.2 Existing regulatory framework in the US and the EU

Taking stock of the existing US and EU regulatory framework, it should be pointed out that there is no singular regulatory framework for FinTech companies. In the US, Fintech companies are generally regulated at the state level. For example, many states have enacted legislation governing the extension of credit and money transmission in their jurisdictions, combined with licensing requirements for such activities. Similarly, in the EU, Fintech companies operate under passportable licenses. In the EU, certain services provided by FinTech companies, such as retail banking, payment services and financial market services, are subject to the pan-European ‘passporting’ regime: a company licensed in one EU Member State (home state) may provide such services in another EU Member State (host state), e.g. via a local branch, using its home-state license as a sort of “European passport”. Moreover, in both the United States and the EU, cybersecurity-related regulations and Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) regulations apply to FinTech companies.

We may argue that the EU has expanded the scope of its rules to include services that EU FinTech companies offer to consumers. Moreover, the European Banking Authority (EBA) recognises the benefit in protecting consumers when they use financial services offered by firms outside the conventional financial services sector. It recommends defining consumers' rights in the FinTech space, creating effective procedures for processing consumer complaints, improving the quality of disclosures to consumers in a digital environment, and increasing consumer financial literacy. In light of the potentially inconsistent regulatory regimes to which EU FinTech companies are subject, the European Commission published last year an action plan for the implementation of an EU-wide framework dedicated to FinTech companies aimed at “a more competitive and innovative European financial sector”. The Commission's Action Plan proposes 23 steps to enable innovative business models to scale up and support the uptake of new technologies, and to enhance cybersecurity and the integrity of the financial system, including an EU Fintech Laboratory where European and national authorities will engage with technology providers and an EU Blockchain Observatory and Forum, which will report on the challenges and opportunities of crypto-assets.

5.3 Filling in the regulatory gap

From the aforementioned regulatory frameworks, we all agree that risks related to regulation and compliance arise from FinTech’s rapid growth and it is reasonable to expect that new or evolving risks will emerge for the system and for individual institutions.

It appears that the main challenge is to implement legislation governing FinTech companies in order to protect users and markets, while offering an environment favourable to growth. In the context of financial regulation, it is of utmost importance to strike a balance between the following three fundamental elements:

1. Manage the trade-off between efficiency gains associated with technological innovation and the protection of stakeholders in the financial industry. On the one hand, regulation must not be too stringent to the point it preempts the creation and development of new technologies that generate efficiency and savings in transaction costs; on the other hand, regulation must not be too lax, so as to make sure that investors and users of financial services are adequately protected and that regulatory frameworks are continuously adapting to technological advances, rather than falling behind the curve.

2. Ensure an adequate regulatory level playing field for banks and FinTechs, fundamental to achieve appropriate competition. First, activities involving the same risks in terms of financial stability, consumer protection and the integrity of the financial system should receive the same regulatory treatment (this is the number one principle or regulation). Therefore, any difference in regulation and supervision should be based on the risks posed by different products and services. Second, there should not be unnecessary barriers to competition in the market beyond those justified by risk considerations. In relation to this, authorities should further assess the implications of prudential regulation, which often leaves banks in a situation of competitive disadvantage vis-a-vis other players, and work towards eliminating existing loopholes in regulatory frameworks.

3. Given the global dimension of most technological innovations and the increased interconnectedness of the financial system, regulatory frameworks need to be internationally co-ordinated and upgraded. The work of the Financial Stability Board (FSB) and other international standard-setting bodies (SSBs) will be crucial in this endeavour. However, as pointed out by the FSB, regulatory and supervisory approaches to FinTech are becoming increasingly fragmented, undermining the effectiveness of financial institutions' efforts to address the ensuing risks. We, first of all, need to determine the legitimate uses and purposes of FinTech innovations and then define guiding principles at global level that serve to avoid fragmentation across countries’ regulatory approaches. In other words, we do not want to overregulate. We must first see whether there is a fundamental economic case for regulating specific products/functions (which, in some cases, might ultimately be proven useless) and then regulate in a coordinated manner.

Epilogue

In closing, we are at the beginning of the “fourth industrial revolution”, which is transforming the way we live, work and interact. As the FinTech sector grows, it is important that all parties involved not only pay close attention to technical, regulatory, policy, and legal considerations, but also monitor its growth and better understand its impact.

Regulatory trends become increasingly complex and regulators demand ever larger amounts of granular data from firms, as a result, there is substantial scope for big data analytics and machine learning to help both market participants follow regulatory and compliance requirements and supervisory authorities assess compliance and measure risk. One thing is for sure: no matter what, human intervention to provide a final arbitration will always be required!

One final comment, with my professorial hat: More generally and in more philosophical terms, as new technologies evolve and become more accessible, naturally more ethical issues will arise, but I believe the foundation on which everything must be built is quite simple: putting humans and their needs first. Plato the famous ancient Greek philosopher who lived in Athens 2,500 years ago said: the purpose of humanity is to obtain knowledge. In today’s world this could be translated as follows: knowledge for innovation to improve the human condition. The symbiotic relationship between human creativity and computational creativity is still in its infancy. Ultimately, the question is not about what new technologies can create, but rather what humans can create with new technologies to empower the future of humanity.

Thank you for your attention!

(1)Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC.