Interest Rates on Bank Deposits and Loans: October 2020

02/12/2020 - Press Releases

1. INTEREST RATES ON EURO-DENOMINATED NEW DEPOSITS AND LOANS

In October 2020, the overall weighted average interest rate on new deposits remained almost unchanged, while the corresponding rate on new loans increased. The spread between loan and deposit rates also increased to 4.00 percentage points (see Table 1).

New Deposits

The overall weighted average interest rate on all new deposits remained almost unchanged at 0.10%.

In particular, the average interest rate on overnight deposits placed by households remained unchanged at 0.05%, while the average interest rate on deposits placed by non-financial corporations remained almost unchanged at 0.06%. The average interest rate on deposits from households with an agreed maturity of up to 1 year remained unchanged at 0.24%.

New Loans

The overall weighted average interest rate on all new loans to households and non-financial corporations increased by 18 basis points to 4.10%.

More specifically, the average interest rate on consumer loans without a defined maturity (a category which comprises credit cards, open account loans and overdrafts) increased by 17 basis points to 14.49% from 14.32% in the previous month.

The average interest rate on consumer loans with a defined maturity at a floating rate increased by 3 basis points to 11.08%. The average interest rate on housing loans at a floating rate increased by 6 basis points to 2.49%.

The average interest rate on corporate loans without a defined maturity decreased by 8 basis points to 4.42%. The corresponding rate on loans to sole proprietors decreased by 4 basis points to 6.69%.

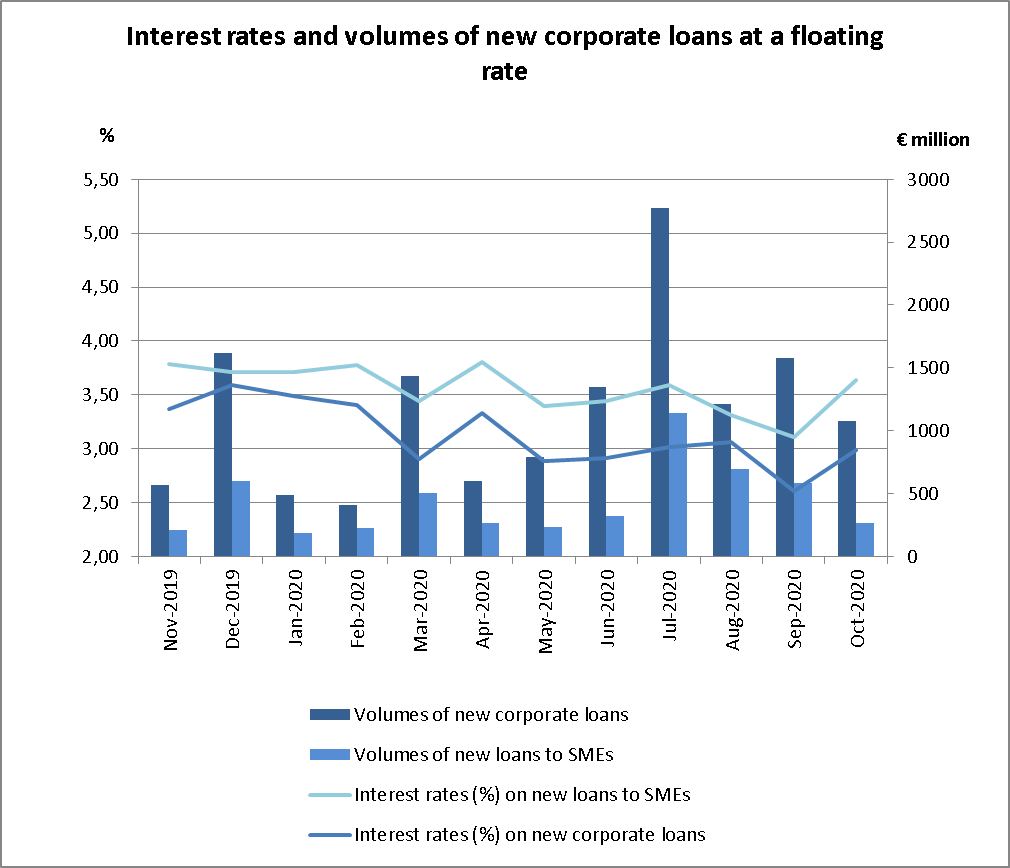

In October 2020 the average interest rate on corporate loans with a defined maturity at a floating rate increased by 33 basis points to 2.92%, whereas the volume of new business decreased to €1,080 million from €1,580 million in the previous month. More specifically, the interest rate on loans with a defined maturity at a floating rate to small and medium-sized enterprises (SMEs) increased to 3.63% from 3.11% in the previous month, whereas the corresponding volume of new business decreased to €265 million from €583 million in the previous month (see Chart and Table 1).

As regards to the structure of interest rates according to the size of the loans granted, the rate on loans of up to €250,000 increased by 98 basis points to 5.53%, on loans of over €250,000 and up to €1 million increased by 36 basis points to 3.47%, and on loans of over €1 million increased by 27 basis points to 2.69%.

2. INTEREST RATES ON OUTSTANDING AMOUNTS OF EURO-DENOMINATED DEPOSITS AND LOANS

In October 2020, the overall weighted average interest rates on outstanding amounts of all deposits and of all loans remained almost unchanged. The spread between loan and deposit rates remained unchanged at 3.67 percentage points (see Table 2).

Deposits

The overall weighted average interest rate on outstanding amounts of all deposits (including overnight deposits) remained almost unchanged at 0.10%.

The average interest rate on outstanding amounts of deposits with an agreed maturity of up to 2 years placed by households remained almost unchanged at 0.23%; the corresponding rate on deposits placed by non-financial corporations remained also almost unchanged at 0.18%.

Loans

The overall weighted average interest rate on outstanding amounts of all loans remained almost unchanged at 3.77%.

In particular, the average interest rate on outstanding amounts of housing loans with over 5 years’ maturity remained unchanged at 2.01%. The average interest rate on outstanding amounts of consumer and other loans to individuals and private non-profit institutions with a maturity of over 5 years increased by 6 basis points to 6.45%; the corresponding rate on corporate loans remained almost unchanged at 3.25%. The average interest rate on outstanding amounts of loans to sole proprietors with over 5 years’ maturity increased by 4 basis points to 4.29% from 4.25% in the previous month.

Table 1: Average interest rates on new euro-denominated deposits and loans (percentages per annum)

| | | August 2020 | September 2020 | October 2020 |

| DEPOSITS | Overnight from households | 0.05 | 0.05 | 0.05 |

| Overnight from non-financial corporations | 0.07 | 0.07 | 0.06 |

| From households with an agreed maturity of up to 1 year | 0.26 | 0.24 | 0.24 |

| Overall weighted average rate on all deposits | 0.11 | 0.11 | 0.10 |

| LOANS | Consumer without a defined maturity | 14.35 | 14.32 | 14.49 |

| Corporate without a defined maturity | 4.52 | 4.50 | 4.42 |

| To sole proprietors without a defined maturity | 6.71 | 6.73 | 6.69 |

| Housing at a floating rate | 2.47 | 2.43 | 2.49 |

| Consumer with a defined maturity at a floating rate | 11.26 | 11.05 | 11.08 |

| Corporate with a defined maturity at a floating rate: | 3.04 | 2.59 | 2.92 |

| -amounts of up to €250,000 | 4.57 | 4.55 | 5.53 |

| -amounts of over €250,000 and up to €1 million | 3.22 | 3.11 | 3.47 |

| -amounts of over €1 million | 2.72 | 2.42 | 2.69 |

| Loans with a defined maturity to small and medium-sized enterprises at a floating rate | 3.31 | 3.11 | 3.63 |

| Overall weighted average rate on all loans | 4.11 | 3.92 | 4.10 |

| Interest rate spread | 4.00 | 3.81 | 4.00 |

| | | | | |

Table 2: Average interest rates on outstanding amounts of euro-denominated deposits and loans (percentages per annum)

| | | August 2020 | September 2020 | October 2020 |

| DEPOSITS | From households with an agreed maturity of up to 2 years | 0.26 | 0.25 | 0.23 |

| From non-financial corporations with an agreed maturity of up to 2 years | 0.22 | 0.19 | 0.18 |

| Overall weighted average rate on all deposits | 0.11 | 0.11 | 0.10 |

| LOANS | Housing with over 5 years’ maturity | 2.02 | 2.01 | 2.01 |

| Consumer and other loans to individuals and private non-profit institutions with over 5 years’ maturity | 6.39 | 6.39 | 6.45 |

| Corporate with over 5 years’ maturity | 3.30 | 3.27 | 3.25 |

| To sole proprietors with over 5 years’ maturity | 4.25 | 4.25 | 4.29 |

| Overall weighted average rate on all loans | 3.80 | 3.78 | 3.77 |

| Interest rate spread | 3.69 | 3.67 | 3.67 |

The complete data set of bank deposit and loan interest rates is published in the sub-section Bank deposit and loan interest rates on the Bank of Greece website.

Notes:

- The interest rate spread is the difference between the overall weighted average rate on all loans and the overall weighted average rate on all deposits.

- For the calculation of the overall weighted average interest rate on all outstanding deposits, the overnight deposits are also taken into account.

- Loans at a floating rate comprise also loans with an initial rate fixation period of up to one year.

- New business refers to new contracts that were agreed during the reference month and not actual loan disbursements.

The next Press Release on “Interest Rates on Bank Deposits and Loans” for November 2020 will be published on 7 January 2021, according to the Release calendar, as published on the Bank of Greece website.