Bank Lending Survey (BLS): Q2 2024

16/07/2024 - Press Releases

- The credit standards for loans to non-financial corporations (NFCs) remained unchanged in the second quarter of 2024, while the terms and conditions for corporate loans eased somewhat. The overall demand for corporate loans remained unchanged.

- The credit standards and the terms and conditions for household loans remained unchanged in the second quarter of 2024. The demand for housing loans remained unchanged, while the demand for consumer credit remained almost unchanged.

Loans to non-financial corporations

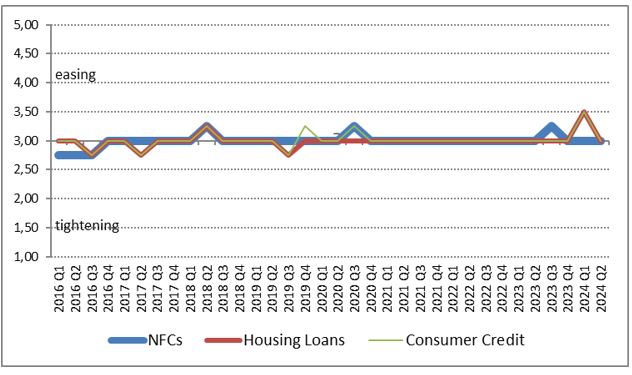

In the second quarter of 2024, the credit standards for loans to non-financial corporations (NFCs) remained unchanged compared with the first quarter of 2024 (see Chart 1), in line with the expectations expressed in the previous quarterly survey round. Moreover, banks expect credit standards to remain unchanged during also the third quarter of 2024.

The overall terms and conditions for loans to NFCs eased somewhat compared with the first quarter of 2024, as the pressure from competition led to narrower margins on average loans.

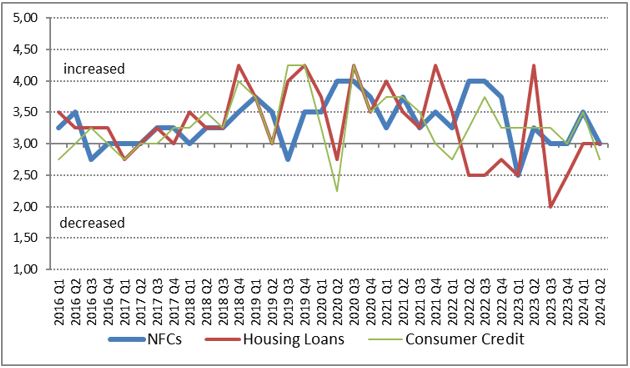

During the second quarter of 2024, the overall demand for corporate loans remained unchanged even though the financing needs for inventories and working capital increased somewhat (see Chart 2). During the next quarter, the overall demand for loans is expected to remain almost unchanged, although the demand from small and medium-sized enterprises is expected to increase somewhat.

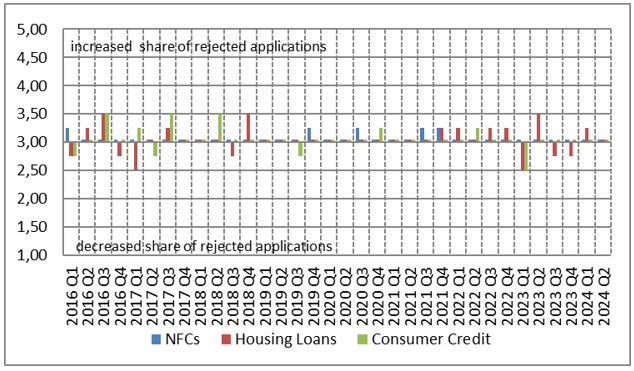

In the second quarter of 2024, the ratio of rejected applications for loans to NFCs remained unchanged compared with the previous quarter (see Chart 3).

Loans to households

In the second quarter of 2024, the credit standards for loans to households remained unchanged compared with the first quarter of 2024 (see Chart 1). The terms and conditions for housing and consumer loans remained also unchanged. Banks expect that, during the third quarter of 2024, credit standards for housing and consumer loans will remain unchanged.

The demand for housing loans remained unchanged, while the demand for consumer credit remained almost unchanged (see Chart 2). During the next quarter, the overall demand for housing and consumer loans is expected to remain unchanged.

During the second quarter of 2024, the ratio of rejected applications for housing loans and consumer credit remained unchanged (see Chart 3).

Chart 1 - Credit Standards (Average)

Chart 2 - Demand (Average)

Chart 3 - Share of rejected applications (Average)

Related information:

The next Press Release on the “Bank Lending Survey” for Q3 2024 will be published on 15 October 2024, in accordance with the Advance release calendar published on the Bank of Greece website.

Related links:

More on the Bank Lending Survey

Methodology