Bank Lending Survey (BLS): Q1 2020

28/04/2020 - Press Releases

Bank Lending Survey (BLS)[1] ,[2] – Q1 202

Loans to non-financial corporations

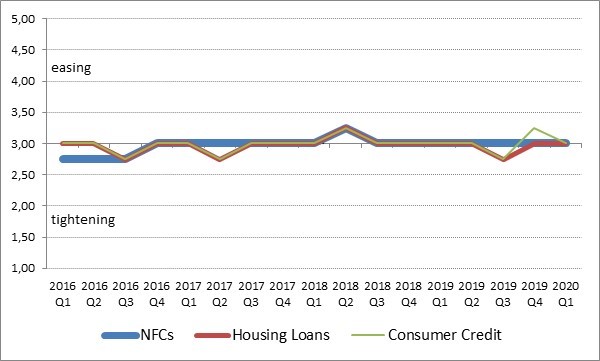

In the first quarter of 2020, the overall credit standards for loans to non-financial corporations (NFCs) remained unchanged (see Chart 1) compared with the fourth quarter of 2019, in line with the expectations expressed in the previous quarterly survey round. Moreover, banks expect that the overall credit standards will in general remain unchanged during the second quarter of 2020.

The terms and conditions for loans to NFCs remained unchanged in the first quarter of 2020.

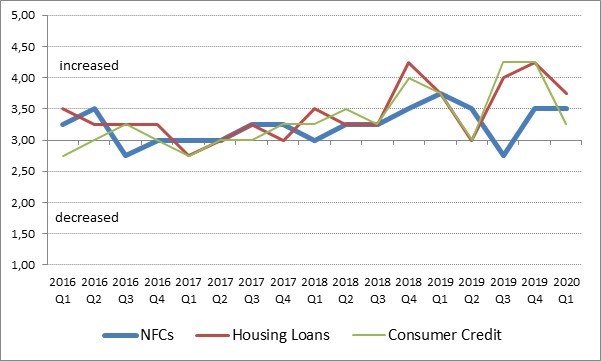

The demand for loans to NFCs increased somewhat compared to the previous quarter (see Chart 2), due to the increased financing needs for fixed investment, inventories and working capital as well as debt refinancing. During the next quarterly survey round, the demand for loans from NFCs is expected to increase, due to the strong demand for short-term loans, both from small and medium and from large enterprises.

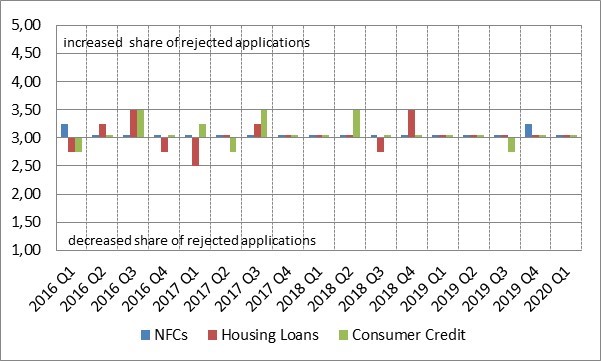

The ratio of rejected applications for loans to NFCs remained basically unchanged during the first quarter of 2020 compared to the previous quarter (see Chart 3).

Loans to households

In the first quarter of 2020, the credit standards as well as the terms and conditions for loans to households remained basically unchanged compared with the fourth quarter of 2019 (see Chart 1), in line with the expectations expressed in the previous quarterly survey round.

The demand for housing loans increased somewhat compared with the fourth quarter of 2019 (see Chart 2), while the demand for consumer loans remained unchanged. The factors which affected the increase of demand in the first quarter of 2020 are the improved housing market prospects, including expected house price developments and increased consumer confidence, just before the pandemic spread in Greece.

Banks expect that credit standards for loans to households will remain unchanged during the second quarter of 2020, while the demand for loans to households is expected to decrease considerably.

The ratio of rejected applications for loans to households remained basically unchanged during the first quarter of 2020 (see Chart 3) compared with the previous one.

Chart 1 - Credit Standards (Average)

Chart 2 - Demand (Average)

Chart 3 - Share of rejected applications (Average)

Note: The next Press Release on the “Bank Lending Survey” for Q2 2020 will be published on 14 July 2020, in accordance with the Advance release calendar, published on the Bank of Greece website.