Statistics on loans serviced by Credit Servicing Firms (CSFs): Q4 2022

16/03/2023 - Press Releases

- In the fourth quarter of 2022, the nominal value of loans to the domestic private sector serviced by domestic CSFs that have been transferred to non-resident specialised financial institutions decreased by €289 million.

- The total value of the above category of loans decreased to €70,679 million at the end of the fourth quarter of 2022, from €70,968 million in the previous quarter.

The nominal value of serviced loans decreased to €70,679 million at the end of the fourth quarter of 2022 from €70,968 million in the previous quarter. It should be noted that as of the fourth quarter of 2022 the nominal value of loans does not include off-balance sheet interest and the amounts of write-offs and write-downs of loans made by the credit institutions that transferred the loan portfolio. The data for the third quarter of 2022 have been recalculated according to the new methodology, so as to allow comparability between the two quarters. The change in the methodology brings harmonisation of statistical and the relevant supervisory data.

Corporate loans

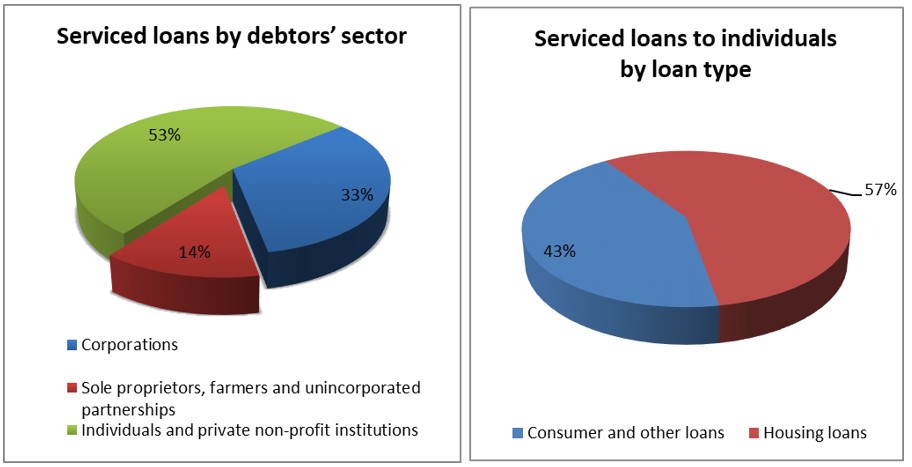

The nominal value of serviced corporate loans decreased to €23,587 million in the fourth quarter of 2022, from €23,679 million in the previous quarter. In further detail, the nominal value of loans to non-financial corporations (NFCs) decreased by €93 million to €23,509 million at the end of the fourth quarter of 2022. Out of the total of these loans to NFCs, an amount of €12,433 million corresponds to loans to small and medium-sized enterprises (SMEs).

The nominal value of loans to other financial institutions serviced by CSFs remained almost unchanged at €78 million at the end of the fourth quarter of 2022.

Loans to sole proprietors, farmers and unincorporated partnerships

The nominal value of loans to sole proprietors, farmers and unincorporated partnerships serviced by CSFs decreased by €273 million from the previous quarter to €9,665 million at the end of the fourth quarter of 2022.

Loans to individuals and private non-profit institutions

The nominal value of loans to individuals and private non-profit institutions serviced by CSFs increased by €77 million to €37,428 million at the end of the fourth quarter of 2022. In further detail, consumer loans serviced increased by €31 million to €15,854 million, while the corresponding housing loans increased by €46 million to €21,386 million.

Table: Loans to domestic residents transferred to foreign financial institutions and serviced by CSFs

(Nominal value, end of quarter data, in EUR millions)

|

| Q2 - 2022 | Q3 – 2022* | Q4 – 2022* |

| Private sector | 87,007 | 70,968 | 70,679 |

| Corporations | 32,400 | 23,679 | 23,587 |

| Non-financial corporations (NFCs) | 32,320 | 23,602 | 23,509 |

| o/w small and medium-sized enterprises | 16,585 | 12,133 | 12,433 |

| Other financial institutions | 79 | 77 | 78 |

| Sole proprietors, farmers and unincorporated partnerships | 12,087 | 9,938 | 9,665 |

| Individuals and private non-profit institutions | 42,520 | 37,351 | 37,428 |

| o/w consumer loans | 18,218 | 15,823 | 15,854 |

| o/w housing loans | 24,115 | 21,340 | 21,386 |

|

|

|

|

|

*Revised data. The nominal value of loans does not include off-balance sheet interest and write-offs/write-downs made by the credit institutions that transferred the loan portfolio.

Figures may not add up due to rounding.

Related information:

The next Press Release on “Statistics on loans serviced by Credit Servicing Firms (CSFs)” for the first quarter of 2023 will be published on 16 June 2023 according to the Advance release calendar published on the Bank of Greece website.

Related link:

Loans serviced by Credit Servicing Firms