Statistics on Insurance Corporations - December 2018

12/03/2019 - Press Releases

Statistics on Insurance Corporations (1) - December 2018

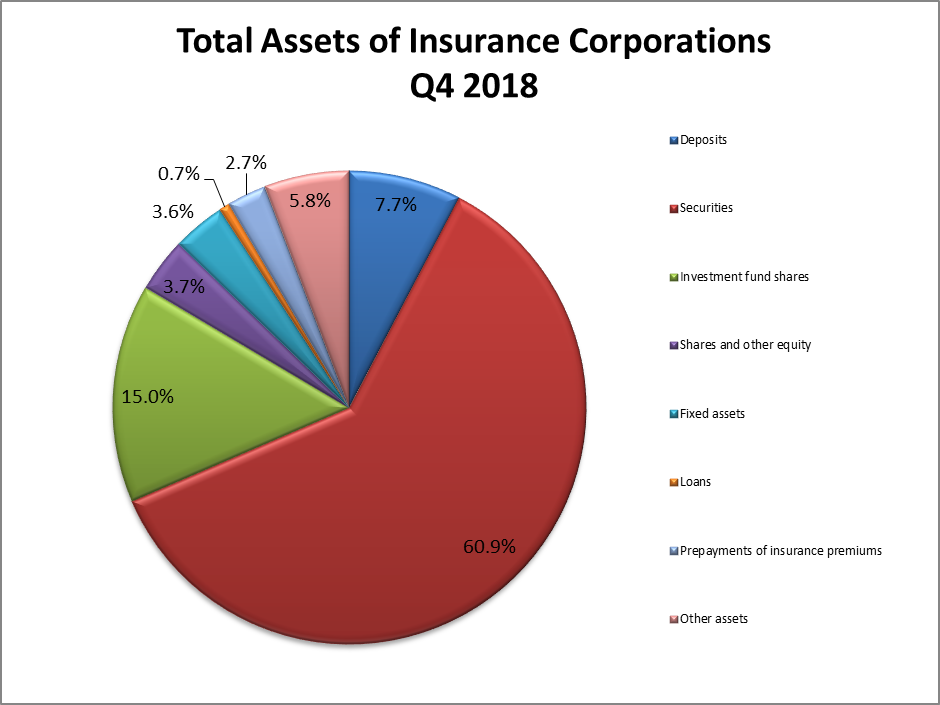

In the fourth quarter of 2018, total assets of insurance corporations stood at €17,037 million compared with €17,041 million in the previous quarter.

In further detail, the overall deposits of insurance corporations increased by €143 million from the previous quarter to €1,305 million at the end of the fourth quarter of 2018. Deposits with domestic credit institutions increased by €77 million, while deposits with foreign credit institutions increased by €66 million. Deposits accounted for 7.7% of total assets in the fourth quarter of 2018 compared with 6.8% in the previous quarter.

Total holdings of debt securities increased to €10,369 million in the fourth quarter of 2018 from €10,198 million in the previous quarter. Debt securities amounted to 60.9% of total assets at end-December 2018 from 59.8% in the previous quarter. This development reflects net purchases mainly of foreign debt securities.

Total holdings of investment fund shares decreased to €2,547 million from €2,878 million in the previous quarter. Investment fund shares accounted for 15.0% of total assets at end-December 2018, compared with 16.9% at end-September 2018. The reduction in the value of the total holdings is mainly due to the net sales of foreign investment fund shares but also to technical reasons.

Total holdings of shares and other equity excluding mutual funds shares increased to €632 million from €524 million in the previous quarter. Equity accounted for 3.7% of total assets at end-December 2018, compared with 3.1% in the previous quarter. However, the increase in the value of total holdings is not due to net purchases of shares and other equity but to technical reasons.

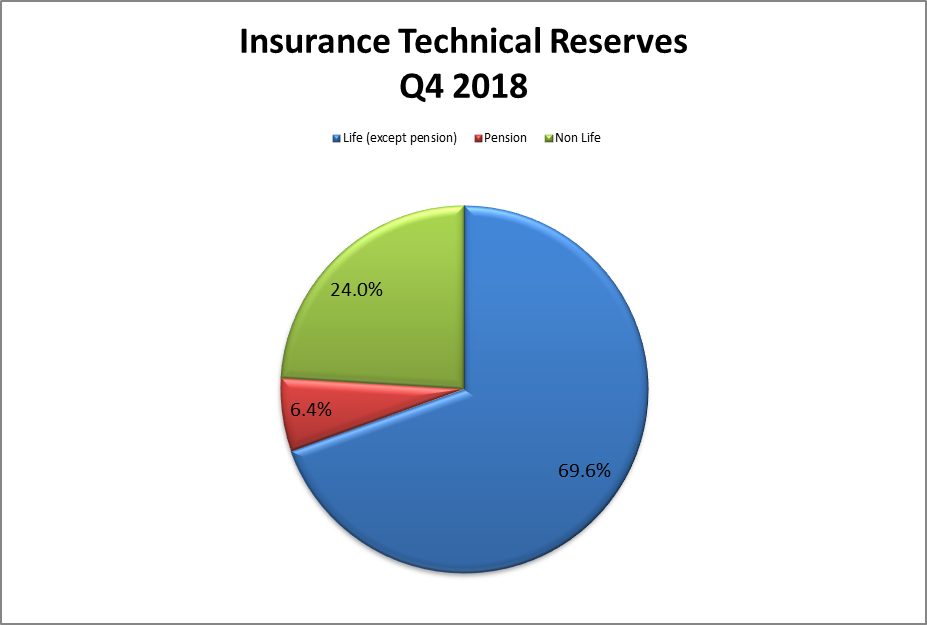

On the liabilities side, own funds decreased by €95 million to €2,774 million at end-December 2018. Total insurance technical reserves increased by €87 million to €12,591 million, due to the increase by €187 million of life technical reserves. On the other hand, non-life insurance technical reserves decreased by €100 million. Life technical reserves (other than pension entitlements) accounted for 69.6% of total technical reserves from 68.6% in the previous quarter.

Table 1: Balance Sheet of Insurance Corporations (EUR millions at the end of the period)

|

Q3 2018

|

Q4 2018

|

|

ASSETS

|

|

|

|

Deposits

|

1,162

|

1,305

|

|

Domestic

|

840

|

917

|

|

Rest of the world

|

323

|

388

|

|

Debt Securities

|

10,198

|

10,369

|

|

Domestic

|

4,132

|

4,136

|

|

Rest of the world

|

6,065

|

6,233

|

|

Investment fund shares

|

2,878

|

2,547

|

|

Domestic

|

894

|

858

|

|

Rest of the world

|

1,984

|

1,689

|

|

Shares and other equity excluding investment fund shares

|

524

|

632

|

|

Domestic

|

389

|

372

|

|

Rest of the world

|

134

|

260

|

|

Fixed assets (net of depreciation)

|

608

|

615

|

|

Financial Derivatives

|

2

|

5

|

|

Loans

|

130

|

127

|

|

Prepayments of insurance premiums

|

468

|

454

|

|

Other assets

|

1,072

|

983

|

|

Total Assets / Liabilities

|

17,041

|

17,037

|

|

|

Q3 2018

|

Q4 2018

|

|

LIABILITIES

|

|

|

|

Own Funds

|

2,869

|

2,774

|

|

Insurance technical reserves

|

12,504

|

12,591

|

|

Life insurance technical reserves

|

9,376

|

9,563

|

|

of which Pension entitlements

|

804

|

805

|

|

Non-life insurance technical reserves

|

3,128

|

3,028

|

|

Loans

|

98

|

96

|

|

Other liabilities

|

1,572

|

1,578

|

Table 2: Net flows (2) of investments of Insurance Corporations (EUR millions)

|

Investments

|

Q3 2018

|

Q4 2018

|

|

Debt Securities

|

188

|

184

|

|

Domestic

|

147

|

15

|

|

Rest of the world

|

42

|

169

|

|

Investment fund shares

|

16

|

-105

|

|

Domestic

|

3

|

-5

|

|

Rest of the world

|

13

|

-100

|

|

Shares and other equity excluding investment fund shares

|

18

|

-8

|

|

Domestic

|

0

|

-17

|

|

Rest of the world

|

18

|

9

|

The complete data set of insurance corporations is published on the Bank of Greece website and can be accessed via the following link:

http://www.bankofgreece.gr/Pages/en/Statistics/nomonetary/default.aspx

Note: The next Press Release on “Statistics on Insurance Corporations” for the first quarter of 2019 will be published on 3 June 2019.

(1)Data to the Bank of Greece are submitted by the supervised insurance corporations as defined in article 1 of the Executive Committee Act 94/16.5.2016 concerning the single submission of national reports by insurance and reinsurance corporations to the Bank of Greece in the context of Solvency II for supervisory and statistical purposes.

(2)Net flows are derived from the change in the outstanding amounts of stocks corrected for revaluation and reclassification adjustments.