Bank Lending Survey (BLS): Q1 2015

14/04/2015 - Press Releases

Loans to non-financial corporations

In the first quarter of 2015, credit standards for loans to non-financial corporations (NFCs) remained unchanged quarter-on-quarter (see Chart 1). Credit standards are, however, expected to tighten somewhat in the second quarter of 2015 owing to the country’s general economic condition.

Demand for loans by NFCs remained unchanged in the first quarter of 2015 (see Chart 2), despite increased financing needs for debt restructuring. Demand for loans by NFCs is expected to remain unchanged also in the second quarter of 2015.

The terms and conditions for loans to NFCs remained broadly unchanged.

Loans to households

In the first quarter of 2015, credit standards for loans to households remained overall unchanged (see Chart 1), whilst they are expected to remain at the same level in the second quarter of 2015.

Demand for consumer credit declined slightly (see Chart 2), mainly as a result of weakened consumer confidence in the general economic outlook and is expected to remain unchanged in the following quarter. Demand for housing loans (see Chart 2) remained unchanged, while it is expected to fall somewhat in the second quarter of 2015.

The terms and conditions for loans to households remained broadly unchanged.

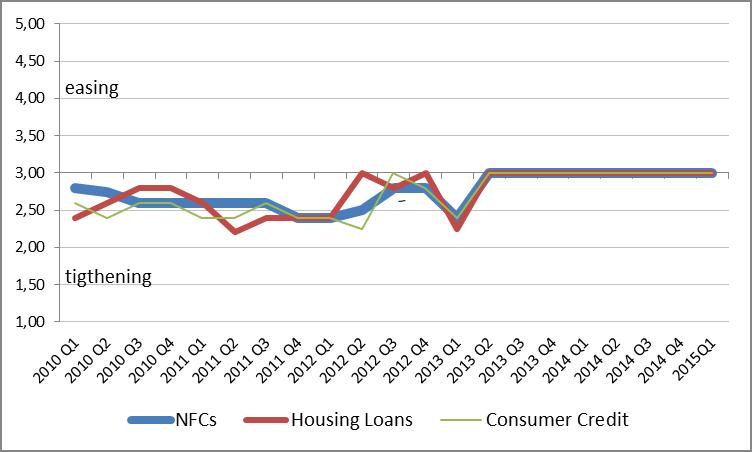

Chart 1

Credit Standards (Average)

Chart 2

Demand (Average)

For more information on the Bank Lending Survey, see

http://www.bankofgreece.gr/Pages/en/Statistics/monetary/BankLendingSurvey.aspx

Information regarding the BLS methodology is available at:

http://www.bankofgreece.gr/Pages/en/Statistics/monetary/BankLendMeth.aspx