Statistics on Pension Funds: Q3 2025

10/12/2025 - Press Releases

- Total assets of pension funds increased by 4.0% to €2,741 million at the end of the third quarter of 2025 from €2,636 million in the previous quarter.

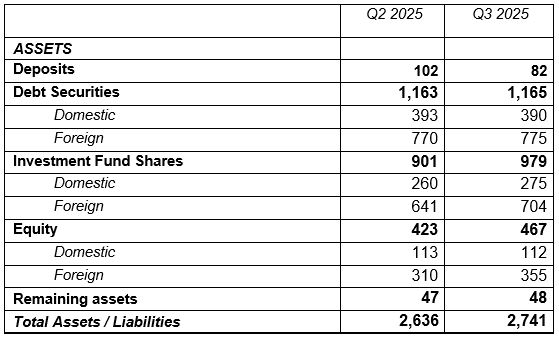

Total assets of occupational pension funds (“pension funds”) increased by €105 million compared with the previous quarter and stood at €2,741 million in the third quarter of 2025.

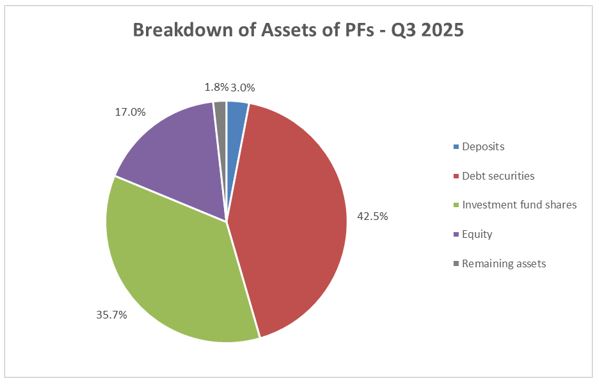

In further detail, the overall deposits of pension funds decreased by €20 million to €82 million at the end of the third quarter of 2025. Deposits’ share in total assets decreased to 3.0% compared with 3.9% in the previous quarter.

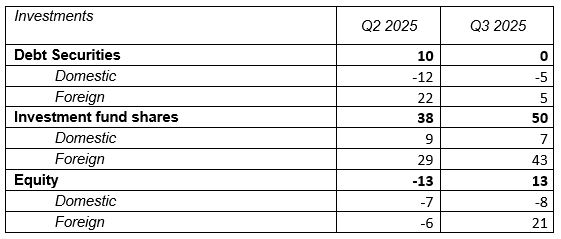

Total holdings of debt securities remained almost unchanged at €1,165 million at the end of the third quarter of 2025, as net sales of domestic bonds were offset by net purchases of foreign bonds. Debt securities’ share decreased to 42.5% of total assets at the end of the third quarter of 2025, compared with 44.1% in the previous quarter.

Total holdings of investment fund shares increased to €979 million at the end of the third quarter of 2025, from €901 million in the previous quarter. The increase in these holdings is mainly due to net purchases but also to increases in foreign funds’ share values. Investment fund holdings’ ratio in total assets increased to 35.7%, compared with 34.2% in the previous quarter.

Equity holdings increased to €467 million at the end of the third quarter of 2025 compared with €423 million in the previous quarter, due to purchases of foreign shares and increases in their values. The share of equity holdings in total assets increased to 17.0% from 16.0% in the previous quarter.

Table 1: Balance Sheet of Pension Funds (EUR millions at the end of the period)

Table 2: Net flows of investments of Pension Funds (EUR million)

Chart

Related information:

The next Press Release on “Statistics on Pension Funds” for the fourth quarter of 2025 will be published on 12 March 2026, according to the Advance release calendar on the Bank of Greece website.

* Pension Funds include compulsory and non-compulsory pension funds.