Bank Lending Survey (BLS): Q4 2024

28/01/2025 - Press Releases

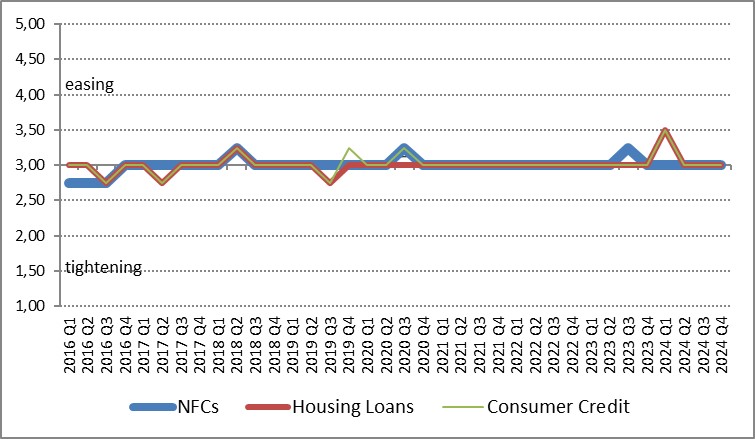

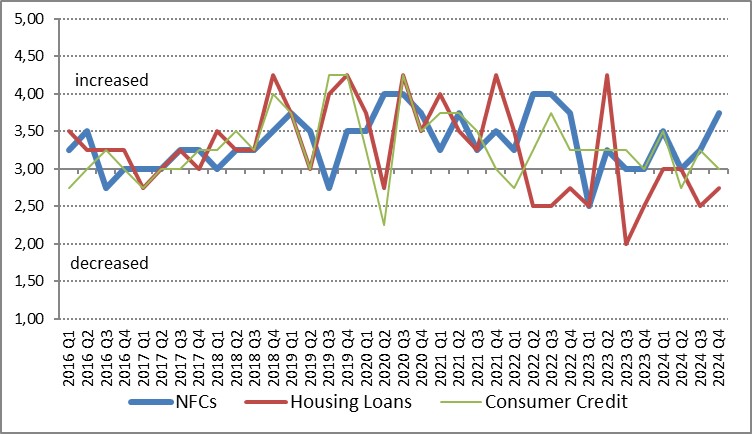

- The credit standards for loans to non-financial corporations (NFCs) remained unchanged in the fourth quarter of 2024. The terms and conditions for corporate loans remained also unchanged. The overall demand for corporate loans increased.

- The credit standards for household loans remained unchanged, while the terms and conditions remained unchanged for consumer credit and almost unchanged for housing loans, in the fourth quarter of 2024. The demand for housing remained almost unchanged, while the demand for consumer credit remained unchanged.

Loans to non-financial corporations

In the fourth quarter of 2024, the credit standards for loans to non-financial corporations (NFCs) remained unchanged compared with the third quarter of 2024 (see Chart 1), in line with the expectations expressed in the previous quarterly survey round. Moreover, banks expect credit standards to remain unchanged during the first quarter of 2025.

The overall terms and conditions for loans to NFCs also remained unchanged compared with the third quarter of 2024, although banks' liquidity position and general economic situation improvement led to lower interest rates and narrower margins on average loans.

During the fourth quarter of 2024, the overall demand for corporate loans increased and in particular, the demand for long-term loans, mainly due to financing needs from “Special Purpose Vehicle Companies” for inventories and working capital (see Chart 2). In the first quarter of 2025, banks expect the demand from NFCs to remain almost unchanged, although the demand for short-term loans is expected to increase.

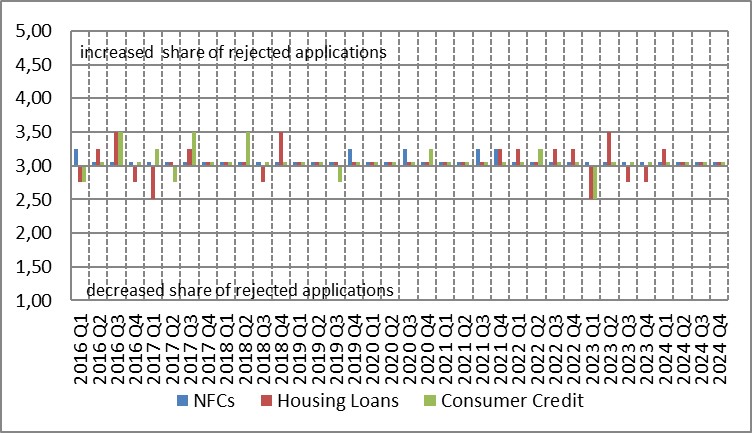

In the fourth quarter of 2024, the ratio of rejected applications for loans to NFCs remained unchanged compared with the previous quarter (see Chart 3).

Loans to households

In the fourth quarter of 2024, the credit standards for loans to households remained unchanged compared with the third quarter of 2024 (see Chart 1). The terms and conditions for housing remained almost unchanged, while non-interest rate charges decreased. The terms and conditions for consumer loans remained unchanged during the fourth quarter of 2024. During the first quarter of 2025, banks expect that credit standards for housing loans will remain almost unchanged, while those for consumer loans will remain unchanged.

The demand for housing loans remained almost unchanged, while for consumer loans it remained unchanged in the fourth quarter of 2024 (see Chart 2). During the next quarter, the demand for housing loans is expected to increase, while the demand for consumer loans is expected to remain unchanged.

During the fourth quarter of 2024, the ratio of rejected applications for housing loans and consumer credit remained unchanged (see Chart 3).

Chart 1 - Credit Standards (Average)

Chart 2 - Demand (Average)

Chart 3 - Share of rejected applications (Average)

Related information:

The next Press Release on the “Bank Lending Survey” for Q1 2025 will be published on 15 April 2025, in accordance with the Advance release calendar published on the Bank of Greece website.

Related links:

More on the Bank Lending Survey

Methodology