Commercial property indices - 2017 H1

27/11/2017 - Press Releases

1. Office Indices

Office price index

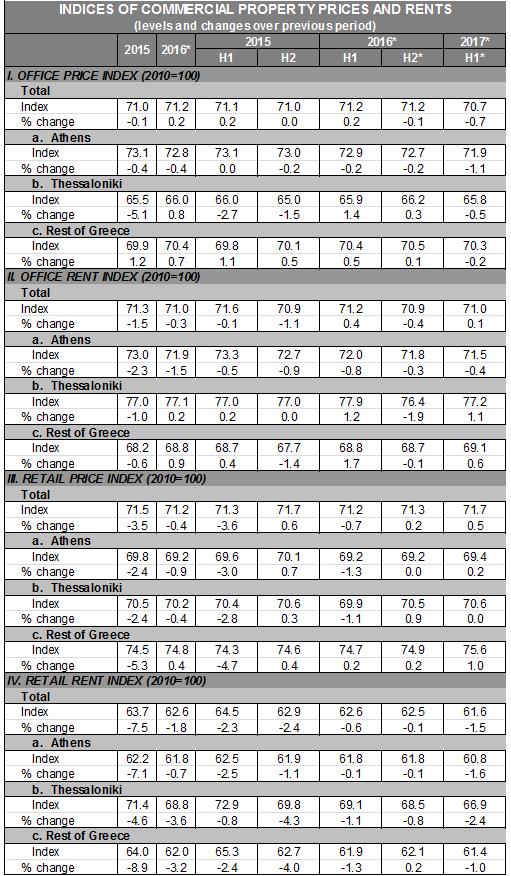

According to provisional data, in the first half of 2017 nominal prime office prices for the country as a whole declined by 0.7%, compared with the second half of 2016. More specifically, in the first half of 2017 nominal prime office prices declined by 1.1% in the greater Athens area, whereas in Thessaloniki and in the rest of Greece prices declined marginally by 0.5% and 0.2% respectively, compared with the second half of 2016.

In 2016, the average annual rate of change in nominal prime office prices is estimated at 0.2% for the entire country, whereas the corresponding average rates of change were -0.4% for Athens, 0.8% for Thessaloniki and 0.7% for the rest of Greece (revised data).

Office rent index

In the first half of 2017, office rents for the country as a whole increased marginally by 0.1% (provisional data) compared with the second half of 2016, against changes of 0.4% in the first half of 2016 and -0.4% in the second half of 2016 relative to the respective previous year-halves. According to revised data, for 2016 office rents declined at an average annual rate of 0.3%.

2. Retail indices

Retail price index

According to provisional data, in the first half of 2017 prime retail prices for the country as a whole increased marginally by 0.5% in nominal terms compared with the second half of 2016. More specifically, in the first half of 2017 nominal prime retail prices increased marginally by 0.2% in Athens, remained unchanged in Thessaloniki and increased by 1.0% in the rest of Greece, compared with the second half of 2016.

Finally, according to revised data, in 2016 nominal prime retail prices changed by -0.4% for the entire country, whereas the corresponding average rates of change were -0.9% for Athens, -0.4% for Thessaloniki and 0.4% for the rest of Greece.

Retail rent index

In the first half of 2017, retail rents for the country as a whole declined by 1.5% (provisional data) compared with the second half of 2016, against declines of 0.6% in the first half of 2016 and 0.1% in the second half of 2016 relative to the respective previous year-halves. According to revised data, for 2016, retail rents declined at an average annual rate of 1.8%.

Detailed tables on retail and office prices and rents by geographical area are published in the “Bulletin of Conjunctural Indicators” (Tables ΙΙ.9, ΙΙ.10, ΙΙ.11 and ΙΙ.12) and are also available on the Bank of Greece website in the “Real Estate Market Analysis” section.

Source: Bank of Greece.

* Provisional data.

Notes:

1. For the purposes of monitoring and analysing the commercial property market, the Real Estate Market Analysis Section of the Bank of Greece compiles office and retail property indices, using data from credit institutions (Bank of Greece Executive Committee Act 23/26.07.2013) and Real Estate Investment Companies – REICs (Bank of Greece Executive Committee Act 9/10.01.2013) operating in Greece, as well as data from other sources, e.g. private real estate consultants, portfolio managers, real estate developers, real estate brokers and public sector entities. The data are collected on a biannual basis and include valuations, rents, transactions, investments and yields of commercial property and commercial property asset portfolios.

2. Indices are published on a biannual basis (base year: 2010). They concern office and retail uses and refer to price and rent levels of mainly prime investment property. It should be noted that price indices are valuation-based and are therefore expected to show some lag, especially in cases of negative changes. Furthermore, especially in periods of limited transactions, the values tend to reflect sentiment and market expectations at the moment of the valuation.

3. Any inconsistencies between levels and percentage changes in the Table are due to rounding.