Interest Rates on Bank Deposits and Loans: July 2023

01/09/2023 - Press Releases

- In July 2023, the weighted average interest rates on new deposits and

on new loans increased to 0.35% and 6.21% respectively.

- The interest rate spread between new deposits and loans increased

to 5.86 percentage points.

- In July 2023, the weighted average interest rates on outstanding

amounts of deposits and loans increased to 0.41% and 6.24% respectively.

- The interest rate spread between outstanding amounts of deposits

and loans increased to 5.83 percentage points.

1. Interest rates on

euro-denominated new deposits and loans

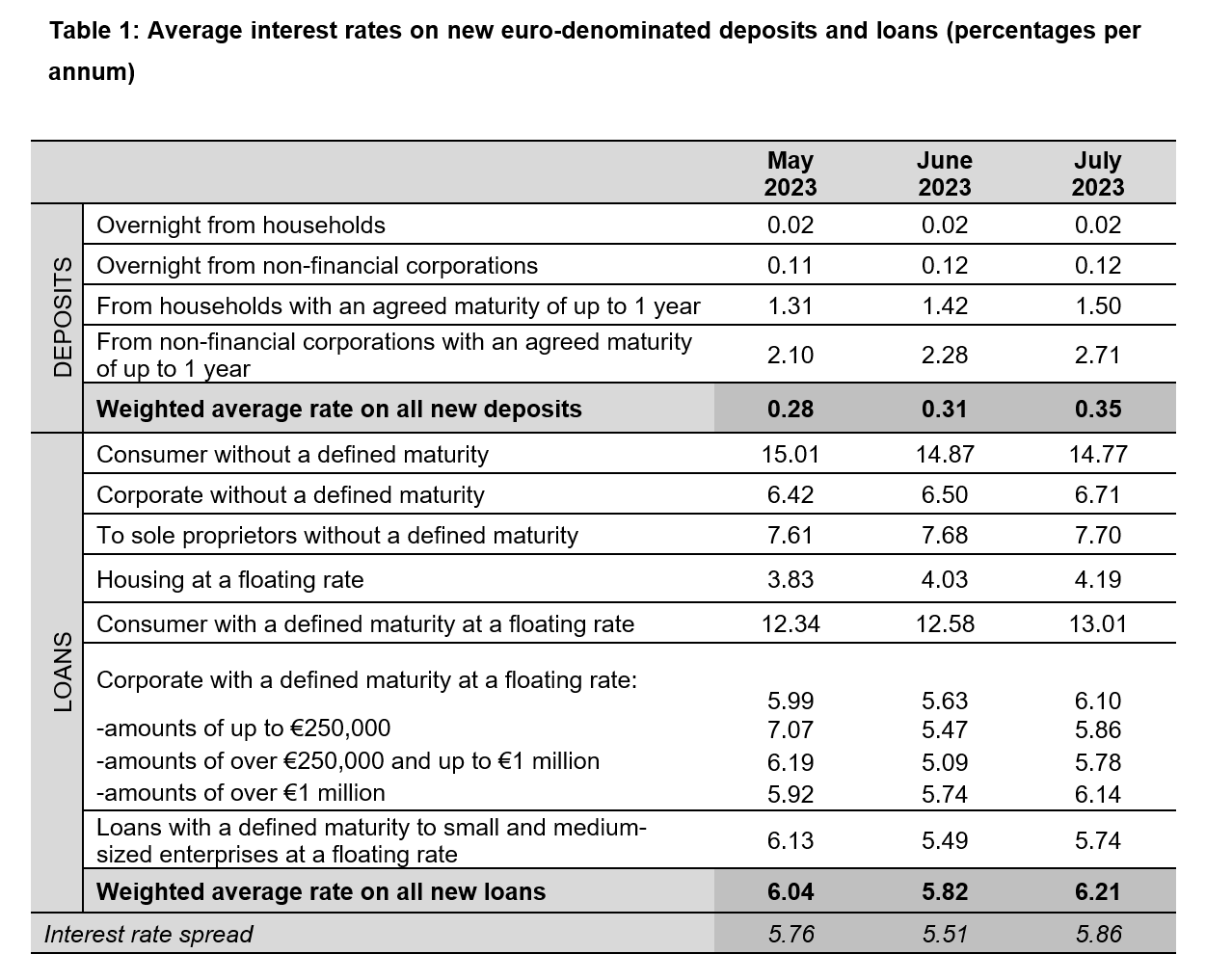

New Deposits

The

weighted average interest rate on new deposits increased by 4 basis points to 0.35%,

compared to the previous month.

In

particular, the average interest rates on overnight deposits placed by

households and non-financial corporations remained unchanged at 0.02% and 0.12%

respectively.

The

average interest rate on deposits from households with an agreed maturity of up

to 1 year increased by 8 basis points to 1.50%. The corresponding rate on

deposits by non-financial corporations increased by 43 basis points to 2.71%.

New Loans

The

weighted average interest rate on new loans to households and non-financial

corporations increased by 39 basis points to 6.21%.

More

specifically, the average interest rate on consumer loans without a defined

maturity (a category that comprises credit cards, revolving loans and

overdrafts) decreased by 10 basis points to 14.77%.

The

average interest rate on consumer loans with a defined maturity at a floating

rate increased by 43 basis points to 13.01%. The average interest rate on

housing loans at a floating rate increased by 16 basis points to 4.19%.

The

average interest rate on new corporate loans without a defined maturity increased

by 21 basis points to 6.71%. The corresponding rate on loans to sole

proprietors remained almost unchanged at 7.70%.

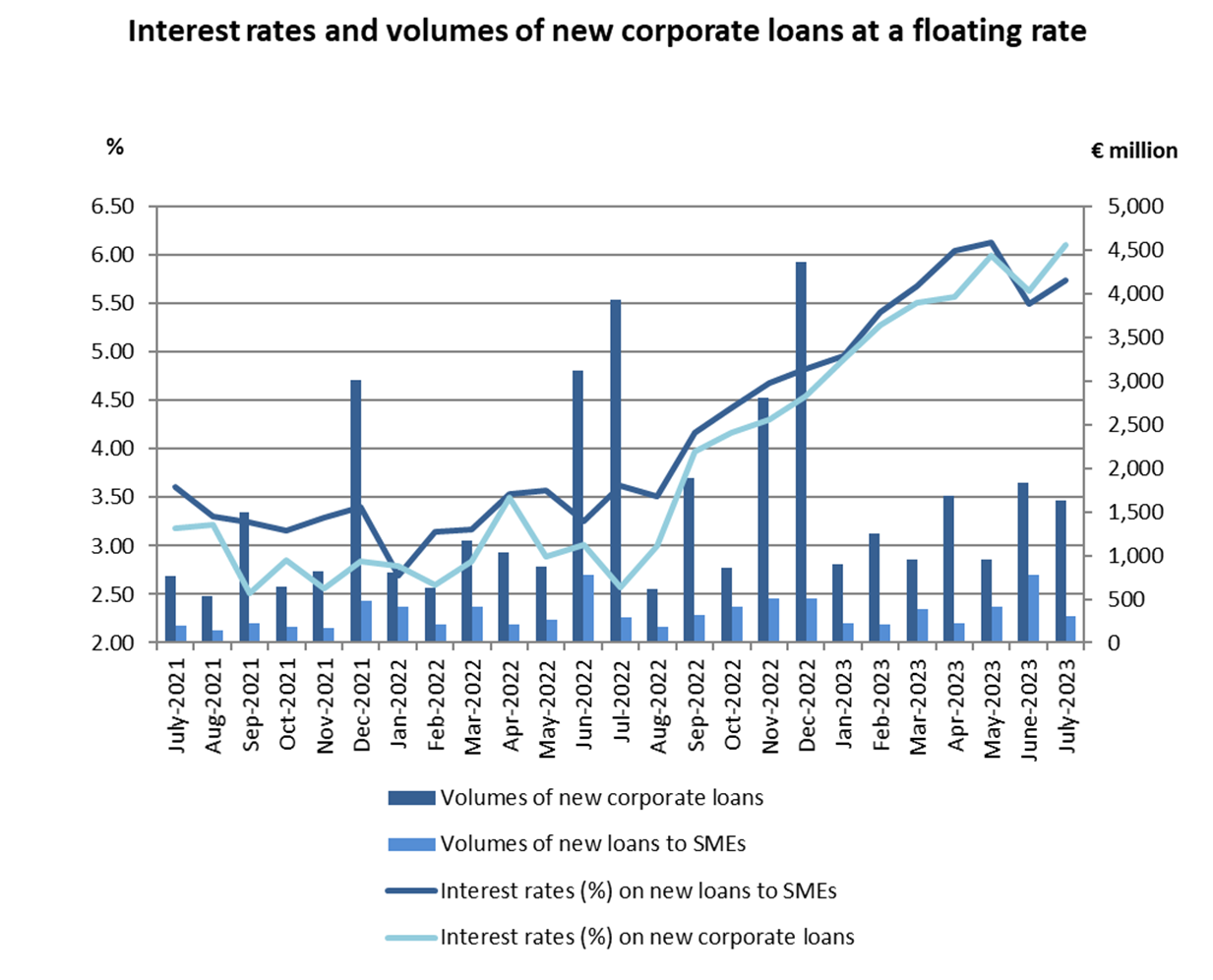

In

July 2023, the average interest rate on new corporate loans with a defined

maturity at a floating rate increased by 47 basis points to 6.10%. The average

interest rate on loans with a defined maturity at a floating rate to small and

medium-sized enterprises (SMEs) increased by 25 basis points to 5.74%.

As

regards the structure of interest rates according to the size of loans granted,

the average rate on loans of up to €250,000 increased by 39 basis points to 5.86%,

on loans of over €250,000 and up to €1 million it increased by 69 basis points

to 5.78% and on loans of over €1 million it increased by 40 basis points to 6.14%.

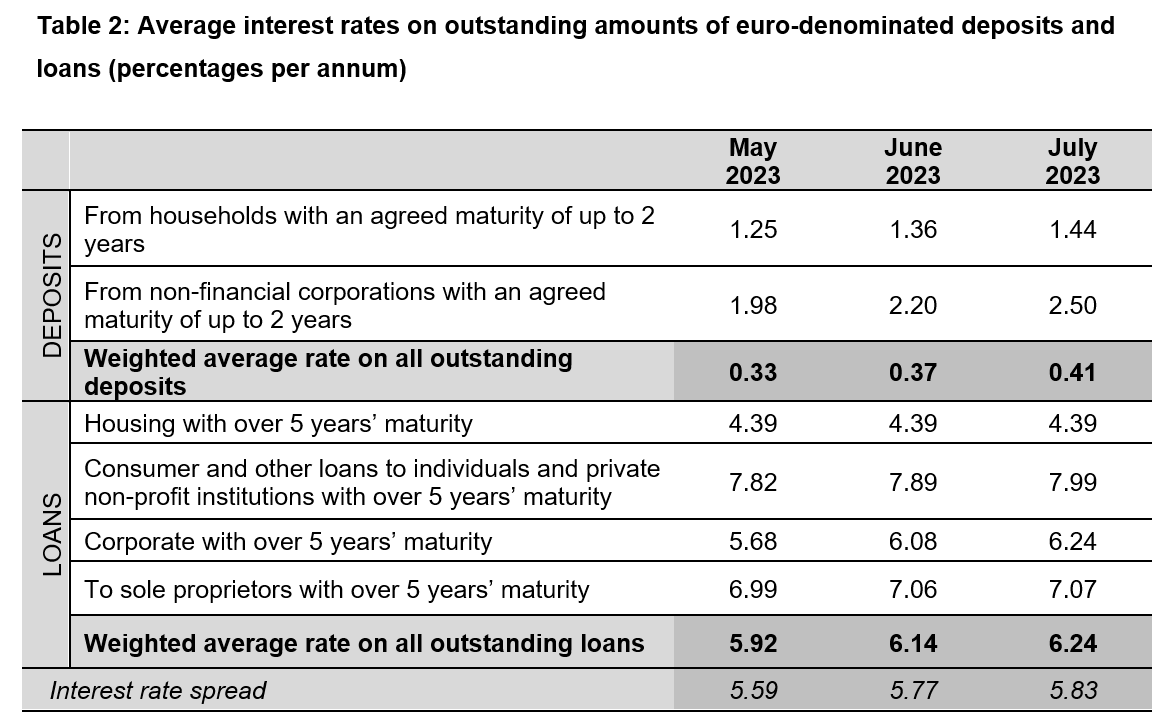

2. Interest rates on

outstanding amounts of euro-denominated deposits and loans

Deposits

The weighted

average interest rate on outstanding amounts of deposits (including

overnight deposits) increased by 4 basis points to 0.41%.

In

particular, the average interest rate on

outstanding amounts of deposits with an agreed maturity of up to 2 years

placed by households increased by 8 basis points to 1.44%. The corresponding

rate on deposits by non-financial corporations increased by 30 basis points to 2.50%.

Loans

The weighted

average interest rate on outstanding amounts of loans increased by 10 basis

points to 6.24%.

In

particular, the average interest rate on outstanding amounts of

housing loans with over 5 years’ maturity remained unchanged at 4.39%. The

corresponding rate on consumer and other loans to individuals and private

non-profit institutions increased by 10 basis points to 7.99%.

The average

interest rate on

corporate loans with over 5 years’ maturity increased by 16 basis points to 6.24%, while the corresponding

rate on loans to sole proprietors remained almost unchanged at 7.07%.

Notes:

- The interest rate

spread is the difference between the weighted average rate on loans and

the weighted average rate on deposits.

- For the calculation

of the weighted average interest rate on all outstanding deposits,

the

overnight deposits are also taken into account.

3. Loans at a floating rate comprise also loans with an

initial rate fixation period of up to one year.

- New business refers

to new contracts that were agreed during the reference month and not

actual loan disbursements.

Related information:

The complete data set of

bank deposit and loan interest rates is published in the sub-section “Bank

deposit and loan interest rates” on the Bank of Greece website.

The next Press Release for

August 2023 will be published on 4 October

2023 according

to the Advance release calendar on the Bank of Greece website.

Related links:

Bank

deposit and loan interest rates

Advance

release calendar