Speech by Bank of Greece Deputy Governor John (Iannis) Mourmouras in Oxford entitled: “On Emergency Liquidity Assistance: theory and evidence”

27/02/2017 - Speeches

On Emergency Liquidity Assistance (ELA): theory and evidence

Speech

by John (Iannis) Mourmouras,

Bank of Greece/Eurosystem

Former Deputy Finance Minister

Former Chief Economic Advisor to the Greek Prime Minister

delivered at Oxford University’s The Political Economy of Financial Markets (PEFM) programme

Oxford, 27 February 2017

1. Introduction

During the last decade’s disruptive developments in the global financial markets closely linked with liquidity shortages, central banks around the world, once again, played the role of lender-of-last-resort (LOLR), providing credit to solvent, yet illiquid institutions, quite often heeding financial stability considerations, with the objective to restore the smooth functioning of financial markets. In the euro area, as the financial crisis intensified, the supply of liquidity on the interbank market in distressed countries (Greece, Ireland and Cyprus), especially during the sovereign debt crisis between 2011-2013, banks short of financially eligible collateral for the ECB's standard monetary policy operations had to resort to Emergency Liquidity Assistance (ELA) provided by their own national central banks, paying higher interest rates as some sort of penalty rate.

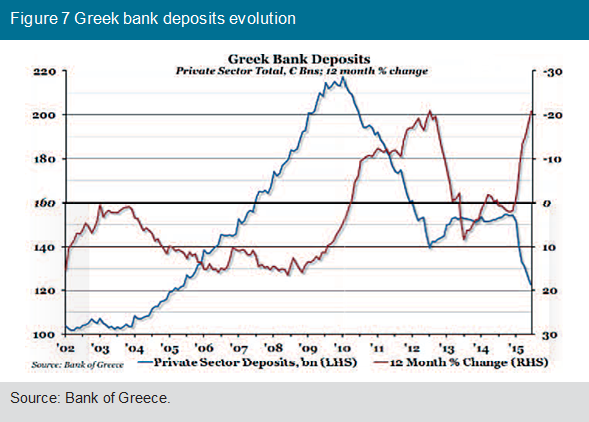

Thus, ELA has proven an increasingly important device to maintain liquidity in the eurozone during times of financial distress. The existence of numerous ELA programmes in the Eurosystem since 2008 led the ECB in 2013 to provide a brief official description of how ELA programmes work. However, the ELA mechanism falls within the competence of the Eurosystem’s national central banks (NCBs), whose statutes differ; furthermore, its framework and its practical operational rules vary from one country to the other. In Germany, France, Italy, Austria and Luxembourg, the central banks’ statutes hardly make any reference to the provision of emergency liquidity. In Ireland, Finland and Belgium, the central banks pursue a financial stability objective, in accordance with their statutes, while ancillary documents explicitly recognise the use of ELA (only this second aspect applies to the Netherlands). In Portugal, the statutes clearly refer to ELA and to the Bank of Portugal’s role as lender of last resort. In Spain, the Bank of Spain pursues a financial stability objective, but its statutes do not set out in detail whether or not it could implement an ELA mechanism. In Greece, the ELA mechanism has been used extensively (since 2011) and effectively, as the Greek banking sector has faced extreme liquidity constraints. In the case of Greece, the primary reason behind ELA funding is to counterbalance the decline in and withdrawal of deposits by the private and public sectors, as well as the drop in the value of eligible collateral for monetary policy operations, against the background of banks’ inability to raise funds on international markets.

Historically, most of the central banks in advanced economies acted as lender of last resort. The Bank of England accepted the role of “lender of last resort” in the 1870s credit crunch, acting in line with the rules demonstrated by Thornton and Bagehot. In the US, the Federal Reserve System, greatly expanded its lending powers in response to the Great Depression and eased collateral restrictions. In 1932, the famous Section 13, paragraph 3 was added to the Federal Reserve Act to allow the Fed to lend directly to “any individual, partnership, or corporation, […] in unusual and exigent circumstances”. More recently, the Fed responded to the financial crisis of 2007-2008 with repeated interventions to restore smooth market functioning. The Bank of Japan, during the Japanese banking crisis of the 1990s, extensively supported the liquidity of the financial system. In the beginning of the 1990s, Sweden also experienced a severe banking crisis and the Sveriges Riksbank had to provide ELA twice. In October 2008, the Bank of England (BoE) provided ELA to two banks: Hallifax and Bank of Scotland (HBOS plc.) and the Royal Bank of Scotland (RBS). The RBS facility was repaid by 16 December 2008, and the HBOS facility a month later. Use of the facilities peaked at £36.6 billion for RBS (on 17 October 2008) and at £25.4 billion for HBOS (on 13 November 2008). Total use of ELA by both banks peaked at £61.6 billion on 17 October. At that point, the two banks provided the BoE with collateral (such as residential mortgages, personal and commercial loans and UK government-issued debt) valued at more than £100 billion. The banks were charged fees for the use of the facilities. Finally, the ECB, at the height of the euro area sovereign crisis in 2009-2010, provided funds in unlimited quantities mainly to the financial institutions of peripheral countries. Our analysis here focuses on the functioning of the Eurosystem and to what extent the function of LOLR is implicitly embedded in the operational framework of the Eurosystem concentrating on the ELA mechanism from 2008 till today, the scope for ELA provision and its rules.

Section 2 right below provides some theoretical remarks on ELA, while Section 3 focuses on the eurozone experience with ELA. Section 4 offers an extensive analysis of the case of Greece’s ELA tool which has been used to address illiquid financial market conditions and the risk of contagion in the banking sector, as well as the rules governing it and the potential risks it entails.

2. Theoretical background

2.1 ELA’s importance in terms of financial stability and liquidity provision

Taking into account that the first central bank was established in 16091, the idea of the LOLR goes back to Thornton (1802) and Bagehot (1873) and, more recently, to Humphrey (1989) and Rochet and Vives (2004), who laid out the theory and basic objective of the lender of last resort. According to this theory, the central bank’s task is to provide funding to illiquid but solvent banks, thereby alleviating the credit crunch and preventing inefficient liquidations. Since then, a number of authors have argued in favour of or against central bank intervention during a severe financial crisis. For example, Goodhart (1985) considers the possibility of distinguishing between illiquidity and insolvency a myth, while Stein (2013) and Acharya and Tuckman (2014) argue that banks create too much short-term debt leading to excessively vulnerable financial systems, whereas an indirect effect of the LOLR is to lower incentives for banks to decrease their exposure to illiquid assets. Moreover, Goodhart and Schoenmaker (1995) provide evidence that central banks have a strong tendency to bail out rather than liquidate banks under financial distress. On the other hand, Bernanke & Gertler (1999), among other authors, have provided evidence that central banks play a significant role towards reducing the frequency of bank runs. To sum up, the term “LOLR” is used extensively in the academic literature as defined by Freixas et al. (2000), i.e. liquidity provision to an individual financial institution (or to the market as a whole) by a central bank in reaction to an abnormal surge in demand for liquidity that cannot be met through an alternative source.

In general, ELA procedures can be classified in two categories: the first is implemented at domestic level and the second is implemented at international level.

Domestic ELA procedures are used by central banks in order to address the liquidity problems of banks that are essentially solvent. ELA is an emergency liquidity line provided by national central banks (NCBs) to solvent banks that exceptionally and temporarily no longer have collateral of sufficiently high quality to obtain funding via conventional Eurosystem operations. These lines are set up at the discretion and under the responsibility of the NCBs.

ELA should be seen as a means of handling acute problems, to give the authorities time to decide whether other crisis management measures are needed, such as restructuring of troubled institutions. ELA operational issues are addressed within the central bank so as to effectively reduce credit risk for the said central bank and in order to avoid moral hazard effects. Usually, each central bank publishes guidelines on eligible collateral and appropriate haircuts applied to ELA provision. It is important that the central bank closely monitors domestic financial developments to correctly evaluate the emergency liquidity needs of financial institutions.

International ELA procedures are implemented through the cross-border provision of central bank liquidity, usually in the form of foreign currency swap lines. The issue of multinational emergency liquidity provision via inter-central-bank swap facilities is not new. The first great era of sustained international central bank cooperation outside a crisis was in the 1920s with the gold standard rule and intensified in the 1960s with the swap network of major central banks. Recently, cross-border central bank cooperation was highlighted in the aftermath of the 2007-2008 financial turmoil, when the Federal Reserve established temporary central bank swap lines for a period of 30 days with the ECB and the Bank of England, and temporarily increased an existing swap line with the Bank of Canada.

Before discussing extensively the ECB’s terms governing ELA provision, it may be useful to recall and classify the Eurosystem’s standard methods of liquidity provision via monetary policy operations. The standard monetary policy operational framework in the Eurosystem rests on three main building blocks: open market operations, standing facilities and minimum reserve requirements for financial institutions.

Unlike the US, in which open market operations are conducted through purchases of Treasury bonds, the ECB conducts its operations mainly through repurchase agreements (repos). Repos are loans that the ECB grants to its counterparties, against eligible collateral and at the rate applicable to its main refinancing operations (MRO) or its longer-term refinancing operations (LTRO). They are conducted on a weekly basis with a maturity of one week and with a maturity of three months respectively. Since the start of the crisis, the ECB has extended the maturity of its operations up to four years via the very longer-term refinancing operations (VLTRO), while all the main refinancing operations are implemented under the fixed-rate full allotment (FRFA) policy which is currently at 0.00% under which the main obligation of credit institutions is to provide eligible collateral. In addition, the eligibility criteria for the collateral have been broadened, aiming at more liquidity to be supplied to the market.

The second instrument is that of standing facilities, which aim to smooth overnight liquidity shocks to individual banks and provide a corridor that bounds the overnight interest rate. Banks can deposit their excess reserves at the deposit facility (whose remuneration rate provides a floor for market rates) and borrow reserves from the marginal lending facility (whose rate provides a ceiling for market rates). There are no limits on how much a bank can deposit with the ECB, while the amount it can borrow from the marginal lending facility is limited only by the available eligible collateral. Since the start of the fixed rate full allotment policy, the marginal lending facility (the current rate of which is 0.25%) was rarely used.

The final building block is the Eurosystem’s minimum reserve requirement, which applies to credit institutions in the euro area and is determined in relation to balance sheet items. Compliance with the reserve requirement is determined on the basis of a credit institution’s average daily reserve holdings over the maintenance period. Institutions’ holdings of required reserves are remunerated at the weighted average rate on the Eurosystem’s main refinancing operations within the respective maintenance period. Amounts in excess are not remunerated and banks can park them on the deposit facility, the rate of which now stands at -0.40%, thus providing credit institutions with a strong incentive to trade them on the market.

In May 2000, Lars Nyberg, Deputy Governor of the Sveriges Riksbank, the Swedish central bank which had to provide emergency liquidity assistance to its banks twice in the early 1990s, amidst a severe banking crisis, said in a speech: “Clearly, ELA is a last resort measure that central banks use only when the stability of the financial system is at stake2”. Turning to the euro area, the first decade after the introduction of the single currency in 1999 was plain sailing for the ECB, and the robustness of this institutional arrangement was hardly tested. That changed radically in 2008, after the collapse of Lehman Brothers plunged the world into a global financial crisis. In the euro area, where it led to mutually reinforcing banking and sovereign debt crises, the ECB and the NCBs emerged as the lenders of last resort to the banking system.

In this context, ELA has been used extensively by some NCBs in the euro area to help their domestic banks find their way out of the emergency situation by providing ELA so as to prevent a domino effect on other banks and ultimately prevent a systemic crisis. In the crisis countries across the euro area, the domestic banking system was suddenly faced with an unexpectedly increased need for cash, for example due to sudden deposit outflows resembling a bank run as in the case of Greece, or due to large margin calls in order to back up tumbling securities transactions as in the case of Ireland. Banks in these countries had been exposed to sovereign debt, therefore, yields and spreads on sovereign bonds influenced those on bank loans to the private sector, thus causing contagion of financial stress. Since banks’ liquidity situation was largely influenced by sovereign debt exposure and considering the impact sovereign debt spreads had on the functioning of the transmission mechanism, central banks’ major concerns focused on their banking system’s illiquid situation. Hence, central banks borrowed the domestic banking system under the ELA procedure.

ELA is not only a monetary tool which is granted when institutions do not have sufficient liquidity and they cannot obtain it through markets or through normal participation in the Eurosystem’s credit operations. It can also be considered part of a national central bank’s financial stability toolbox which includes the provision of liquidity to the financial system as a whole through market operations, as well as emergency lending to individual banks. It is important to recognise that not all liquidity injections aimed at preventing the spread of a liquidity problem relate to a crisis, as central banks routinely offer liquidity against specified collateral requirements in order to support the orderly functioning of markets.

Commenting on unusual features of ELA in the Eurosystem during the financial crisis, Mr. Praet, Member of the Executive Board of the ECB3, pointed out the two types of innovation in the governance of ELA interventions: first, the lengthened duration of assistance and, second, the scope of assistance broadened from individual to the entire banking system.

In theory, emergency liquidity support should be provided only to illiquid but solvent institutions. But the distinction between these two concepts is particularly difficult in periods of financial distress, which is exactly when central banks may have to use this tool. Consequently, careful judgement is necessary as far as providing emergency liquidity assistance is concerned. The Asian crisis provides a clear example thereof. Central banks in the region had to make difficult choices between providing support to individual institutions and encouraging moral hazard, and limiting the fallout of troubled institutions for the wider economy. All central banks could potentially face this dilemma.

Because of the obvious dangers of moral hazard, central banks have maintained an increasingly cautious stance towards emergency lending by adopting a policy of case-by-case discretion. The Bank of England, for example, clearly stated that a “zero-failure financial system” is not and should not be its overall aim,4 and that the decision whether to provide or extend ELA in any particular case must therefore always remain at the discretion of the authorities.5

In the case of Eurosystem, ELA is granted to a bank upon the presentation of adequate collateral and in order to do this, banks must be solvent. The national bank evaluates the seriousness of the situation and acts as a lender of last resort, providing ELA only after obtaining the consent of the ECB’s Governing Council.

In a nutshell, ELA is used in crises, and national central banks have an important role to play as monetary authorities, since it is part of their remit to contribute to the smooth operation of payment systems and ensure financial stability.

2.2 Central bank risk management associated with the ELA framework

As ELA is a national competence and NCBs bear the costs and risks associated with ELA, the management of the risks is also the responsibility of NCBs, to the extent that managing those risks does not interfere with the objectives and tasks of the ESCB. In this regard, NCBs can in principle autonomously design their own collateral framework for ELA, including the applicable risk control measures. Given that assets pledged as collateral for ELA provision do not comprise marketable bonds and are not eligible for the Eurosystem’s standard operations, they are only accepted for the provision of ELA (with a haircut). In other words, each NCB has to implement a high-quality risk management framework based on two pillars: 1) Identify the risk associated with assets pledged as collateral for ELA by applying a haircut, and 2) Evaluate the risk associated with the national central bank’s exposure as a result of ELA liquidity provision. Such a framework should, however, ensure that sufficient collateral is provided, according to the NCB’s own risk assessment, to cover the risks arising from such operations to such an extent that the financial independence of the NCB is safeguarded.

More precisely, subject to compliance with the statutory requirement on collateral efficiency and adequacy and with non-interference with the single monetary policy (pursuant to Articles 18.1 and 14.4 of the ESCB Statute), the conditions for access to ELA, the types of assets accepted as collateral and the risk control measures applicable to such assets, e.g. the haircut imposed, fall within national competences. However, the assessment of bank solvency, one of the prerequisites for ELA provision, is a supervisory competence and in the case of systemically important banks (SIBs), it is exercised centrally by the Single Supervisory Mechanism (SSM).

In addition, Article 59(3)(e) of the Bank Recovery and Resolution Directive (BRRD)7 implicitly requires that ELA collateral needs to be appropriate to avoid an equity write-down and/or conversion of capital instruments in the credit institution receiving ELA. According to paragraph 62(b) of the relevant Banking Communication,6 ELA may constitute state aid if it is not “fully secured by collateral to which appropriate haircuts are applied, in function of its quality and market value”.

Since the national central bank has to accept many types of unencumbered assets in the case of an idiosyncratic liquidity need when the concerned institution has exhausted its high-quality assets, the following necessary conditions must be met for the accepted collateral: (i) ownership can be legally transferred; (ii) it can be priced; and (iii) the asset, including associated risks, can be managed by the central bank. ELA normally comes with an explicit state guarantee, which means the state will cover any losses on the ELA loans, given that the collateral is usually highly illiquid.

As far as it is known, the majority of collateral used in ELA as collateral is Government guarantees or bonds that have ratings lower than those accepted for the ECB’s standard monetary policy operations.

The ECB and the NCBs also do not publish details on their collateral holdings, the prices they paid or the valuations they attach now to the securities they hold as collateral as part of the monetary policy operations of the Eurosystem.

3. Eurozone experience

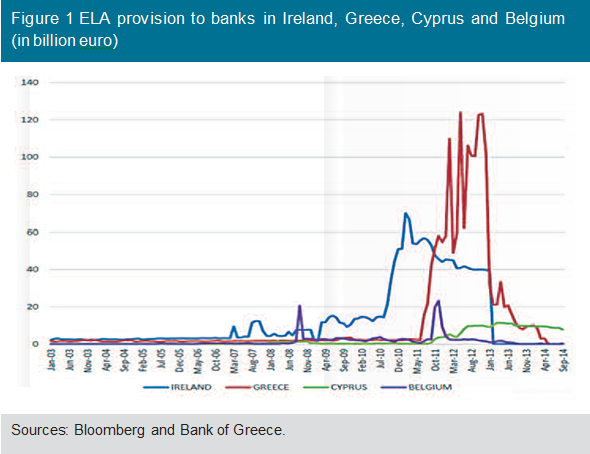

In the wake of the banking crisis of 2008 the ECB has acted as lender of last resort to the banking system for several countries. ELA played an important role during the protracted financial crisis in the euro area. Between 2010 and 2014, ELA had been extended to banks in Ireland, Greece, Cyprus, and Portugal. The following figure shows the development in ELA provision to banks in Ireland, Greece, Cyprus and even Belgium, which needed extraordinary liquidity amidst its banking crisis. As shown in Figure 1, the amounts of liquidity used for ELA were quite substantial at the height of the respective crises. This also reveals that the ECB’s existing collateral framework did impose limits on standard access to liquidity in a number of countries.

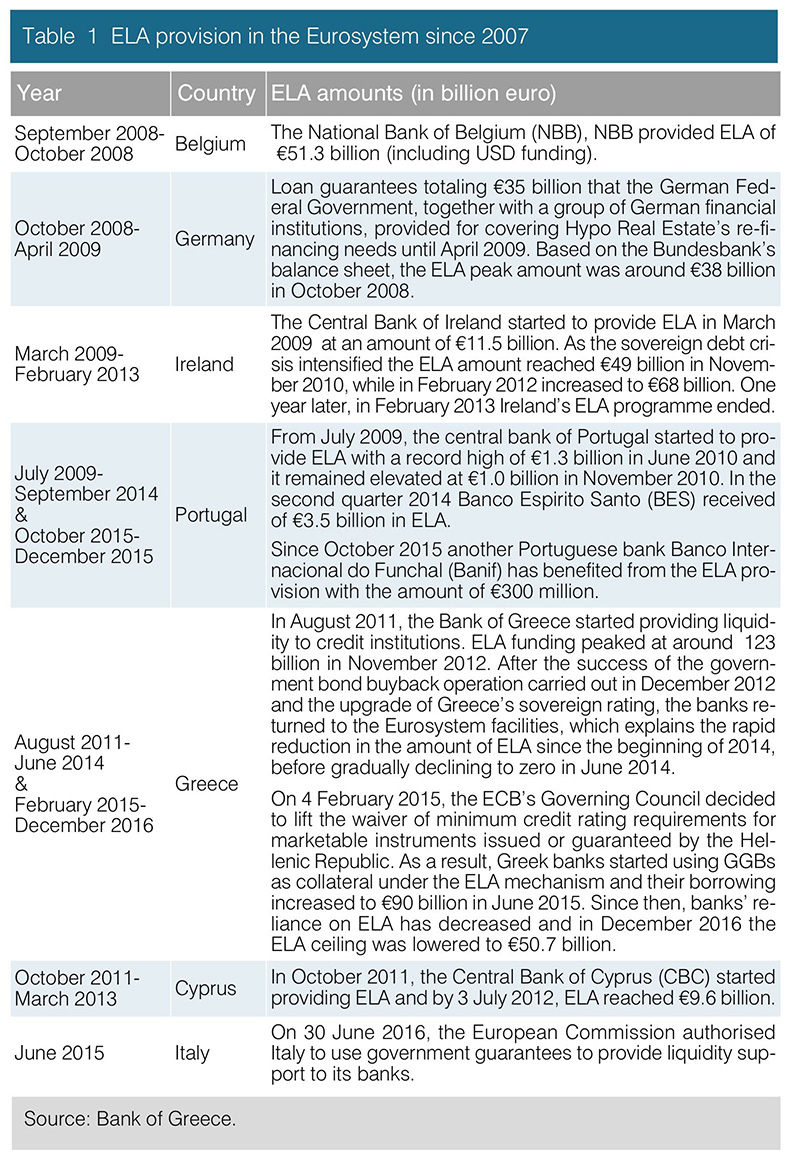

The following Table presents an overview of the countries that used ELA lending since the financial turmoil of 2007.

ELA, as recorded on NCB balance sheets and therefore on the consolidated financial statement of the Eurosystem, showed a surge since the beginning of the financial crisis in 2007, with a peak around the Lehman collapse in autumn 2008, suggests that several NCBs have used or still use ELA. Since the beginning of 2007 ‘Other claims on euro area credit institutions denominated in euro’ of the Eurosystem have increased by around €34 billion to €45 billion (as at 14 January 2011) and ‘other assets’ surged by around €75 billion to €297 billion over the same period. In the following section, the Eurosystem’s ELA programmes are presented per country.

3.1 ELA: The case of Ireland

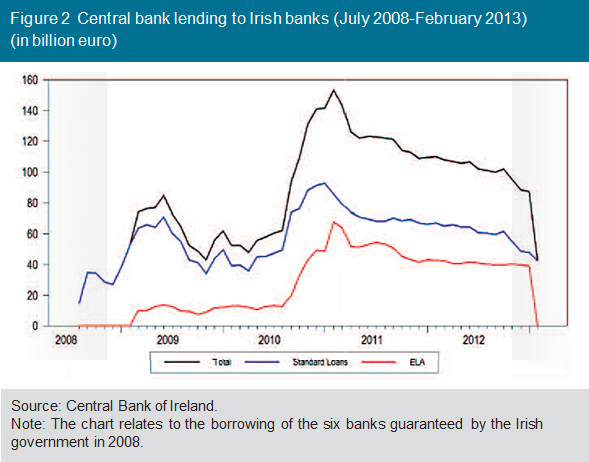

As the scale of the Irish construction collapse became increasingly evident in the course of 2008, international investors became concerned about the exposure of Irish banks to property investment loans. These banks found it increasingly difficult to raise funds on bond markets and on 29 September 2008, two weeks after the collapse of Lehman Brothers, Anglo Irish Bank, specialising in commercial property lending, ran out of eligible collateral for standard ECB monetary policy operations. The bank was nationalised in early 2009 and suffered substantial deposit withdrawals. In March 2009, the Central Bank of Ireland agreed to provide Anglo Irish Bank with €11.5 billion in ELA. As the sovereign debt crisis intensified through 2010, the pace of deposit withdrawals from Anglo Irish Bank intensified and its ELA borrowings moved up sharply. Over the course of 2010, the other main Irish banks also came under pressure from deposit outflows. The September 2008 guarantee had been put in place for two years and the covered banks had issued a large amount of bonds that matured prior to September 2010. They subsequently failed to find new sources of private sector funding. Indeed, since January 2010 the Eurosystem had provided approximately €90 billion - including ELA - to Irish banks, and support began to accelerate rapidly in the latter part of the third quarter of 2010 reaching about €140 billion, or around 85% of Irish GDP, by November 2010, out of which ELA amounted to around €49 billion or around 31% of GDP. This represented around one fourth of the ECB’s total lending - an unprecedented level of exposure to a country such as Ireland, whose share in the capital of the ECB was less than one percent. In late 2010, Ireland applied for financial assistance and its EU-IMF bailout programme began in late 2010. Deposits continued to flow out of the Irish banking system for a number of months and ELA actually increased significantly over those months, from €43 billion in November 2010 to €68 billion in February 2012. The Central Bank of Ireland (CBI) provided emergency loans to banks with an interest rate ranging between 2% and 3%, i.e. based on the ECB’s marginal lending facility of 1.75%, topped by a ‘penalty’ reflecting the emergency nature of the aid. However, the banking system began to stabilise after the release of official stress tests and a large recapitalization round. Ireland’s ELA programme ended in February 2013 when Anglo Irish Bank’s successor organisation, the Irish Bank Resolution Corporation was put into liquidation.

3.2 ELA: The case of Cyprus

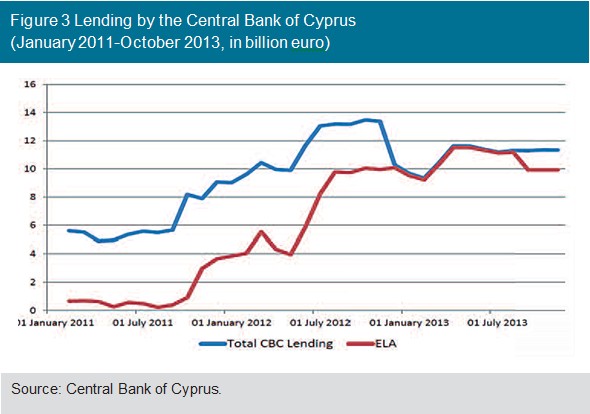

The financial situation in Cyprus is intrinsically linked to that of Greece, given Cypriot banks’ massive exposure to (downgraded) Greek government bonds and also to the private sector in Greece. After suffering losses of €4.1 billion (25% of Cypriot GDP) as a result of the Greek public debt restructuring (private sector involvement – PSI), Bank of Cyprus (BoC) and Laiki Bank (accounting for more than 50% of the banking system’s assets) partially lost access to the interbank market and turned to the Central Bank of Cyprus to obtain funding. This situation was exacerbated by the consecutive downgrades of the Cypriot sovereign rating because of the risk to the government’s implicit liabilities arising from the banks’ situation, and also due to increased deposit outflows. The restructuring of Greek sovereign bonds sharply reduced Laiki Bank’s stock of assets that could be used as collateral for regular Eurosystem monetary policy operations. In October 2011, Laiki Bank applied to the Central

Bank of Cyprus (CBC) for ELA. By November 2011, Laiki Bank had €2.5 billion in ELA funding from the CBC and as of the end of 2011, the total ELA from the CBC stood at €3.5 billion. During the first six months of 2012, as a result of deposit outflows of €2 billion from Laiki Bank’s Greek branches, and the downgrading of Greek bonds held by Laiki Bank worth

€1.2 billion and Cyprus bonds amounting to €2.6 billion, which ceased to be accepted as collateral by the ECB for its monetary policy operations, ELA funding increased by €5.8 billion. In the meantime, and by 3 July 2012, ELA came to €9.6 billion, accounting for more than two thirds of Cyprus’s GDP. Consequently, the government, following the CBC Governor’s suggestion and a decision by Parliament, applied to the EU Support Mechanism. Hence, negotiations with the “troika” (IMF, European Commission and ECB) began in July 2012. Throughout this period and thereafter, which included an election in February 2013, a financial assistance package for Cyprus was agreed in March 2013 under extremely stressed circumstances, and Laiki Bank came under unprecedented pressure due to massive deposit outflows. More precisely, at the end of January 2013, the ECB’s Board of Directors extended the deadline of ELA to Laiki Bank until 21 March 2013. Accordingly, in February 2013, Cypriot banks raised virtually all their funding via the ELA programme. The ECB’s Board of Directors indicated that its decision was taken in accordance with the Terms of Reference of the Eurogroup, in order to urge the new government of the Republic of Cyprus to finalise the agreement for the support programme soon after the elections of February 2013. This decision was notified by the CBC Governor to the new president of the Republic of Cyprus in a letter dated 4 March 2013. This was followed by the first Eurogroup decision of 16 March 2013 in favour of a general ‘haircut’ on deposits held with any bank operating in Cyprus. On 19 March 2013, the Cypriot Parliament rejected the government’s bill to implement this decision. On 21 March, the ECB’s Board of Directors implemented its decision to cease the provision of ELA to Laiki Bank, with a requirement to repay on 26 March 2013. The implementation of this decision would have led to a disorderly bankruptcy of Laiki Bank and to an immediate activation of the Deposit Protection Scheme, which had only €125 million in funds. This would have resulted in an obligation for the Republic of Cyprus to repay the €6.4 billion of insured deposits in Laiki Bank, which would have caused the bankruptcy of the country itself. Faced with this disastrous outlook, the CBC Governor publically stated on the evening of 21 March 2013 the need for immediately passing a series of bills through Parliament, including the bill for the resolution of banks, so that Laiki Bank could be resolved immediately and avoid liquidation and dissolution. A second Eurogroup decision followed on 25 March 2013, whereby a support programme for the Cyprus economy was agreed with the “troika”, which included the immediate resolution of Laiki Bank and the subsequent absorption of its operations by the Bank of Cyprus.

3.3 Other countries: Belgium, Germany, Italy, Portugal

The case of Germany

On 2 October 2008, the European Commission authorised the provision by the German Federal Government (together with a group of German financial institutions) of loan guarantees totaling €35 billion to alleviate Hypo Real Estate’s (Hypo Real Estate Holding AG or HRE Group) liquidity constraints (due to its short-term refinancing strategy as the crisis of confidence among banks worsened in mid-September 2008) and cover its re-financing needs until April 2009, via a newly created special purpose vehicle (SPV)8. The Commission concluded that the measures comply with EU rules on state aid, while the approval of the HRE’s bailout had no bearing on the similar approval of any future measures by German authorities to support a restructuring. Any such measures would have to be assessed on their own merits according to the rules on restructuring aid to establish whether aid was involved, and if so whether sufficient compensatory measures to offset potential distortions of competition were put in place. The HRE Group had a total balance sheet of €400 billion and consisted mainly of three German banks ―Hypo Real Estate Bank AG, Hypo Real Estate Bank International AG and DEPFA Deutsche Pfandbriefbank AG - as well the Irish DEPFA plc. The banks of the HRE Group belonged to one of the largest issuers of covered bonds (Pfandbriefe).

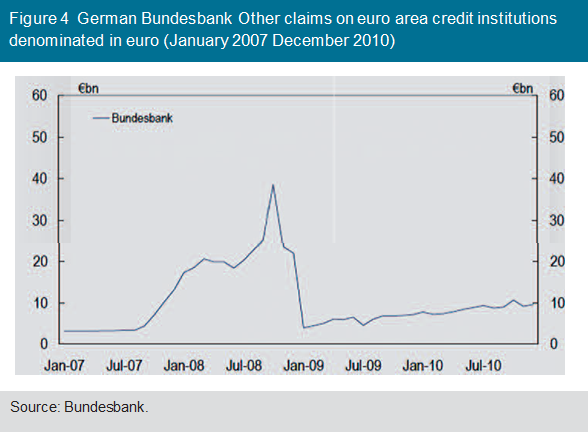

Until the bailout package was finalised, an upfront emergency rescue loan of €15 billion had been provided by a group of German financial institutions. Based on the Bundesbank’s balance sheet, ELA in Germany peaked at €38 billion in October 2008 (see Figure 4), accounting for 1.5% of GDP.

The case of Italy

Following the “Brexit” vote, market participants began to focus their attention on the risks posed by continental Europe. Just one day after the Brexit vote, shares in many Italian banks slumped by more than 30%. On 30 June 2016, the European Commission approved Italian government guarantees to provide liquidity support to the country’s banks9. Italian banks hold nearly €360 billion or 18% of gross total NPLs, a third of the €990 billion of the total Eurosystem’s unpaid loans, while 14 large Italian banks have recorded €286 billion in non-performing exposures.

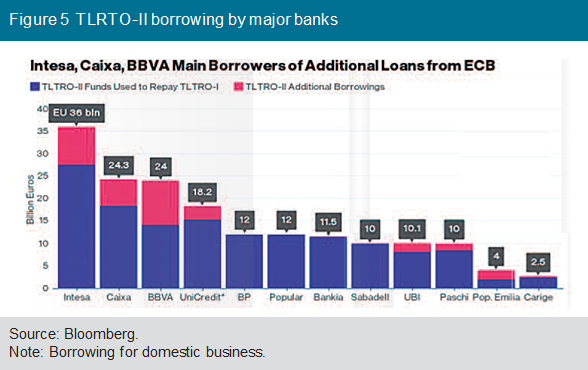

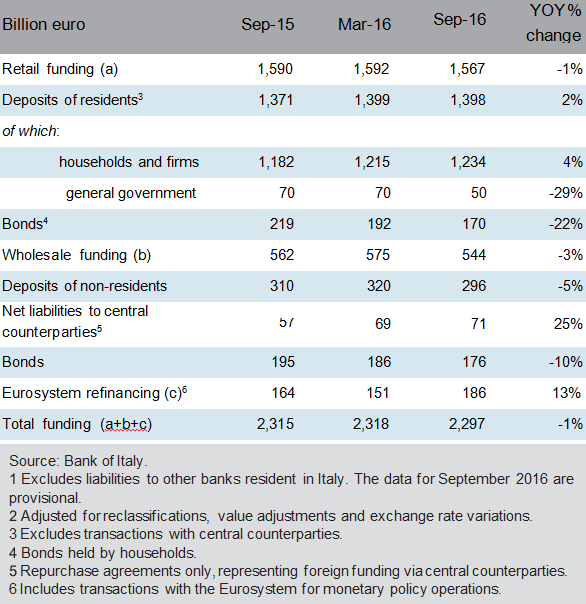

After the UK referendum result, investors have been concerned that weaker Italian banks may struggle to raise the capital they need to work off their bad loans. Hence, Italian banks have increased their borrowing from the ECB by more than 23% since March 2016 (see Table 2). Moreover, Italian banks currently have €150 billion of TLTRO financing, accounting for 34% of total TLTRO take-up in Europe, while in the last ECB’s TLTRO-II operation, most of the new TLTRO-II loans were taken by Italian and Spanish banks, the net borrowings of which exceed €25 billion (see Figure 5).

A potential deterioration in the Italian banking system’s asset quality, rising provisions and Italian sovereign risk pose downside risks to the banks’ ratings.

The cases of Portugal and Belgium

In the case of Portugal, the growing difference between the amount of total loans to financial institutions and the amount of Eurosystem open market operations triggered the use of ELA in early July 2009. This gap rose from levels at, or close to, zero before July 2009 to a record high of

€1.3 billion (0.8% of GDP) in June 2010 and remained elevated at €1.0 billion in November 2010. A bank that extensively used the ELA facility was Banco Espirito Santo (BES) during the period of 2010-2014. Particularly in the second quarter of 2014, shortly after the announcement of record losses, BES virtually exhausted its collateral buffer, having received more than €3.5 billion in ELA and faced imminent suspension of its counterparty status with the ECB. The above developments forced BES into resolution: its equity and liabilities to subordinated debt were housed in a bad bank that retained the name and banking license of BES. Another Portuguese bank that has benefited from the ELA provision was Banco Internacional do Funchal (BANIF) due to its dwindling deposits, which amounted to €726 million between 15 October 2015 and 15 December 2015 and considerably worsened the already fragile liquidity position of BANIF. As a result, BANIF’s immediate liquidity needs were met by the provision of credit of €300 million granted by Banco de Portugal under the rules applicable to ELA provision. As regards the National Bank of Belgium (NBB), NBB provided ELA of €51.3 billion (including funding in US dollars) in September/October 2008.

4. The Greek experience

4.1 The two ELA episodes: 2011-2013 & 2015-2017

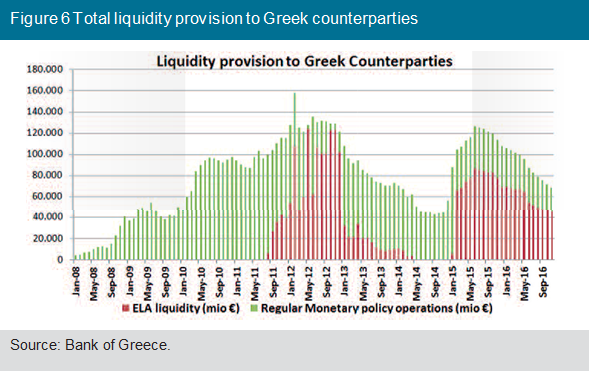

In May 2010, the Greek government requested a financial bailout from the IMF and the European Union and signed a Memorandum of economic and financial policies with the so-called “troika”: the IMF, the European Commission and the ECB. The programme provided for loans of €110 billion, to be disbursed quarterly over a three-year period in exchange for the Greek government’s commitment to a three-year macroeconomic adjustment plan. The EU-IMF programme had the dual objective of a large fiscal adjustment to address fiscal insolvency and, simultaneously, “internal devaluation” to close the competitiveness gap. However, it soon became apparent that the programme’s implementation was lagging behind schedule. Greek banks have not been immune. More than 25% of deposits had been lost by November 2011, compared with their levels prior to the onset of the crisis in early 2010. Banks’ access to international capital markets was also cut off. As a result, Greek banks relied fully on ECB funding via regular open market operations, which peaked at around €110 billion in June 2011. The total provision of liquidity to domestic banks through the Bank of Greece increased sharply from €8.8 billion at end-2007 to €40.5 billion at end-2008, tripled by the end of 2011 and continued to rise in 2012, before declining gradually after July 2012.

As a result, the first episode of ELA began in August 2011, when the Bank of Greece started providing liquidity to credit institutions through the ELA mechanism due to the decreasing value of their eligible collateral, given that the most common marketable assets in Greek banks’ portfolios (Greek government bonds) at times ceased to be accepted as collateral by the Eurosystem. This funding was aimed at counterbalancing the decrease in and the withdrawal of deposits by the private and public sectors, as well as the decrease in the value of eligible collateral for monetary policy operations, against a background of the banks’ inability to resort to the markets for funding. Indeed, uncertainty led to large deposit outflows, amounting to some €90 billion, i.e. one third of the initial deposit base, in less than three years during 2010-2013. Indicatively, between end-December 2011 and end-June 2012 private sector deposits with the Greek banking system fell by €26.3 billion while in May 2012 alone this reduction reached €9 billion. It should be noted that ELA funding peaked at around €123 billion in November 2012, as the Bank of Greece provided banks with ample liquidity under the recapitalisation plan following the signing of the PSI in March 201210. This increase in central bank funding led to sharply heightened financial and operational risks assumed by the Bank of Greece, as analysed in the following section.

After the success of the government bond buyback operation carried out in December 2012 and the upgrade of Greece’s sovereign rating, the banks returned to the Eurosystem facilities, which explains the rapid reduction in the amount of ELA since the beginning of 2014, before gradually declining to reach zero in June 2014.

The second episode of ELA started in the aftermath of Greece’s January snap election, when a further four-month technical extension of Greece’s bailout programme was approved by the troika, giving rise to expectations that the payment terms would be renegotiated before the end of April, allowing the programme review to be completed and the release of the final tranche of financial assistance to be approved before the end of June. During that time, as it was still unclear whether a political agreement would be struck between Greece and its international creditors, the deteriorating economic climate and heightened uncertainty led to widespread deposit outflows, with Greek banks starting to resort to ELA facility. On 4 February 2015, the ECB’s Governing Council decided11 to lift the waiver affecting marketable instruments issued or guaranteed by the Hellenic Republic, which allowed them to be used in Eurosystem monetary policy operations despite the fact that they did not fulfil minimum credit rating requirements, arguing that at the time it was not possible to assume a successful conclusion of Greece’s programme review. As a result, Greek banks could no longer use Eurosystem open market operations to raise liquidity at very low rates (0.05%) and cover their huge deposit outflows, and instead had to use GGBs as collateral under the ELA mechanism, at a much higher rate of 1.55%. In the space of one month (February), Greek banks’ liquidity options were limited to ELA and they could use only EFSF bonds for direct and low-cost funding from the ECB. Published data implied an average haircut of 25%-35% to the portfolio of collateral of Greece’s four systemic banks (Piraeus Bank, National Bank of Greece, Alpha Bank and Eurobank). Against this background, the ECB decided to cap the Bank of Greece’s ELA provision to €60 billion in February and given the huge deposit outflows which grew to €45 billion in the first half of 2015, gradually increased it over this five-month period to reach the amount of almost €90 billion. About one third of Greece’s deposit outflows were effected through the withdrawal of banknotes (for hoarding cash “under the mattress”); one third was transferred to banks abroad; and one third was invested in foreign money market instruments.

After the announcement of the Greek referendum on 26 June 2015 and the halting of negotiations between Greece and its creditors, the ELA amount remained unchanged and in order to stop further deposit outflows, the Greek government imposed capital controls and announced a bank holiday. The bank holiday and the imposition of capital controls (including restrictions on cash withdrawals from bank accounts, crossborder payments and cross-border capital movements) managed to contain deposit outflows and capital flight. From September 2015, the Bank of Greece decided to disclose12 on a biweekly basis the ELA ceiling approved by the ECB’s Governing Council (GC) in order to ensure more clarity and transparency in the banking system. Since then, banks’ reliance on ELA has decreased and, since end-July 2015, the ceiling has been lowered by more than €38.3 billion to €50.7 billion. This lower ceiling reflects the improved liquidity situation of Greek banks amid lesser uncertainty and stabilised private sector deposit flows; the gradual and improving access regained by banks to interbank market funding (in fact, using collateral not eligible for Eurosystem operations) following the ECB Governing Council’s decision of 29 June 2016 to reinstate the waiver affecting the eligibility of Greek bonds used as collateral in the Eurosystem’s funding operations; and the successful recapitalisation of Greek banks at the end of 2015. It also reflects progress with the restructuring of Greek banks (sale of Finansbank by the National Bank of Greece). In more detail, as far as deposits are concerned, the completion of bank recapitalisations in December 2015 and of the first review of the third programme in June 2016 represents an important step towards the restoration of confidence in the Greek banking system which has been gradually facilitating the recovery of bank deposits. The continued easing of capital controls is also likely to contribute to this end. By September 2016, a total of €7.4 billion of funds invested since the imposition of capital controls in June 2015 by Greek residents (firms and households) in financial assets abroad, i.e. deposits (€4.6 billion) and equities including mutual fund shares (€2.8 billion), has been repatriated. Overall, between end-June 2015 and October 2016, deposits of the domestic non-financial private sector with Greek banks have increased by €2.5 billion, with the total stock of deposits of the non-financial private sector coming to €119.4 billion in October 2016.

4.2 Risk management in the Greek ELA case

Pillar 1: Identification of the risk associated with the collateral pledged for ELA liquidity by applying a haircut

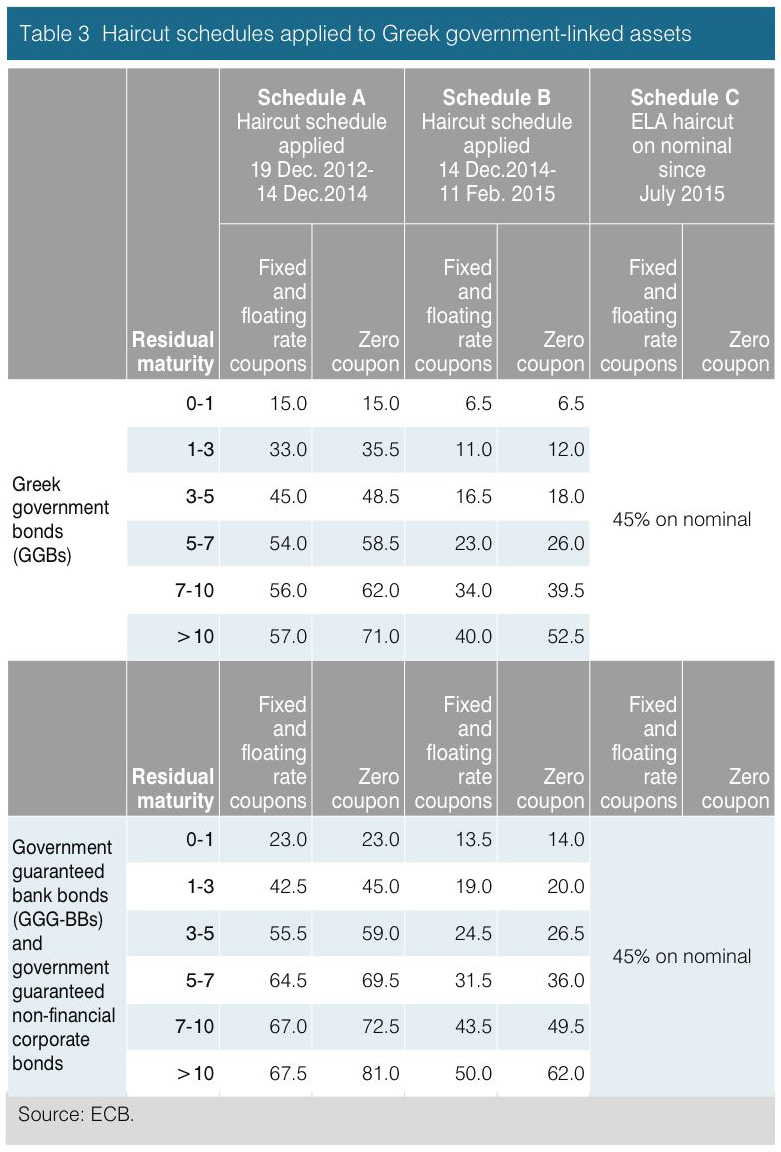

In the case of Greek government-linked assets and their haircuts benefitting from a waiver, the first ad-hoc haircut schedule for Greek government-linked assets was applicable from 19 December 2012 to 14 December 2014 and reflected the compliance of Greece with the adjustment programme, following the Private Sector Involvement (PSI).14

The second haircut schedule was applied from 15 December 2014 to 11 February 2015 and reflected an optimistic outlook for the Greek economy, justified by positive economic indicators and progress in the reforms required in the context of the programme.15

Subsequently, Greek government-linked assets were accepted by the Bank of Greece as collateral in ELA operations and subject to the abovementioned December 2014-February 2015 haircuts.

In February 2015, the ECB Governing Council decided to lift the waiver of minimum credit rating requirements for marketable instruments issued or guaranteed by the Hellenic Republic, such as Greek government bonds, T-bills and Greek government-guaranteed bank bonds (GGGBBs), due to high uncertainty surrounding the conclusion of the programme review. Furthermore, in July 2015 the Governing Council of the ECB16 decided not only to keep the amount of ELA provided to Greek banks unchanged at €89 billion17, but also to adjust the haircuts on collateral accepted by the Bank of Greece for the provision of ELA.

The aforementioned assets have been pledged as collateral in ELA operations subject to a flat 45% haircut on nominal value, according to Bloomberg18, as the haircuts set under ELA operations aren’t public, a level which ensured that banks remained sufficiently collateralised at the time of its introduction. The application of this haircut schedule would lead to an aggregate government-linked collateral availability of €35.7 billion (with €6.8 billion collateral available for Eurosystem operations and €28.9 billion remaining available for ELA).

The methodology used to value the Greek government-linked collateral is derived from quoted prices or from a theoretical pricing model in line with the provisions of the General Documentation19 taking into consideration both market and credit risk. In other words, there has been no significant deviation from the Eurosystem practice of applying haircuts to the most representative value of the collateral, as required in the General Documentation, taking into account the difficulties connected with estimating a yield curve when few quoted bond prices are available, the shallow liquidity in the bond market, the country’s credit quality and market volatility. In other words, the risks involved in lending to counterparties are mitigated and transformed into several types of risks (mainly market, liquidity and credit) related to the collateral asset that can only materialise in the event of a counterparty default. The bulk of these risks are in turn mitigated for the ELA’s collateral by valuation haircuts and, in certain cases, concentration limits, and the haircut is estimated as the deduction of a certain percentage from the valuation of the asset accepted as collateral for the purpose of calculating the amount of liquidity that can be backed by this asset in case of counterparty default.

The following table resumes the haircut schedules applied to Greek government-linked assets.

Pillar 2: Evaluation of the risk associated with the national central bank’s exposure resulting from ELA liquidity provision

Turning now to the financial risks of ELA incurred and managed by NCBs, the competent NCB risk management unit has to adopt a sophisticated methodology based on an ongoing review and renewal of key credit risk calculation parameters relating to ELA in order to estimate principally the central bank’s exposure to credit risk through ELA provision, given that the majority of assets accepted as ELA collateral are not marketable.

More specifically, the Bank of Greece implements an ongoing procedure primarily renewing the default probabilities of the loans accepted as collateral in ELA, using historical data for housing and business loans in the last five years and default data for specific ratings by credit rating agencies such as Moody’s, Standard & Poors, Fitch and ICAP. The renewed default probabilities assume a worst-case scenario based on a particularly unfavourable situation over the last five years. This option leads to a conservative measure of the credit risk for the ELA’s collateral portfolio. In other words, the methodology followed by the Bank of Greece for measuring risk relating to ELA collateral is similar to the measurement carried out by the ECB20 in its monetary policy operations, but with more strict and conservative key parameters. Specifically, different simulations are produced using the Monte Carlo methodology and the expected shortfall (conditional value-at-risk) is estimated at a 99% confidence level (ES 99%), which is defined as the average loss occurring within the worst percentile of the distribution of the final value of the collateral portfolio over a one-year horizon. For practical calibration purposes, an adverse scenario is adopted to correspond to the average loss in the worst 1% of cases, i.e. to the concept of expected shortfall at a 99% (ES 99%) confidence level. When in this extreme simulation, a counterparty defaults, the change in the value of the collateral is measured, taking into account the time required until the liquidation (liquidation period) or until each security or loan matures, if such an event were to occur earlier. The last step is to determine whether the drop in collateral value is greater than the haircut applied, resulting in the final potential losses to the Bank of Greece.

However, even after risk control measures have been applied, some residual risks remain, given that the credit risk, market risk and liquidation risk associated with the collateral in the event of counterparty default cannot be fully mitigated by valuation and haircuts. In general, ELA also carries operational and legal risks. Indeed, the residual risks associated with ELA tend to be higher than those relating to regular monetary policy operations. ELA should function as a “bridge” measure to prevent acute crises, it is thus very important that ELA is provided in a way that minimises credit risk for a central bank, in order to avoid moral hazard effects.

5. Concluding remarks

Based on the recent experience from the euro area sovereign debt crisis, ELA operations should have a distinct role in the general crisis management infrastructure of dealing with quickly emerging problems. Clearly, ELA is a last-resort measure that central banks use only when the stability of the financial system is at stake. Precise guidelines and a solid analysis capability are the most important to pinpoint those situations in which ELA is necessary.

Moreover, the costs and risks incurred through the provision of ELA amidst a crisis suggest that the financial system needs to be more resilient if the future need for ELA were to be significantly reduced. International banks’ capital buffers must have sufficient quality to absorb losses, in order to reassure market participants of banks’ soundness. Several factors arguably contributed to insufficient self-insurance before the crisis, including weaknesses in the assessment and management of liquidity risk by financial institutions; a regulatory framework that did not place sufficient emphasis on the adequacy of capital and liquidity buffers; and a lack of market discipline. The consensus that financial institutions need more and better liquidity and higher capital levels is reflected both in the behaviour of the private sector and in the new post-crisis regulatory architecture.

From a regulatory perspective, at least two conditions need to be met in order to effectively reduce the need for ELA. First, liquidity regulation needs to be designed in a way that encourages prudent liquidity man-

agement under normal circumstances and allows the use of liquidity buffers to cushion a liquidity shock. For example, the liquidity coverage ratio (LCR) aims to provide banks with the ability to sustain operations for 30 days by drawing down their buffer stocks of liquid assets rather than resorting to government assistance. In addition, requiring institutions to maintain strong liquidity buffers may also facilitate a wind-down without a need to draw on ELA. Yet a systemic liquidity shock may require an infusion of liquidity into the financial system. For instance, banks may hoard liquid assets over and above those necessary to satisfy the regulatory requirement for precautionary reasons. And banks may be reluctant to use liquidity buffers and let the LCR drop because of fears of stigma. As a consequence, more stringent liquidity regulation can be expected to reduce the need for ELA in response to idiosyncratic events and to make systemic events less likely. But it is not clear to what extent such regulation would or should be intended to reduce the need for liquidity injections by central banks if a systemic liquidity crisis were to occur. Second, the perimeter of regulation would have to cover institutions that can be the source of liquidity shocks with system-wide effects. As a result, financial regulators will need to continuously monitor developments in the financial system to identify where maturity transformation is taking place, consider the implications for liquidity risks in the financial system, and consider policy measures to contain moral hazard. Finally, it seems that a more transparent communication regarding the central bank’s actions as a lender of last resort helps to better understand its actions in times of crisis.

Annex: The ECB’s internal ELA procedures

ELA should not conflict with the objectives and tasks of the European System of Central Banks (ESCB). Interference with the ESCB’s objectives and tasks could, for instance, result from the following:

(i) a threat to the singleness of monetary policy,

(ii) a threat to the implementation of monetary policy, for example by making the steering of short-term rates more difficult,

(iii) a threat to the financial independence of the NCB, for instance, if ELA was not provided against sufficient collateral to safeguard such independence,

(iv) an obvious concern about a possible breach of the monetary financing prohibition, or

(v) provision of ELA at overly generous conditions, which, in turn, could increase the risk of moral hazard on the side of financial institutions or responsible authorities.

As distinct from the Eurosystem’s credit operations, NCBs can temporarily provide ELA to euro area credit institutions which are solvent but face liquidity problems. ELA is a national monetary policy instrument under the ECB’s supervision. More precisely, the ECB Governing Council can object to ELA provision, should this national monetary policy tool interfere with the objectives and tasks of the ESCB as set forth under Articles 2 and 3.1 of the Statute of the European System of Central Banks and of the ECB (hereinafter Statute of the ESCB).21 To ensure the possibility of such an objection, ELA provision is subject to ex ante information requirements.

Despite the existence of ELA in the Eurosystem since 2008, in October 2013 the ECB published a brief official definition and description of its ELA procedures, although it has not so far published an ELA breakdown by country.

According to the ECB, ELA means the provision by a Eurosystem National Central Bank (NCB) of:

(a) central bank money and/or

(b) any other assistance that may lead to an increase in central bank money to a solvent financial institution, or group of solvent financial institutions, that is facing temporary liquidity problems, without such operation being part of the single monetary policy.

The main key features of the ELA procedure are the following:

• The responsibility for the ELA provision lies with the NCB(s) concerned unlike the standard Eurosystem liquidity providing operations (i.e. MROs, LTROs). Any costs of, and the risks arising from, the provision of ELA are incurred by the relevant NCB.

• Article 14.4 of the Statute of the ESCB assigns the Governing Council of the ECB responsibility for restricting ELA operations if it considers that these operations interfere with the objectives and tasks of the Eurosystem. Such decisions are taken by the Governing Council with a majority of two-thirds of the votes cast.

• As a rule, NCBs are required to inform the ECB of the details of any ELA operation, at the latest, within two business days after the operation was carried out. The information needs to include the counterparty to which the ELA has been/will be provided, the ELA duration, the ELA amount, the collateral pledged including the valuation of, and any haircuts applied to, and the specific reasons for the ELA provision (i.e. margin calls, deposit outflows, etc.). The ECB Governing Council can decide to request additional information from the respective NCB, or to broaden the information/reporting requirements, and/or make them more stringent in specific cases, if this is deemed necessary.

• A prudential supervisor’s assessment is required, over the short and medium term, of the liquidity position and solvency of the institution receiving the ELA, including the criteria used to come to a positive conclusion with respect to solvency.

• An assessment of the cross-border dimensions and/or the potential systemic implications of the situation that necessitates the extension of ELA is required where relevant.

• In the event of the overall volume of the ELA operations envisaged for a given financial institution or given group of financial institutions exceeding a threshold of €500 million, the NCB(s) involved must inform the ECB as early as possible prior to the extension of the intended assistance.

• In the event of the overall volume of the ELA operations envisaged for a given financial institution or given group of financial institutions exceeding a threshold of €2 billion, the ECB Governing Council will consider whether there is a risk that the ELA involved may interfere with the objectives and tasks of the Eurosystem. Upon the request of the NCB(s) concerned, the Governing Council may decide to set a threshold and not to object to intended ELA operations that are below that threshold and conducted within a pre-specified short period of time. Such a threshold may also refer to several financial institutions and/or several groups of financial institutions at the same time.

• The NCB(s) provide(s) the relevant information at least three business days before the ECB Governing Council meeting at which the request is to be considered. Where the threshold refers to several financial institutions or several groups of financial institutions at the same time, the information should be provided on a bank-by-bank basis, along with a projection ―covering, in principle, the period up to the next ordinary ECB Governing Council meeting― of the funding gap for each individual bank that is to receive ELA on the basis of two scenarios, namely the expected scenario and a stress scenario.

Two important remarks must be made in relation to the framework changes for the ELA operations:

1. It should be noted that the ECB did not specifically disclose information about ELA procedures prior to 16 September 2015, the day on which the ECB Governing Council decided that NCBs will have the option to communicate publicly about the provision of ELA to banks in their country, in cases where they deem that such communication is necessary. Indeed, for the period before 2015 there was not a lot of disclosed information for the ELA provision procedures22 where it was referred only that where ELA is provided, it is provided by an individual National Central Bank (NCB), at its own risk and potential cost, while there is no obligation to reveal publicly any information concerning ELA provision. Also, it is referred that cooperation between EU central banks during crises is facilitated by a specific framework set out in an EU-wide Memorandum of Understanding (MoU) and in some regional MoUs. The MoU is a nonpublic document consisting of a set of principles and procedures for cross-border co-operation between banking supervisors and central banks in crisis situations, it is legally non-binding, and without prejudice to further co-operation arrangements.

2. As far as the amount of outstanding ELA is concerned, the ECB did not explicitly disclose the amount of outstanding ELA in the ESCB consolidated financial statements (published weekly), but included it under the items: “Other securities” and “Other assets”. The ECB disclosed the aggregate amount of ELA in the eurozone as at 20 April 2012 by including it into the item: “Other claims on euro area credit institutions denominated in euros” (asset item 6) of its financial statement. This accounting reclassification allowed the total amount of ELA to be calculated at €121.14 billion in the eurozone as at 20 April 2012. Financial statements are updated weekly and, as a result, the total amount of ELA per week is unknown, after this date, because it is consolidated with the other components of the “Other claims” item, which include current accounts, fixed term deposits, day-to-day money and reverse repo transactions in connection with the management of security portfolios held under asset item 7. As a result, estimated ELA outstanding in each country must be derived using data in the balance sheet at a historical level. Usually there is a two or three-month lag between the end of an accounting period when an NCB’s balance sheet is released and the current date, so it is difficult to determine total ELA outstanding in each country on a timely basis. Also, it is difficult to determine which part of the amounts that credit institutions borrow are used to meet their normal short-term liquidity needs and which part thereof represents ELA. However, after 20 September 2015, NCBs may release their own ELA ceiling approved by the ECB Governing Council in order to ensure more clarity and transparency in the banking system.

1 The Bank of Amsterdam, established in 1609, is considered to be the precursor to modern central banks, followed by the Central Bank of Sweden, which was founded in Stockholm in 1664.

2 Speech by Sveriges Riksbank Deputy Governor Lars Nyberg entitled “The infrastructure of Emergency Liquidity Assistance what is required in today’s financial system?”, delivered at the CGFS regional meeting in the Bank of Japan (Tokyo) on 22 May 2000.

3 Speech entitled “The ECB and its role as lender of last resort during the crisis” by Peter Praet, Member of the Executive Board of the ECB, at the Committee on Capital Markets Regulation conference on “The lender of last resort – an international perspective”, Washington, D.C., 10 February 2016.

4 HM Treasury (HMT) and the Department for Business, Innovation & Skills, White paper “Banking reform: delivering stability and supporting a sustainable economy”, June 2012, p. 4.

5 In the UK, the Bank of England acts under the framework of the Tripartite Memorandum of Understanding (MoU) with HMT and the Financial Services Authority (FSA).

6 Directive 2014/59/EU of the European Parliament and of the Council of 15 May 2014 establishing a framework for the recovery and resolution of credit institutions and investment firms.

7 As collateral, HRE provided a package of securities and loans with a nominal value of

€42 billion and the shares of its subsidiary banks

8 Such a guarantee was necessary for attracting liquidity from a private consortium of German financial institutions and for allowing the SPV to tap additional emergency liquidity lines from the German Bundesbank.

9 Opinion of the European Central Bank of 24 January 2012 on a guarantee scheme for the liabilities of Italian banks and on the exchange of lira banknotes (CON/2012/4) sets out the relevant conditions for ELA operations under Article 8 of the relevant Italian Decree Law No 201 of 6 December 2011 on equity, growth and fiscal consolidation.

10 Eurogroup statement of 21 February 2012.

11 ECB Press Release “Eligibility of Greek bonds used as collateral in Eurosystem mone-

tary policy operations”, 4 February 2015.

12 Bank of Greece, Press Release “ELA ceiling for Greek banks”, 17 September 2015.

13 See Decision of the European Central Bank on temporary measures relating to the eligibility of marketable debt instruments issued or fully guaranteed by the Hellenic Republic of 19 December 2012 (ECB/2012/32), OJ L 359, 29.12.2012, pp. 74-76.

14 See Guideline 2014/870/EU of the European Central Bank of 19 November 2014 amending Guideline ECB/2014/31 on additional temporary measures relating to Eurosystem refinancing operations and eligibility of collateral and amending Guideline ECB/2007/9 (ECB/2014/46), OJ L 348, 4.12.2014, pp. 27-29.

15 See Decision (EU) 2015/300 of the European Central Bank of 10 February 2015 on the eligibility of marketable debt instruments issued or fully guaranteed by the Hellenic Republic (ECB/2015/6), OJ L 53, 25.2.2015, pp. 29-30.

16 ECB press release, “ELA to Greek banks maintained”, 6 July 2015.

17 ECB press release, “ELA to Greek banks maintained its current levels”, 28 June 2015.

18 “Greek Banks Seen Days From Breakdown as Bailout Talks Resume”, 7 July 2015.

19 See Guideline 2015/510/EU of the European Central Bank of 19 December 2014 on the implementation of the Eurosystem monetary policy framework (ECB/2014/60), OJ L 91, 2.4.2015, pp. 3-135.

20 European Central Bank (2015), “The financial risk management of the Eurosystem’s

monetary policy operations”, European Central Bank: Frankfurt Am Main.

21 Whilst Article 2 refers to the objective of maintaining price stability, Article 3.1 lists the

following four primary tasks to be carried out through the ESCB, in accordance with Article 127(2) of the Treaty on the Functioning of the European Union (TFEU): “to define and implement the monetary policy of the Union; to conduct foreign-exchange operations consistent with the provisions of Article 219 of that Treaty; to hold and manage the official foreign reserves of the Member States, to promote the smooth operations of payment systems”.

22 See, by way of reference, ECB Annual Report 1999, Annex 1; ECB press release of 10 March 2003, ECB press release of 18 May 2005, ECB Monthly Bulletin February 2007, and European Commission press release, 2 October 2008.