Talking points by the Bank of Greece Governor Yannis Stournaras at the LSE "The Greek Economy: Past, Present and Future”

14/03/2024 - Speeches

- Greece: Beyond any doubt, an international success story. The recent recovery of investment grade status confirms this. Bond spreads and other metrics were actually consistent with investment grade status, even when Greece had not formally achieved investment grade. Economic growth is expected to be considerably higher than the average euro area growth rate in the medium term. Major fiscal problems, debt sustainability as well as bank restructuring and recapitalization issues have been successfully resolved. However, in the second half of 2000’s, an imprudent fiscal policy and loss of competitiveness created gigantic “twin deficits” and financial problems which brought Greece into the center of the Global Financial Crisis, with markets and analysts predicting Grexit both in 2012 and 2015. So, how did Greece turn itself into a success story?

(A) Painful domestic fiscal and structural adjustment during the three adjustment programmes,

(B) Strong will to stay in the euro area,

(C) Generous debt refinancing at very favorable terms,

(D) ECB waiver - not needed any more since Greece obtained investment grade,

(E) NGEU-RRF generous participation,

(F) In the last several years, orthodox fiscal, financial and structural policies are being pursued.

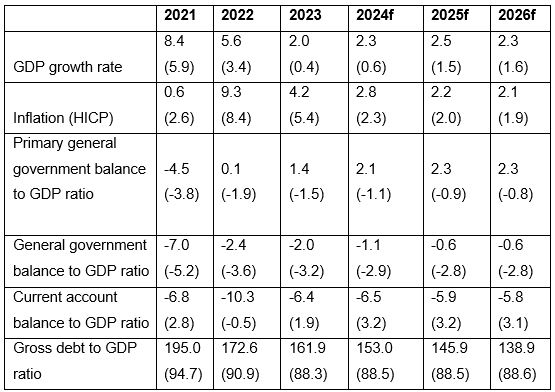

- Baseline Projections (%) – Greece and Eurozone (in parenthesis)

Source: ELSTAT (Eurostat) and March 2024 ECB Projection Exercise

f: forecasts

- Financial Sector:

1. Banks:

- Recapitalisation from HFSF, Funding Gap from HFSF, HAPS (Hercules): Remarkable progress since then:

NPLs 6.6% now, from 49% in 2016 (EU: 1.8%).

-Increased profitability, Capital metrics above minimum supervisory demand, Adequate Liquidity, Strong Supervision, Frequent stress tests, No national bias, Manageable interest rate risks, Limited exposure to CRE & other market risks, RRF support, Hellenic Development Bank support - large spread between deposit and lending interest rates.

- HFSF disinvestment is well on its way with very good results: Unicredit-Alpha Bank deal is a further indication of return to normality and NBG privatization has been an unexpected success. The significant interest from investors facilitated the successful divestment of the total amount of HFSF’s share (27%) in Piraeus Bank. Banks now have full access to capital markets.

- LSI’s restructuring and capital increases well under way, with the merger between Attica Bank and Pancretan Bank being the cornerstone expected in Q3 2024.

However:

- Strong monetary policy tightening, tightening of financial conditions, new NPLs, quality of capital (53.6% DTC in their CET1 capital), lack of homogeneous crisis management framework in Europe, lack of EDIS (It is important to adopt the European Commission proposals on Crisis Management - Deposit Insurance - CMDI).

2. Private Insurance:

Very strong capital position (Solvency Capital Requirement- SCR: 2.1 billion euros vs eligible own funds 3.7 billion euros, SCR ratio 1.8) as per Q4 2023.

Large upside: Gross written premiums approximately 2.3% of GDP vs 8.0% in EU as per Q4 2022.

Challenges:

- Cover Insurance Protection Gap in: Catastrophes (e.g. earthquakes, floods, wildfires), Health, Pensions. The Government has already initiated measures for Natural Catastrophes Insurance Gap (tax incentives and obligatory Insurance for SMEs).

- Climate Change – Digitalisation – Cyber Threats.

- Investment Opportunities:

- FDI already 3.1% of GDP in 2021, 3.6% in 2022 and 2.0% in 2023, from 1.7% previously (2015 – 2020) - NGEU (RRF) + EU Structural Funds = 65 billion euros in the next five years (2024-2028).

- Investment to GDP ratio: 14.3% in 2023, from 16.6% in 2010. Corporate investment has fully recovered to pre-2010 levels. Nevertheless, total investment-to-GDP ratio is still lagging behind relative to the EU (22.0%) mainly due to the decline in housing investment over the past decade. But investment in housing is catching up very fast. RRF funding will help increase investment-to-GDP ratio to the EU average. Full implementation of RRF and related reforms is expected to increase GDP by 10% over the next 10 years (BoG simulations). Will this create an unsustainable current account deficit? No, if strong reforms expand the production capacity in the tradeable goods and services sectors, if competitiveness continues to improve and if fiscal buffers are adequate. In any case, FDI needs to expand even more especially in periods of high current account deficits.

- Challenges ahead:

- While relative unit labour costs and relative prices have fallen indicating improving competitiveness, structural competitiveness remains low because of structural rigidities. In a nutshell, these are:

Delays in delivery of Justice, Red tape, Poor infrastructure, Delays in National Cadastre and Land Use plans, Low female and youth participation in the labour market along with mismatches in labour skills, increased tightness in the labour market, Adverse demography, Tax evasion, Problems in the “triangle of knowledge” (Education-Research-Innovation), Oligopolies (e.g. food, fuels, banks, private hospital care). These structural rigidities impose a constraint in productive capacity, potential growth and Total factor productivity (TFP) growth.

- Exogenous factors with negative implications: Uncertainty world-wide, geopolitical risks, stagflationary forces, financial instability episodes, public debt problems. The “snowball effect” (the difference between interest rates and growth rates) will likely play a dominant role worldwide in the next period.

- Exogenous factors with positive implications: The new fiscal framework in Europe.

- Recommendations:

- Eliminate the above-mentioned rigidities, improve structural competitiveness and enhance competition.

- Primary general government surplus 2% cyclically adjusted.

- Create additional fiscal buffers for unforeseen events and climatic crises.

- Accelerate Energy Conservation & Green Transition.

- Import Substitution equally important to export promotion.

- Maximise the productive use of EU funds and expand FDI.

- Major goal: To achieve real convergence without macroeconomic imbalances.

- Major challenge: to exploit the investment grade rating that has been achieved and to move quickly to higher credit rating.