Bank of Greece Economic Bulletin, Issue 51

30/07/2020 - Press Releases

Today, the Bank of Greece published the latest issue of its Economic Bulletin (No. 51/July 2020).

The articles published in the Economic Bulletin reflect the views of the authors and not necessarily those of the Bank of Greece.

Issue 51 features the following four articles:

Sofia Anyfantaki, Hiona Balfoussia, Dimitra Dimitropoulou, Heather Gibson, Dimitris Papageorgiou, Filippos Petroulakis, Anastasia Theofilakou and Melina Vasardani: “COVID-19 and other pandemics: a literature review for economists”

The article provides a comprehensive review of the literature on the economic impact of pandemics and identifies the transmission channels at play. The primary channel comes from the supply side, as pandemics reduce both the quantity and the quality of labour. They can also lead to a destruction of capital, as businesses close and investment is curtailed. On the demand side, consumption is particularly vulnerable to the impact of both reduced income and declining consumer confidence. A third channel works through the financial system. While the natural rate of interest might be expected to fall, leading to a period of low interest rates, financial institutions are likely to come under stress. Rising uncertainty, along with an increase in the number of borrowers with debt servicing difficulties, may dampen investment and generate a liquidity squeeze, exacerbating the demand effects of the pandemic. All three channels work to reduce current and potential output. Spillovers and asymmetries can explain the varying impact of the pandemic across countries, but it seems that open economies, embedded in global value chains, are especially vulnerable. Nonetheless, the literature provides ample evidence on how to limit the impact of pandemics using monetary and fiscal policy, combined with measures to ease liquidity constraints on the financial sector. In the context of the EU, the coordination and mutualisation of the policy response to the pandemic can prove to be very beneficial.

Dimitris Malliaropulos and Petros Migiakis: “Sovereign credit ratings and the fundamentals of the Greek economy”

In this paper, the authors discuss the factors behind sovereign credit ratings and reproduce their quantitative component, focusing on the case of Greece. The sovereign credit rating of Greece is still lower than the investment grade threshold. However, some of the fundamentals of the Greek economy are shown to be better than the average of the rating category it belongs to at present (BB) and better even than higher rating categories. Based on the reproduction of the score component of sovereign credit ratings of the three major Credit Rating Agencies, the authors show that an improvement in the institutional factors of the Greek economy to the level of the early 2000s can lead to a significant increase in Greece’s score, thus contributing to an upgrade to the investment grade category.

Constantina Backinezos, Stelios Panagiotou and Christos Papazoglou: “The current account adjustment in Greece during the crisis: cyclical or structural?”

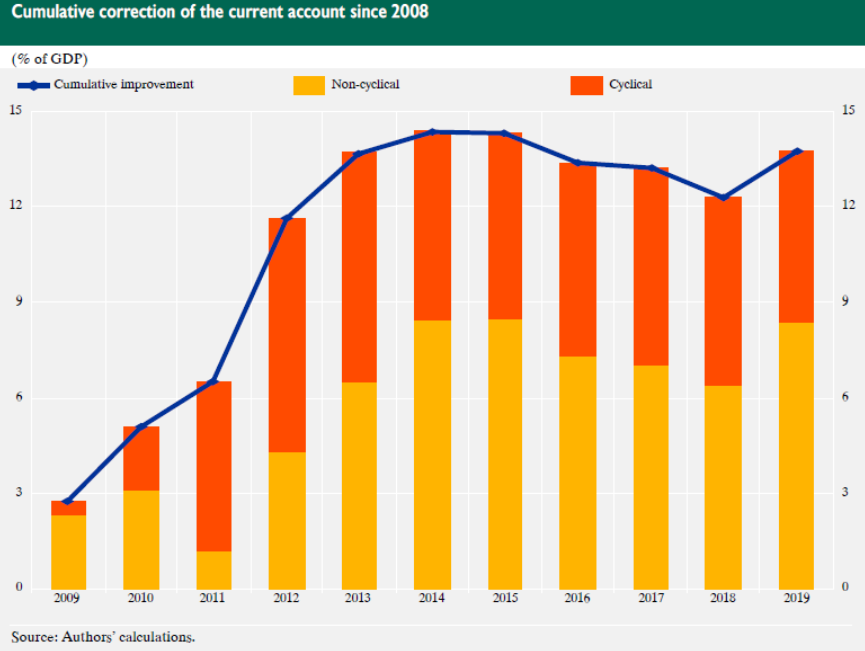

The substantial narrowing of the Greek current account deficit – by more than 13 percentage points of GDP – constitutes a significant part of the overall adjustment of the economy in the 2008-2019 period. A major issue, however, is related to whether the factors driving this external correction are temporary, due mostly to the economic cycle, or structural, in which case they are expected to be sustained over the medium term. The paper evaluates the degree to which cyclical versus structural developments have driven the pattern of correction of the country’s external imbalance, as this is essential in assessing its evolution going forward. The analysis shows that the current account adjustment has in a considerable part been driven by structural factors, which, according to the baseline scenario, account for 60% of the overall adjustment. Therefore, most of the correction is of a permanent nature, which means that the relatively high deficits of the pre-crisis period are not expected to re-emerge any time soon. The results are robust to various income elasticities of trade; the non-cyclical component ranges from 47% to 74% of the current account deficit correction.

Yorgos Korfiatis: “D-euro: issuing the digital trust”

Since 2008, new schemes such as digital currencies have emerged in limited forms. Currently, digital technologies enjoy a widespread use in the area of payments and, as a result, central banks have started contemplating the costs and benefits of issuing a digital currency for broad use in payments and settlements. This paper defines Central Bank Digital Currency (CBDC) and classifies it alongside existing forms of money. Further, it highlights the properties that such a currency should have, and analyses the main motivations behind the potential issuance of an account-based retail CBDC (called here the “d-euro”). It is argued that the latter should involve a public-private partnership, whose effectiveness will be enhanced by the establishment of separate and distinct roles. The paper briefly discusses legal considerations, monetary policy implications and financial stability issues arising from d-euro. In doing so, it further analyses d-euro’s underlying principles, which would at the same time constitute its key benefits. A general framework is provided and the technical design of the so called “two-dot model” is proposed. Issues concerning parity, supply limits and anonymity are dealt with. The proposed technical design seems an effective and workable solution that boosts the autonomy and resilience of the European payment systems. Finally, the paper argues that the initial introduction of d-euro as a retail payment medium may establish it as the new cash of a digitalised ecosystem, reflecting a new digital trust issued by central banks.

* * *

Issue 51 also includes the abstracts of Working Papers published by the Special Studies Section of the Bank’s Economic Analysis and Research Department between January and July 2020.

The full text of Issue 51 is available here.