Bank Lending Survey (BLS): Q1 2022

12/04/2022 - Press Releases

-The credit standards and the terms and conditions for loans to non-financial corporations (NFCs) remained unchanged in the first quarter of 2022. The overall demand for corporate loans remained almost unchanged.

-The credit standards as well as the terms and conditions for loans to households remained unchanged. The demand for consumer credit remained almost unchanged, while the demand for housing loans increased somewhat.

Loans to non-financial corporations

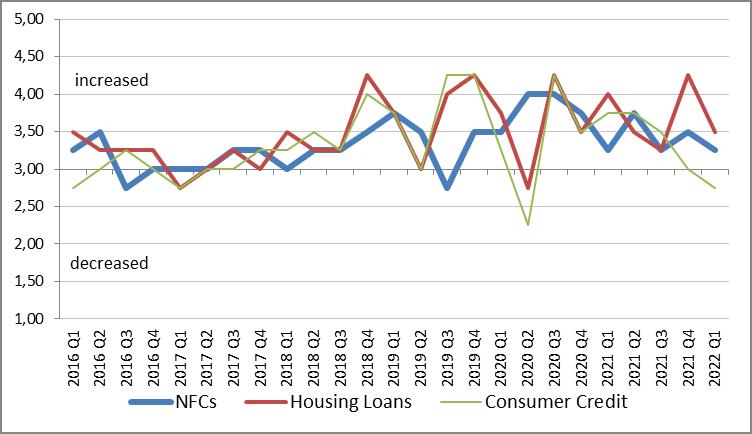

In the first quarter of 2022, the credit standards for loans to non-financial corporations (NFCs) remained unchanged (see Chart 1) compared with the fourth quarter of 2021, in line with the expectations expressed in the previous quarterly survey round. Moreover, banks expect that credit standards will remain unchanged during the second quarter of 2022.

The overall terms and conditions for loans to NFCs remained unchanged compared with the fourth quarter of 2021.

The overall demand for loans to NFCs remained almost unchanged (see Chart 2), even though loans to small and medium sized enterprises increased somewhat due to financing needs for inventories and working capital. During the next quarter, the overall demand for loans to both small and large corporations is expected to remain unchanged.

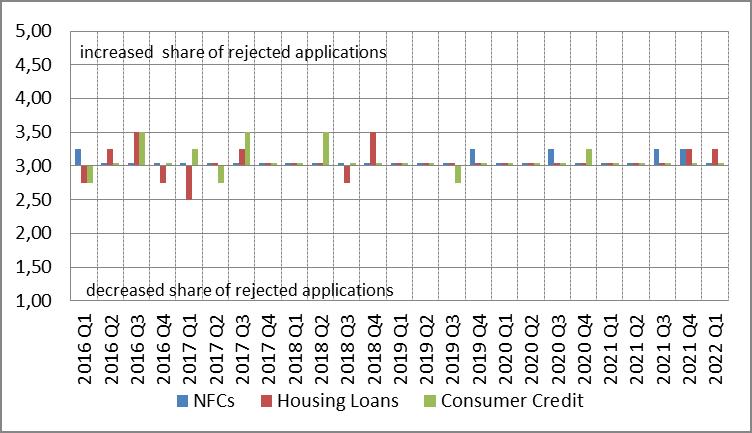

In the first quarter of 2022, the ratio of rejected applications for loans to NFCs remained unchanged compared with the previous quarter (see Chart 3).

Loans to households

In the first quarter of 2022, the credit standards as well as the terms and conditions for loans to households remained unchanged compared with the fourth quarter of 2021 (see Chart 1), in line with the expectations expressed in the previous quarterly survey round.

The demand for consumer credit remained almost unchanged (see Chart 2), while the demand for housing increased somewhat but not as much as was expected according to the previous survey round. During the next quarter, the overall demand for housing loans and consumer credit is expected to remain almost unchanged.

Banks expect that during the second quarter of 2022 credit standards for housing loans will ease somewhat, while for consumer credit they will remain unchanged.

The ratio of rejected applications for loans to households remained almost unchanged during the first quarter of 2022 (see Chart 3) compared with the previous quarter.

Chart 1 - Credit Standards (Average)

Chart 2 - Demand (Average)

Chart 3 - Share of rejected applications (Average)

Related information:

The next Press Release on the “Bank Lending Survey” for Q2 2022 will be published on 19 July 2022, in accordance with the Advance release calendar published on the Bank of Greece website.

Related links:

More on the Bank Lending Survey

Methodology