Speech by Dimitris Malliaropulos, Chief Economist and Director of Economic Analysis and Research of the Bank of Greece, at the AHK Europa Konferenz: Remarks on monetary policy in a low for long environment

20/09/2019 - Speeches

Speech by Dimitris Malliaropulos, Chief Economist and Director of Economic Analysis and Research of the Bank of Greece, at the AHK Europa Konferenz, Athens, September 20, 2019

In my contribution, I would like to share some thoughts with you on the monetary policy challenges in a low interest rate environment and the way forward.

Monetary policy has undergone significant changes over the past decade. Following the Global Financial Crisis, central banks have cut short-term interest rates to zero and provided accommodation via unconventional monetary policy measures such as large-scale bond purchases, forward guidance and even negative interest rates for banks’ excess reserves.

Because long-term bonds and reserves are imperfect substitutes, Quantitative Easing (QE) lowered long-term interest rates and stimulated spending, thereby supporting the economic recovery and limiting deflationary pressures. Overall, unconventional monetary policy measures have succeeded in stimulating the economy, preventing a much deeper recession and averting a deflationary downward spiral.

But, they likely had also negative side effects: Central bank asset purchases may fuel financial bubbles as investors reallocate their portfolios towards higher yielding, riskier assets. Negative interest rates may hurt the profitability of the banking system as banks cannot fully pass the negative interest rates to depositors. Finally, negative interest rates are penalizing savers who face zero or even negative interest rates on their deposits.

These worries are justified. Low and even negative interest rates do have unwarranted side effects and limit the policy space of the central bank to provide stimulus in case of a new economic downturn. In my short remarks I will first explain why I believe that, despite its negative side effects, overall, the benefits of QE outweigh its costs. Second, I will try to describe the way forward for monetary policy in a world of low inflation and low interest rates.

With respect to the costs and benefits of QE, I will claim that in the absence of QE, depositors would likely be worse off because of higher unemployment, lower income and higher interest payments to service their loans. Similarly, companies would face lower demand for their products or services, lower volumes of bank lending and higher lending rates. Finally, banks would face lower demand for credit because of lower economic growth, higher default rates on their loans, higher provisions and, hence, lower revenues.

With regard to negative policy interest rates, I will claim that depositors should be concerned about the real interest rate on their deposits and not about the nominal interest rate. Looking back over the past fifty years of history, real interest rates on deposits have been often negative, particularly during periods of high inflation and/or periods of economic downturns.

Regarding the way forward, I will explain my view that interest rates will likely remain low for long not because central banks decided to do so but because of structural factors affecting long-term economic growth such as the productivity slowdown, population ageing, savings-investment imbalances and secular changes in the structure of our economies. These trends cannot be reversed by the actions of central banks. They can be tackled only with structural economic policies aiming at the supply side of our economies. Moreover, fiscal policy has to provide more rigorous support to economic recovery, especially in countries with ample fiscal place.

Did QE work?

The answer is a qualified yes. The unconventional measures deployed by the ECB have contributed to a major easing of euro area financial conditions, stimulated the economy and ensured a more sustained and robust economic recovery. Since the launch of the APP, the unemployment rate in the euro area declined from 12% in 2014 to 7.5% currently. In some core euro area countries, the unemployment rate has reached lows never seen before. The growth rate of bank loans to nonfinancial companies increased from -4% in 2014 to 3.9% currently along with a significant decline in bank borrowing costs. HICP inflation increased from -0.6% in January 2015 to 1.5% in December 2018, when the ECB decided to end its net purchases under the APP.

Overall, without QE, unemployment would have been higher, bank credit would have been more scarce and expensive, economic growth would have been lower and inflation would have dropped into further negative territory for a longer period. Yet, unconventional monetary policy had also negative side effects, particularly for the financial sector. I will focus on the effects of negative policy interest rates, which is one of the most controversial issues in the current debate about the new normal of monetary policy.

The effects of negative policy interest rates

A number of central banks, including the ECB and the central banks of Denmark, Switzerland, Sweden and Japan, have experimented with negative policy rates in recent years. The ECB introduced negative interest rates on the deposit facility in June 2014. A negative nominal interest rate on the deposit facility means that commercial banks must pay interest for parking their excess reserves at the central bank. The purpose of introducing negative policy rates was to incentivize banks to provide credit to the real economy instead of holding their liquidity at the central bank. Nonetheless, the role of negative policy interest rates is quite controversial among economists and central bankers because they act as a tax on the banking system and can therefore reduce credit growth. Also, below a certain threshold, the so-called “reversal rate”, negative policy rates may become counterproductive as they may affect bank profitability, since banks cannot easily pass negative nominal interest rates to depositors. Finally, they may lead depositors to withdraw deposits from the banking system and switch to cash.

Effects on depositors

Recent research at the ECB suggests that on average interest rates became negative for around 5% of total deposits and around 20% of corporate deposits in the euro area as a whole. However, in Germany it is estimated that about 15% of total deposits and about 50% of corporate deposits carry negative interest rates, far more than the euro area average.[1] One possible explanation is that German banks have high levels of excess liquidity, hence they are less dependent on their customers’ deposits and may be therefore better able to pass the negative policy rates to their customers. In fact, the same study has shown that banks offering negative interest rates on deposits are mainly banks with low NPL ratios (“healthy” banks) and high levels of excess liquidity based in core euro area countries.

Although negative nominal interest rates are a new phenomenon, negative real (i.e. inflation adjusted) interest rates on bank deposits are not new. In fact, the real return of households on their deposits has been negative most of the time over the past 50 years in many euro area countries.

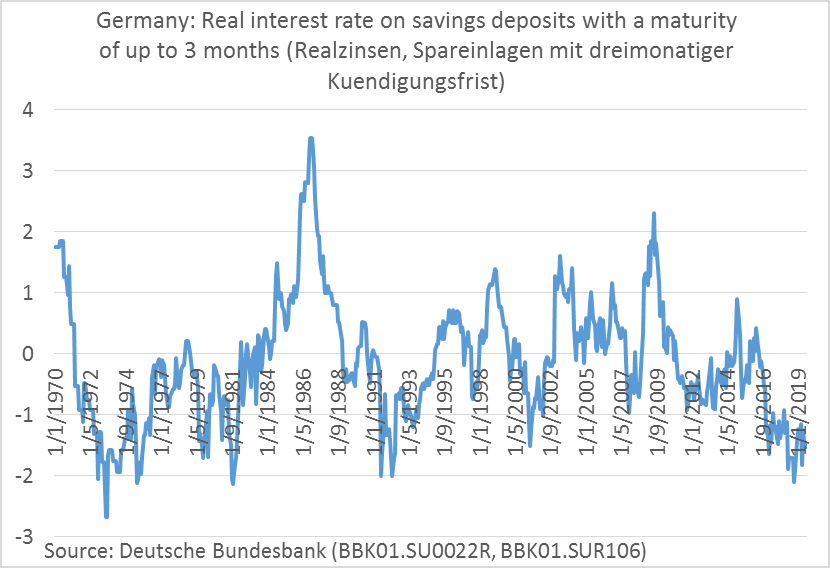

Figure 1 plots the real interest rate on 3-month savings deposits of households at German banks, as compiled by the Deutsche Bundesbank. The figure shows that real interest rates on deposits have been negative for more than ten years in the 1970s, as well as during the first half of the 1990s and in the early years of this millennium. Real deposit rates are on average -0.77% since the introduction of negative policy rates in June 2014. Real deposit rates were on average even lower (at -1%) during the twelve year period from mid-1971 to mid-1982.

These observations suggest that in both periods of high inflation and periods of very low inflation, negative real deposit rates may apply to depositors. The difference is that, due to money illusion, depositors care more for the nominal than for the real return of their savings.

Figure 1

Nevertheless, focusing the discussion on the issue of negative interest rates is too narrow. One needs a full cost-benefit analysis to assess the net effect of the low interest rate environment on depositors. The same depositor who faces low or negative interest rates on her deposits, may gain at the same time from low interest payments on her mortgage or consumer loan. The net effect of the low interest rate environment on the households’ finances depends on its net financial position.

Effects on banks

Critics often blame QE and particularly negative interest rates for the low profitability of euro area banks. In fact, the reduction in the spread between long-term and short-term interest rates due to the bond purchases of central banks may compress commercial banks’ net interest margins and thus put pressure on their profitability. This is because banks carry out maturity transformation: they borrow short-term and lend long-term. Hence, a flattening of the yield curve may negatively affect their profits and reduce their willingness to provide credit to the economy. However, at the same time, QE has had a positive effect on the economy and, hence, on bank profits, as banks faced higher demand for credit. In addition, lower interest rates imply less defaults on bank loans, hence, lower losses for banks. Overall, based on evidence so far, it is far from clear that the net effect of QE on bank profitability is negative.

Nevertheless, in order to alleviate the effect of negative interest rates on bank profits, the ECB recently introduced a deposit-tiering system which provides an exemption from the negative deposit facility rate for banks’ deposits at the central bank up to six times the value of their minimum reserve requirements.

Monetary policy in the “new normal”

Monetary policy easing was certainly a major driver of interest rates on their way down over the past decade. However, the decline in global interest rates should not be seen as the result of accommodative monetary policy alone. The downward trend in long and short-term interest rates is related to a number of structural factors which have led to a secular decline in the equilibrium real interest rate, also known as the “natural” interest rate:

- the slowdown in trend productivity growth -- “secular stagnation” hypothesis (Summers 2014, 2016, Gordon 2015, 2016 and others);

- the decline in the growth rate of labour supply, due to ageing of population;

- the increase in life expectancy, which implies that people must save more for retirement, hence are ready to accept a lower real return on their savings;

- global factors such as the “global savings glut” due to a higher propensity to save in emerging markets (Bernanke 2005);

- the decline in the relative price of capital goodswhich has led to a decline in aggregate investment relative to savings (Rachel and Smith 2015);

- the rebalancing of economies towards the services sector, which is less capital intensive than manufacturing, hence less investment is needed on aggregate in order to produce the same output (Summers 2014).

The effect of these structural drivers on real interest rates has been reinforced by two forces: first, the deleveraging process of over-indebted firms and households which followed the Global Financial Crisis. The slow deleveraging process and the lack of bank credit gave rise to a “balance-sheet recession” and sluggish growth in the aftermath of the financial crisis (Reinhart and Rogoff 2009).

Second, the emergence of a deflationary “safety trap”, due to the shortage of safe assets following the Great Financial Crisis, which pushed real risk-free rates lower because investors are willing to keep safe assets at low and even negative yields (Caballero and Fahri 2017).

Looking forward, if the new normal is characterized by a lower natural interest rate, nominal interest rates will likely hit the zero lower bound more often and central banks will have less room to stimulate the economy during an economic downturn. This will necessitate greater reliance on unconventional monetary policy tools, along with conventional tools such as policy rates.

Central banks will continue to use the size of their balance sheet and forward guidance as a complement to the standard interest rate policy. They will do so in order to provide liquidity and safety to the financial system. Liquidity is essential, especially in a crisis, and creating liquidity enhances financial stability. Safety is also desired given the shortage of safe assets following the Great Financial Crisis and the sovereign debt crisis in the euro area.

Finally, given that monetary policy has less room for maneuver during economic downturns, fiscal policy must fill the gap, particularly in countries where fiscal space is available. Fiscal policy should be redesigned in a way that allows building systematically fiscal buffers during cyclical upturns which could be used in the cyclical downturns to support economic activity.

References:

Altavilla, C., Burlon, L., Giannetti, M. and Holton, S. (2019): Is there a zero lower bound? The effects of negative policy rates on banks and firms. ECB Working Paper No. 2289, June 2019.

Caballero, R.J. and Fahri, E. (2017): The safety trap. Review of Economic Studies, 1-52.

Gordon, R.J. (2015): Secular stagnation: A supply-side view. American Economic Review, Papers and Proceedings, Vol 105(5), pp. 54-59.

Gordon, R.J. (2016): The rise and fall of American growth: The US standard of living since the civil war. Princeton University Press.

Summers, L. (2014): US economic prospects: Secular stagnation, hysteresis, and the zero lower bound. Business Economics, vol. 49(2), pp. 65-73.

Summers, L. (2016): The age of secular stagnation: what it is and what to do about it. Foreign Affairs March/April 2016.

Rachel, L. and Smith, T.D. (2015): Secular drivers of the global real interest rate. Bank of England Staff Working Paper No. 571.

Reinhart, C. and Rogoff, K. (2009): This time is different: Eight centuries of financial folly. Princeton University Press.

[1] See, Altavilla et al (2019).