Interest Rates on Bank Deposits and Loans: March 2023

05/05/2023 - Press Releases

- In March 2023, the weighted average interest rate on new deposits remained almost unchanged at 0.23%, while the corresponding rate on new loans increased to 5.73%.

- The interest rate spread between new deposits and loans increased to 5.50 percentage points.

- In March 2023, the weighted average interest rate on outstanding amounts of deposits increased to 0.26%, while the corresponding rate on loans increased to 5.69%.

- The interest rate spread between outstanding amounts of deposits and loans increased to 5.43 percentage points.

1. Interest rates on euro-denominated new deposits and loans

New Deposits

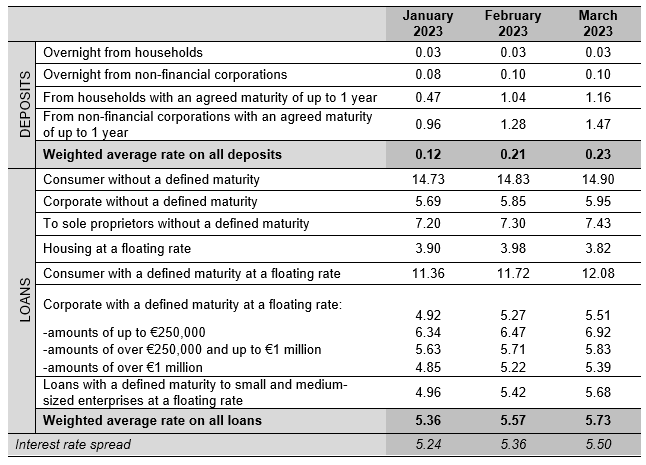

The weighted average interest rate on new deposits remained almost unchanged at 0.23%.

In particular, the average interest rates on overnight deposits placed by households and non-financial corporations remained unchanged at 0.03% and 0.10% respectively.

The average interest rate on deposits from households with an agreed maturity of up to 1 year increased by 12 basis points to 1.16%. The corresponding rate on deposits from non-financial corporations increased by 19 basis points to 1.47%. It should be noted that a large part of new deposits by households is currently placed in deposits with an agreed maturity of over 1 year. The amount of new deposits in this category increased to €3.6 billion in March 2023 compared with €229 million in December 2022, while the average interest rate increased to 1.83% in March 2023, compared with 1.04% in December 2022.

New Loans

The weighted average interest rate on new loans to households and non-financial corporations increased by 16 basis points to 5.73%.

More specifically, the average interest rate on consumer loans without a defined maturity (a category that comprises credit cards, revolving loans and overdrafts) increased by 7 basis points to 14.90%.

The average interest rate on consumer loans with a defined maturity at a floating rate increased by 36 basis points to 12.08%. The average interest rate on housing loans at a floating rate decreased by 16 basis points to 3.82%.

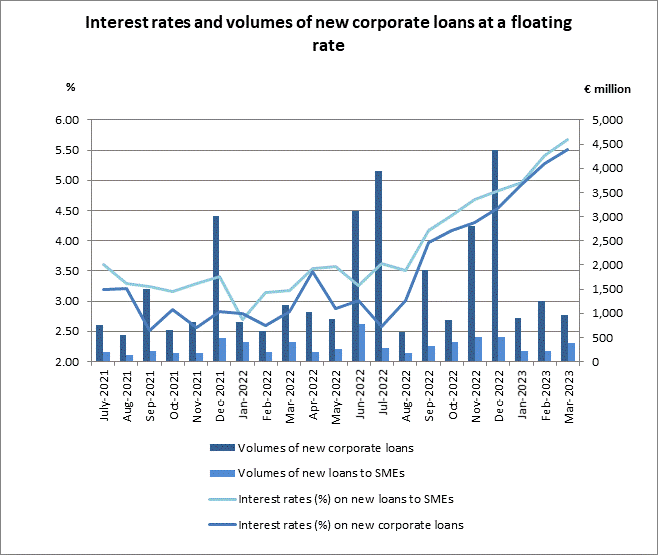

The average interest rate on new corporate loans without a defined maturity increased by 10 basis points to 5.95%. The corresponding rate on loans to sole proprietors increased by 13 basis points to 7.43%.

In March 2023, the average interest rate on corporate loans with a defined maturity at a floating rate increased by 24 basis points to 5.51%. The average interest rate on loans with a defined maturity at a floating rate to small and medium-sized enterprises (SMEs) increased by 26 basis points to 5.68%.

As regards the structure of interest rates according to the size of loans granted, the average rate on loans of up to €250,000 increased by 45 basis points to 6.92%, on loans of over €250,000 and up to €1 million increased by 12 basis points to 5.83% and on loans of over €1 million increased by 17 basis points to 5.39%.

2. Interest rates on outstanding amounts of euro-denominated deposits and loans

Deposits

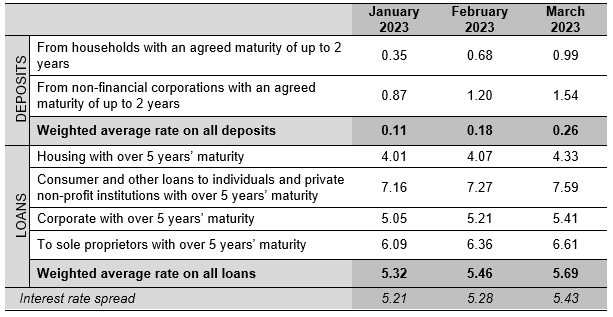

The weighted average interest rate on outstanding amounts of deposits (including overnight deposits) increased by 8 basis points to 0.26%.

In particular, the average interest rate on outstanding amounts of deposits with an agreed maturity of up to 2 years placed by households increased by 31 basis points to 0.99%, while the corresponding rate on deposits from non-financial corporations increased by 34 basis points to 1.54%.

Loans

The weighted average interest rate on outstanding amounts of loans increased by 23 basis points to 5.69%.

In particular, the average interest rate on outstanding amounts of housing loans with over 5 years’ maturity increased by 26 basis points to 4.33%. The corresponding rate on consumer and other loans to individuals and private non-profit institutions increased by 32 basis points to 7.59%.

The average interest rate on corporate loans with over 5 years’ maturity increased by 20 basis points to 5.41%. The corresponding rate on loans to sole proprietors increased by 25 basis points to 6.61%.

Table 1: Average interest rates on new euro-denominated deposits and loans (percentages per annum)

Table 2: Average interest rates on outstanding amounts of euro-denominated deposits and loans (percentages per annum)

Notes:

- The interest rate spread is the difference between the weighted average rate on all loans and the weighted average rate on all deposits.

- For the calculation of the weighted average interest rate on all outstanding deposits, the overnight deposits are also taken into account.

- Loans at a floating rate comprise also loans with an initial rate fixation period of up to one year.

- New business refers to new contracts that were agreed during the reference month and not actual loan disbursements.

Related information:

The complete data set of bank deposit and loan interest rates is published in the sub-section “Bank deposit and loan interest rates” on the Bank of Greece website.

The next Press Release for April 2023 will be published on 6 June 2023 according to the Advance release calendar on the Bank of Greece website.

Related links:

Bank deposit and loan interest rates

Advance release calendar