Speech by Bank of Greece Deputy Governor John (Iannis) Mourmouras in Valencia entitled: “Behind and beyond the yield curve: ECB monetary policy impact and exit strategies”

21/03/2017 - Speeches

Behind and beyond the yield curve:

ECB monetary policy impact and exit strategies

by John (Iannis) Mourmouras,

Bank of Greece/Eurosystem

Former Deputy Finance Minister

Former Chief Economic Advisor to the Greek Prime Minister

Inaugural address at the 2017 Banco Bilbao Vizcaya Argentaria (BBVA) conference for public sector investors and issuers (21-23 March 2017)

Valencia, 21 March 2017

1. Introduction

My speech is about current and future European Central Bank (ECB) monetary policies and will revolve around two key words: behind and beyond. My focus in terms of the first, namely “behind the yield curve”, is on the impact of quantitative easing and negative rates across bond markets (markets for sovereign, corporate and covered bonds, assetbacked securities, as well as repos). I will also take a look at the recent rise of TARGET2 imbalances and how, if at all, these are related to the large balance sheets of central banks. The second part of my speech will be centered on the phrase “beyond the yield curve”, which refers to the exit strategy of the ECB, of course when the right time comes. Not yet. Clearly, at some point in time, there will be an end to these unconventional monetary policies. So when we cross that bridge, the crucial question will revolve around timing, but also sequencing. Using a Taylor rule framework, I will try to provide tentative answers for a number of important future monetary policy issues, for instance: ‘rate hikes first and then start tapering’ or vice versa, with changes in forward guidance potentially preceding them?

Would the ECB be allowed to leave assets to mature? Or take active steps to shrink its balance sheet? Should the scaling back of a national central bank’s balance sheet be discretionary or rules-based?

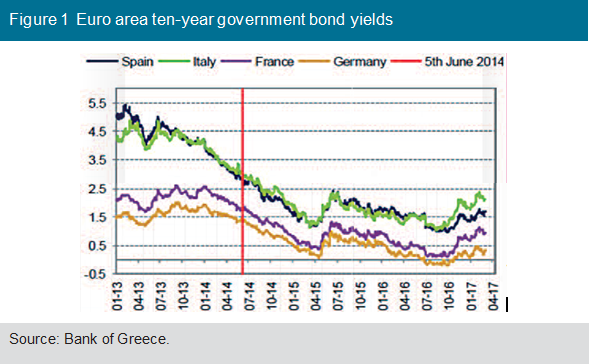

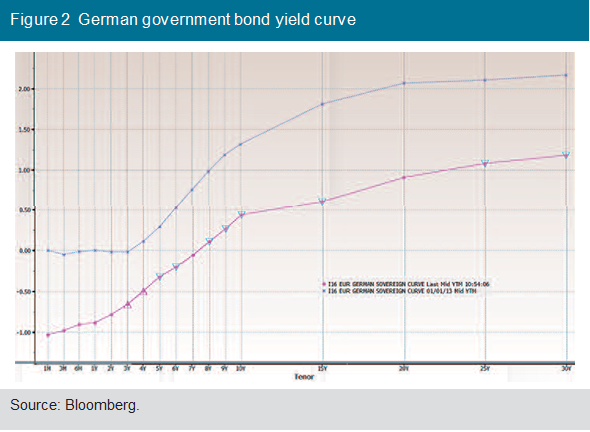

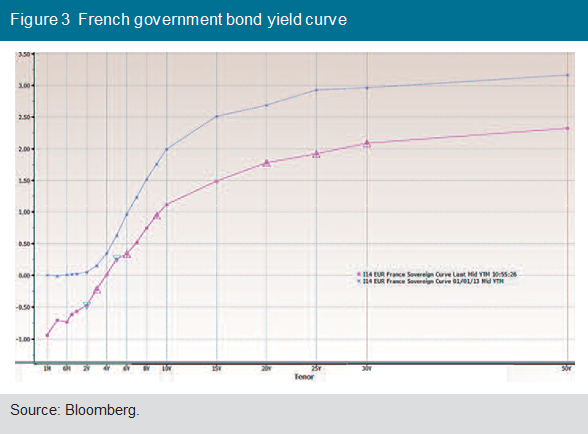

The purchase programmes have also greatly contributed to a significant decline in sovereign yields, a compression of intra-euro area spreads and a flattening of yield curves across all markets (see Figures 1-3).

2. Behind the yield curve

2.1 Evidence from the ECB’s unconventional monetary policies

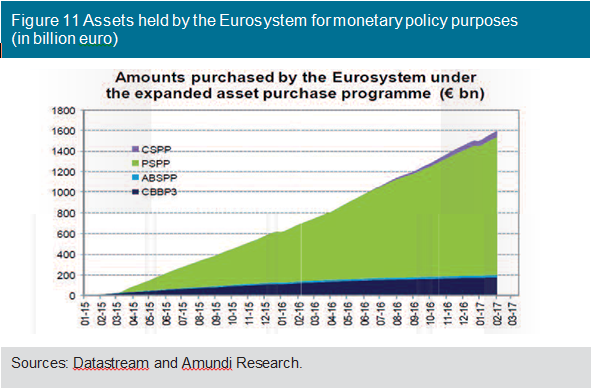

For the time being, the Eurosystem has already purchased assets worth up to €1,618 billion under the expanded asset purchase programme (APP), including €1,371 billion under the public sector purchase programme (PSPP)1, and has pledged to buy €660 billion in assets until the end of 2017. As a result, the ECB’s balance sheet now accounts for 34% of the euro area’s GDP.

It is true that there is positive evidence from the ECB’s quantitative easing (QE) programme, mainly found in the M3 growth rate and the banking sector, such as the growth rate of loans and the cost of funding.

• The broad monetary aggregate M3 increased faster than expected, by 4.8% on a yearly basis; the annual growth rate of loans to households stood at 2.0% in December; credit to the private sector increased to 2.5% in December; at the same time, loans to non-financial corporations (NFCs) rose to 2.3%. Bank lending rates decreased and stabilised at their historical lows. Significant declines were recorded in the nominal cost of bank borrowing for NFCs and households (by around 110 basis points respectively). The decline in bank lending rates over this period was stronger in vulnerable euro area countries than in the rest of the eurozone, indicating an improvement in the pass-through of monetary policy measures to bank lending rates. As a result, cross-country heterogeneity in bank lending rates was further reduced. For example, since the announcement of the ECB’s credit easing measures in June 2014, the average cost of borrowing for euro area NFCs has fallen by around 111 basis points, and by 151 basis points and 180 basis points for NFCs in Spain and Italy, respectively.

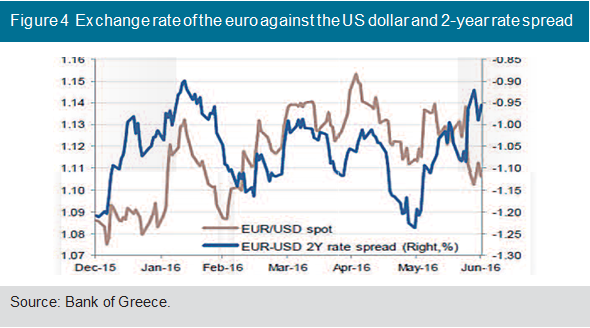

• Since the launch of the QE programme in March 2015, the euro depreciated by 6% vis-à-vis the US dollar (over the past 2.5 years, the euro was devalued by 25% against the US dollar) and fell to a 14-year low (1.04) on 26 December 2016 (see Figure 4).

2.2 ‘Crowded trades’ in bond markets

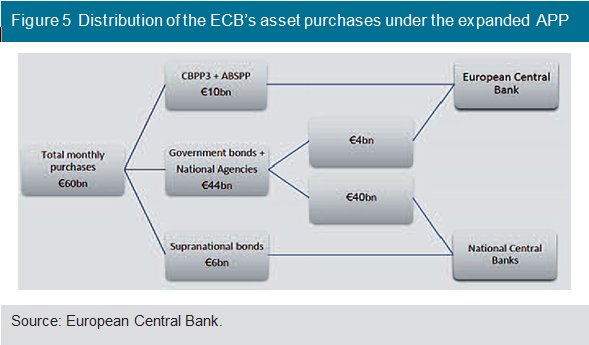

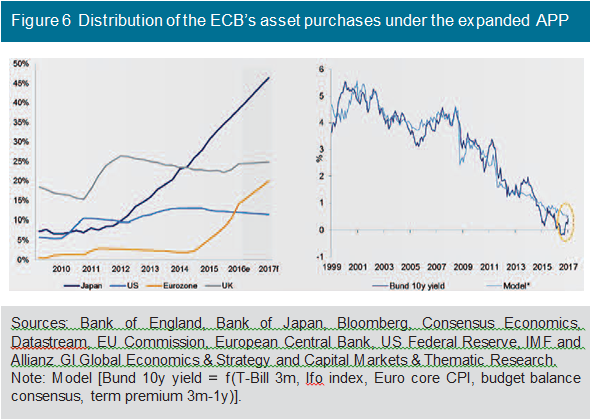

As QE celebrates its second anniversary, the ECB remains a large-scale buyer on euro area bond markets. The breakdown of the asset purchases under the expanded APP which have been reduced from €80 billion to €60 billion with effect from 1 April, as shown in Figure 5 below (see also Figure 6):

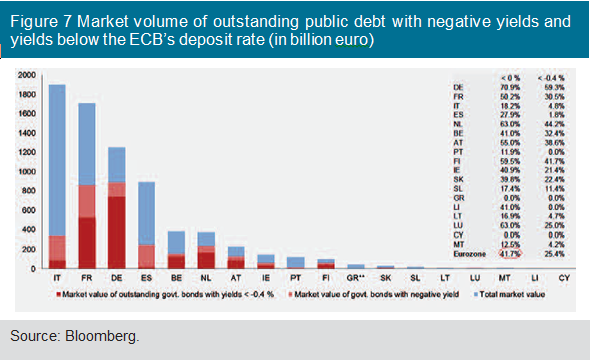

These purchases will continue to put downward pressure on yields and reduce the cost of borrowing, with about 40% of eurozone government

bonds currently carrying a negative nominal yield (see Figure 7), creating a scarcity issue, in particular, for German and some small countries’ securities.

An analysis of the disruptions from the ECB’s QE per financial market sector is presented in the following sections.

2.2.1 Sovereign bond markets

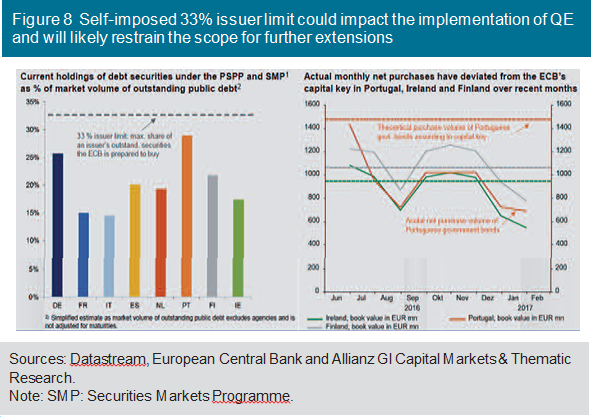

The biggest challenge for the PSPP has emerged as the 33% issuer limit,2 which is a means to mitigate the risk of the ECB becoming a dominant creditor of governments, seems to be within reach for some countries. This could not only restrain the scope for further QE extensions in 2018, but might entail ramifications for the Outright Monetary Transactions (OMTs) scheme.3 Therefore, the ECB will possibly further reduce the pace of purchases for smaller countries such as Portugal and Finland (see Figure 8), a sign that scarcity is more of an issue for these issuers.

Overall, market liquidity is becoming more challenging. Under heightened political uncertainty, the ECB’s large-scale purchase programme and resulting “crowded trades” are disrupting prices in the entire euro bond market.

2.2.2 Covered bond markets

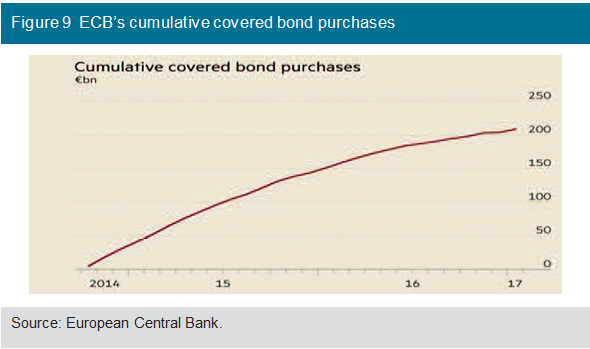

Since May 2009, i.e. the first announcement of the ECB’s covered bond purchase programme, the ECB has made purchases accounting for 27% of the entire covered bond market (or €228 billion), with a view to stabilising European banks in need of capital market funding following the global financial crisis of 2008 (see Figure 9 below).

Because the ECB has been buying covered bonds for so long, it has been subject to complaints of disruption for several years. The ECB buys in primary markets, when new bonds are sold, making it difficult for private investors to compete on price. As a result, the central bank’s potential exit from the markets could lead to a volatile period of repricing and stressed liquidity due to limited issuance.

2.2.3 Corporate bond markets

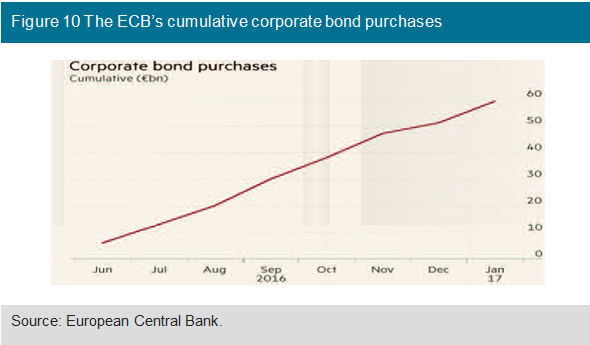

As with government bonds, ECB purchases in the corporate bond market totalling €61 billion up until now have encouraged investors to make decisions based on anticipating central bank policy (see Figure 10 below). The ECB will remain a very active participant in the market, even when net purchases are tapered to zero, as the proceeds from maturing bonds will be reinvested. This is premised on the assumption that the ECB’s corporate bond-buying programme will grow to €150 billion by June 2018.

With exceptionally low borrowing costs, firms are lining up to issue debt in Europe. US firms also benefit from these favourable conditions, tapping into European bond markets and accounting for 30% of debt issuance in 2016. Since the announcement of the ECB programme, bond market illiquidity, measured by bid-ask spreads, has risen by around 15%. This probably reflects increasing inefficiencies in price discovery mechanisms and liquidity. The search for yield is leading to increased risk-taking among investors and distorts price discovery in yet another segment of the bond market.

2.2.4 ABS markets

Asset-backed securities (ABS) have been bought by the ECB since late 2014. This has been the most disappointing purchase programme, with the ECB buying a relatively small amount of bonds of around €23 billion until now and failing to kick-start a flagging market (see Figure 11 below).

The ECB’s intention to involve local central banks more deeply in its purchases of ABS does indicate a longer-term commitment to the ABS market.

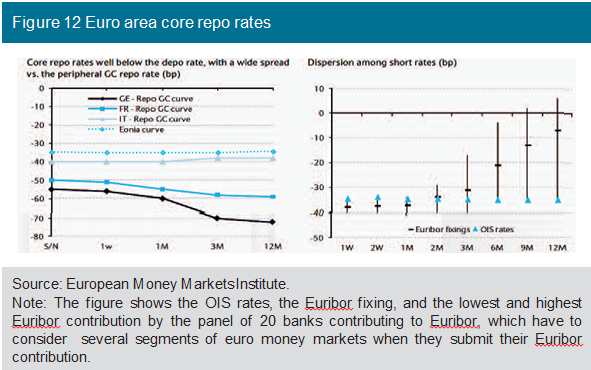

2.2.5 Repo market disruption

One of the most significant disruptions created from bulk buying of government bonds and other high-quality debt has shown up in Europe’s repo market, a key part of the continent’s financial liquidity. Government bonds are used as collateral for repurchase or “repo” trades – secured short-term loans between banks, investors and other market participants. Because the ECB has bought so many government bonds, the availability of collateral has fallen sharply (see Figure 12).

If banks continue to shrink their repo balance sheet or start to calculate the leverage ratio as an average in a period (such as one month) rather than on a specific day (such as the last day of the quarter), repo volumes and collateral velocity would decline sharply, thus significantly hampering the functioning of the repo market.

2.3 QE and TARGET2 imbalances

The renewed increase in TARGET24 balances is a more general “disruption” from the ECB’s QE programme. In September 2015, for the first time, the ECB decided to release data on intra-euro system claims and liabilities that national central banks (NCBs) had accumulated since the 2008 financial crisis under the TARGET2 system, which reached a peak of more than €1 trillion amidst the sovereign debt crisis of 2012. Nowadays, these balances are trending upwards again. But as I will explain, the current increases should be interpreted differently than those earlier episodes: they are largely a direct result of the asset purchase programme and do not signal renewed stress in financial markets.

The crisis, and the corresponding development of TARGET2 balances, can be broadly divided into three phases:

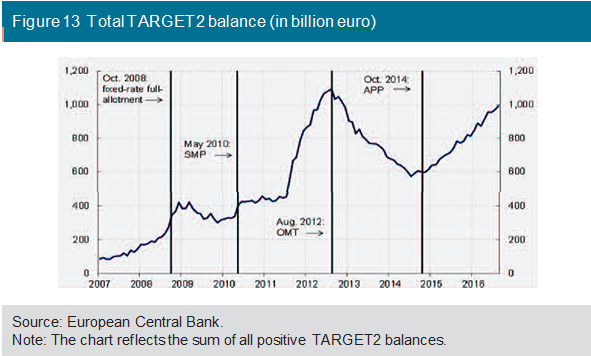

1. In the first phase which followed the collapse of Lehman Brothers, heightened uncertainty about counterparty credit risk triggered a seizing up of money markets that spread across borders. In order to meet bank funding needs, the ECB introduced fixed-rate full-allotment tenders and extended the maturities of longer-term refinancing operations. In this environment, there was an over-proportional provision of central bank liquidity in jurisdictions where funding needs were more acute. In essence, collateralised liquidity provision by NCBs substituted for private sources of funding that had dried up. Accordingly, the total TARGET2 balance increased from €100 billion in mid-2007 to around €400 billion by end-2008, around which it fluctuated until the middle of 2011 (see Figure 13).

2. In the second phase, as the sovereign debt crisis unfolded over the period 2010-2012, bank funding pressures intensified once again, but in a much more country-specific way than before. This triggered a precipitous increase in the total TARGET2 balance to a peak of over €1 trillion by mid-2012. In the cases of Spain and Germany, their balances hit record highs in August 2012, when Spain had a liability of around €435 billion and Germany had a claim of around €750 billion. This compares with TARGET2 claims for both Spain and Germany in August 2007, of around €20 billion and €40 billion, respectively.

3. In the current third phase, TARGET2 balances have risen following the launch of ECB asset purchases. Having fallen to around €600 billion at the end of 2014, the total TARGET2 balance is now back to levels of around €1 trillion. Indeed, since March 2015, the TARGET2 balances of euro area NCBs have risen steadily, in some cases exceeding the levels seen during the sovereign debt crisis (see Figure 14, left-hand panel). However, unlike that time, the link to the implementation of monetary policy is now direct rather than indirect.

Liquidity injection via asset purchases can immediately impact TARGET2 balances if it entails a cross-border payment by the purchasing central bank. And here lies the crucial difference to the rise in TARGET2 balances observed until mid-2012: under the APP, TARGET2 balances are directly affected by the way in which the programme is implemented, which is independent of financial market stress. Record TARGET2 balances should be viewed as a benign by-product of the decentralised implementation of the APP, rather than a sign of renewed capital flight. Because liquidity operations in the Eurosystem are decentralised, claims or liabilities of NCBs vis-à-vis the ECB can arise. Market operations are to a large extent implemented by the Eurosystem’s NCBs rather than by the ECB. When an NCB disburses liquidity directly to commercial banks, it keeps the claims on those commercial banks on its own balance sheet. But the funds may end up in another commercial bank’s account with a different NCB. As a consequence, the liquidity-providing NCB has a liability vis-à-vis the ECB, while the NCB receiving the reserves holds a claim on the ECB. The net of such claims and liabilities is referred to as a “TARGET2 balance” because it is recorded as such in the main payment settlement system of the euro area.

In the period leading up to mid-2012, TARGET2 balances grew strongly (Figure 14, left-hand panel) due to intra-euro area capital flight. At the time, sovereign market strains spiked and redenomination risk came to the fore in parts of the euro area. Private capital fled from Ireland, Italy, Greece, Portugal and Spain into markets perceived to be safer, such as Germany, Luxembourg and the Netherlands. Indeed, during that period, the rise in TARGET2 balances seemed related to concerns about sovereign risk. The blue dots in the centre panel of Figure 14 show the close relationship between the sovereign credit default swap (CDS) spreads of Italy, Portugal and Spain and the evolution of their combined TARGET2 balance from January 2008 to September 2014. Whenever the CDS spreads of those economies rose, the associated private capital outflows increased their TARGET2 deficit. When the CDS spreads decreased after confidence in the euro area was restored in mid-2012, the capital outflows partly reversed, and TARGET2 deficits dwindled.

In contrast to previous periods of rising TARGET balances, changes in the TARGET balances immediately after APP purchases are a direct consequence of the implementation of monetary policy decisions, rather than a symptom of renewed stress in financial markets. Consequently, the current rise seems unrelated to concerns about the sustainability of public debt in the euro area. The red dots in the centre-panel of Figure 14 show that, between October 2014 and December 2016, there was no relationship between the sovereign CDS spreads of Italy, Portugal and Spain and the evolution of their combined TARGET2 balance. The current rise in TARGET2 imbalances seems to have a different cause: the Eurosystem’s APP, which mechanically affects the evolution of these balances. Many APP purchases are conducted by NCBs via banks located in other countries. One example is where the Bank of Italy, as part of its implementation of the APP, buys securities from a London-based bank that connects to the TARGET2 system via a correspondent bank located in Germany. The purchase amount is credited to the account of the German correspondent bank at the Deutsche Bundesbank, thus increasing the TARGET2 surplus of the Bundesbank. Similarly, the Bank of Italy’s TARGET2 deficit widens. Thus, TARGET2 imbalances will increase whenever any TARGET2-debtor NCB conducts an asset purchase with a counterparty that has a correspondent bank located in a TARGET2-creditor NCB. This is very frequently the case. According to the ECB, “almost 80% of bonds purchased by national central banks under the APP were sold by counterparties that are not resident in the same country as the purchasing national central bank, and roughly half of the purchases were from counterparties located outside the euro area, most of which mainly access the TARGET2 payments system via the Deutsche Bundesbank.”5 Whereas the Bundesbank itself purchases less than a quarter of the total APP purchases, 60% of all Eurosystem purchases under the APP are conducted via banks that connect to the TARGET2 system via the Bundesbank. As the European interbank market is still fragmented, liquidity does not circulate in the euro area and TARGET2 imbalances grow as the total holdings under the APP accumulate. Indeed, the overall increase in TARGET2 imbalances can be closely linked to the total purchases under the APP (see Figure 14, right-hand panel).

This mechanical impact of the APP on TARGET2 imbalances is also confirmed by the evolution of TARGET2 balances vis-à-vis Greece. The country’s sovereign bonds are not eligible for the APP, and consequently the Greek TARGET2 deficit has actually been more or less stable in recent months (see Figure 14, left-hand panel).

3. The global monetary policy outlook and divergent policies

Before coming to the ECB’s exit strategy, perhaps the most debated issue in monetary policy today, let me give you briefly my own insights on the global policy outlook. 2017 will be quite different from 2016, in many respects. The two seminal events of 2016 have been Brexit and Donald Trump’s election; my prediction for 2017 is that it may be marked by developments in the European continent and, more specifically, the national elections and associated political uncertainty that may trigger further changes in the euro area and even across the European Union. Of course, this year’s key topics will also include the new economic policy in the US under President Trump and the end of central bank dominance, which will give way to fiscal policy across the globe.

The so-called ‘Trumponomics’ will remain an important market influence this year, with investors particularly interested in two things: the transition from announcements to detailed design and sustained implementation; and outcomes, particularly when it comes to the mix between higher growth and inflation. The anticipation of a more active fiscal policy is based on the assumption that President Trump will reinvent the package of policies known as Reaganomics, which resulted then in a seriously overvalued dollar.

On the external front, there is the question of foreign policy, both in terms of trade and geopolitical issues. There is a heightened risk of “trade protectionism” under the Trump administration and we all agree that open borders and free-trade agreements are of paramount importance. Political risks to the European order are on the rise after the UK vote to leave the EU and the unprecedented wave of migration from war-torn countries in the Middle East and North Africa that has fuelled the rise of nationalist politics and populism and a backlash against mainstream politicians, as well as political and financial elites. Euroscepticism is now a strong sentiment in Europe. Elections last week in the Netherlands, and later this year in France, Germany, and maybe Italy four of the founding members of the European Economic Community 60 years ago― are critical, as they may provide gains to populist parties that would result in increased euroscepticism across Europe and as political risks seem to come ahead of economics.

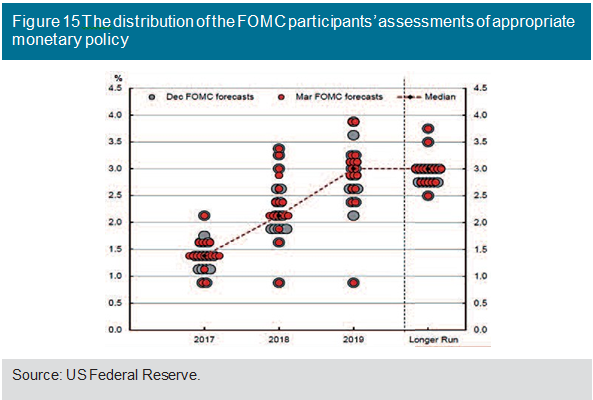

One word now on divergent monetary policies; last week in the US, the Federal Open Market Committee (FOMC) decided to raise the target range for the federal funds rate by 25 basis points, to 0.75%-1.00%, from 0.50%-0.75%, as FOMC participants’ economic projections (known as the ‘dot-plot chart’) are expected to remain unchanged, indicating a median projection of two more hikes this year and three more in 2018 (see Figure 15). The US Federal Reserve raised rates only twice over the last two years (once in 2015 and once in 2016). The FOMC’s statement mentions a “symmetric” inflation target, indicating that, after a decade of below-target inflation, it could tolerate a quicker pace of price hikes, while risks to the outlook remain “roughly balanced”. It thus signals to the markets that it is finally moving toward the end of its nine-year-old monetary stimulus campaign, which began in the depths of the financial crisis.

Clearly, not all Fed tightening cycles are the same in terms of their impact on global financial markets. The 2004-2006 Fed tightening cycle was quite benign, while the 2013-2014 tapering created significant volatility, especially in the bond markets. In short, the so-called monetary policy divergence among the world's four major (or G4) central banks (US Federal Reserve, European Central Bank, Bank of Japan, and Bank of England) will remain a key theme in the first half of 2017, while for the second half of the year, less monetary divergence between the G4 central banks will most probably be on the cards.

Finally, one word about the prospects of financial markets this year, drawing from my responsibility as Chair of the Financial Asset Management Committee, which supervises the Bank’s investment portfolio. In the foreign exchange (FX) markets, we remain bullish for the US dollar, mainly as a result of Trump’s economic policies, bearish on the pound sterling, mainly because the Brexit risk overshadows everything. In the sovereign bond markets, our prediction at the Bank is more than usual volatility, higher term premia especially on the long end of the yield curve, namely steepening yield curves, and an increase in the spread between the core and peripheral yields in the eurozone.

4. Beyond the yield curve: towards an exit strategy for the ECB

4.1 On timing and sequencing

The eurozone’s current economic outlook

Let me give you, first of all, some details on the euro area’s current outlook.

• The flash estimate for euro area annual headline inflation in February is 2.0%, showing a sharp, upward revision.

• Inflation expectations, as measured by the five-year inflation-linked swap rate, stood at 1.78% at the beginning of February; the 5-year swap rate is now slightly above its 1.7% level observed just prior to the start of the PSPP in early 2015.

• However, most of the increase in headline inflation has come from energy prices. Core inflation in the flash estimate remained subdued at 0.9%.

• Real GDP grew by 1.7% in the euro area over the whole of 2016 and is expected to remain unchanged in 2017.

• The unemployment rate was 9.6% in January 2017, unchanged from December 2016 and down from 10.4% in January 2016.

• From a current starting point of 0.9% for core inflation, ECB staff expect it to double over two years. This appears to rely on a sharp pickup in wage growth from 1.3% last year to 2.4% in 2019.

• As regards ECB interest rates, the ECB deposit facility rate has been in negative territory since June 2014 and has remained at -0.40% since 16 March 2016. On the same date, the ECB further reduced its fixed rate on MROs at 0.00% and the marginal lending facility rate at 0.25%.

Following last December’s Governing Council meeting in Frankfurt, when the ECB announced a slowdown in the pace of asset purchases (from €80 billion monthly down to €60 billion),6 many analysts have interpreted this move as a hawkish tilt in the ECB’s reaction function, a signal towards ‘earlier than later’: a) proper tapering and b) interest rate normalisation. The ECB’s decision was motivated partly by concerns about scarcity. It was also influenced by some discomfort with a very accommodative monetary stance (‘too low for too long’), and the influence it has had on the structural reform process. In addition, there are macro considerations. Although core inflation remains below 1%, economic growth has been running at a well above potential pace for a while now and the unemployment rate has been falling fairly briskly. This has dramatically reduced deflation risk in the region.

If this is the case, the next interesting question is the following: when such a proper tapering and/or first rate hike could take place in the euro area. Opinions differ on this bone of contention obviously, even at the top level of the ECB. ECB President Draghi, when asked if the December 2016 Governing Council decision was the start of tapering, replied: “No, […] it wasn’t tapering. We didn’t discuss tapering last time. We didn’t discuss tapering this time. [...] But it is true that when and if well, I’m pretty sure that [the time] will come and then we will have to have a very deep and very careful discussion and analysis of the situation. But we are not there.”7

Compare the President’s reply with the reply given by Sabine Lautenschläger, a German Member of the ECB’s Executive Board and Vice-Chair of the SSM: “Does this mean we still have to wait a long time before exiting accommodative monetary policy? In my view, it doesn’t mean waiting until the last doubt about the return of inflation has been dispelled. […] All preconditions for a stable rise in inflation exist. I am thus optimistic that we can soon turn to the question of an exit.”8

And most recently, Yves Mersch, Member of the ECB’s Executive Board, said: “How much longer can we continue to talk about “even lower rates” as being a monetary policy option? Considering the importance of credibility for a central bank, as mentioned, there should be no delay in making the necessary gradual adjustments to our communication.9

Exit timing is a hard question indeed. Monetary policy is well known as a mix of science and art. Forecasting interest rate decisions and changes in balance sheets is a difficult task in general, all the more so when this is equivalent to a regime switch, given especially the heightened uncertainty in the world economy and the skewed risks to the downside surrounding the global growth outlook.

On the other hand, a premature normalisation of monetary policy (just like in 2008 and 2011 under President Trichet), either in terms of interest rate hikes or in terms of proper tapering or according to the ECB’s preferred wording “orderly adjustment”, entails the following two risks: the first is the risk of a relapse, in other words, the ECB shouldn’t abruptly put an end to loose monetary policy as a result of e.g. a temporary inflation spike not supported by the economic fundamentals. The second risk is the risk of financial instability, once interest rates start to rise. A rate rise could produce major upheavals in European capital markets. For instance, in the foreign exchange market it is not clear at all that ECB tapering, whenever it takes place, will be bullish for the euro against the dollar. When the Fed signalled tapering in mid-2013, the dollar strengthened considerably against emerging market currencies, but weakened against both the euro and the yen. Aggressive bear steepening and rising fixed income volatility tend to slow down inflows and are not universally beneficial to a currency. In any event, ECB tightening is not that simple. Not only would it steepen curves, but it may bring back redenomination risk that has been conveniently compressed by the ECB’s fight against deflation. Take the low inflation excuse away and add back the political risk of a French election, and the removal of the QE backstop looks much less positive.

Below I could try to provide a tentative answer, an indication if you like, to the above hard question on the first ECB rate hike by using the famous Taylor rule:

i = i* +α [π-π*] β [UUn]

Where i is the nominal interest rate, i* is the equilibrium nominal interest rate, π is core inflation (or could be actual inflation), π* is the target rate of inflation (namely 2%), U is the unemployment rate, and Un is the NAIRU or the natural rate of unemployment. As is well known, the Taylor rule can be expressed in many different variants, but I will not have time to go into more details on that. Using the Taylor rule interest rate as a benchmark (namely, the interest rate consistent with the normalisation of the macro economy), I will attempt a hopefully sensible remark about the start of normalisation of the actual base policy rate set by the ECB. I will try to answer the question if and how the ECB will slow down the pace of the normalisation of the policy rate (i.e. rate hikes) relative to the normalisation of the macro economy. Of course, the scarcity of eligible bonds to buy is another important consideration for the ECB.

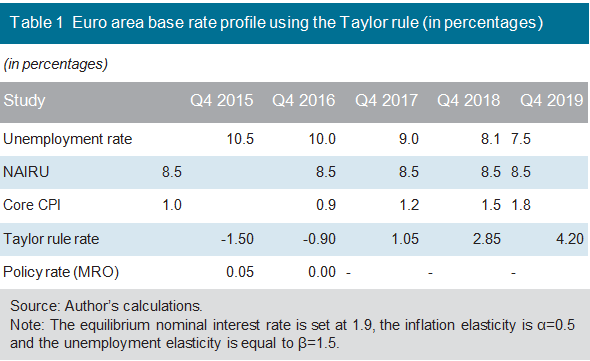

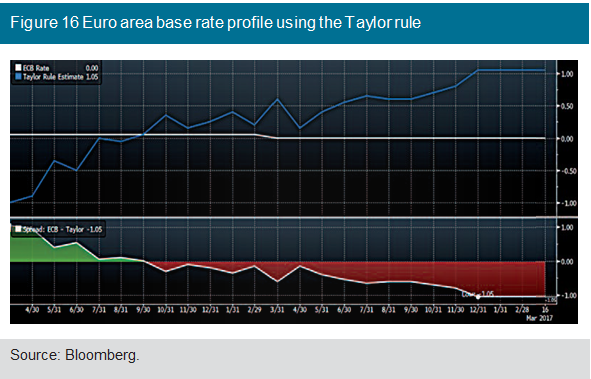

Table 1 below, which assumes a value of 3 for the Okun coefficient, provides a framework for thinking about the ECB monetary tightening (i.e. the first rate hike).

At the end of 2017, when bond purchases at the current rate will officially end, the policy rate generated by the Taylor rule will be at 1.05%, more than 100 basis points higher than the main refinancing operations (MRO) rate and 150 basis points from the deposit facility rate. At the end of 2018, the spread increases from 100 basis points to 280 basis points. This might suggest that early next year would be a reasonable time for the ECB to start tapering. In other words, the Taylor rule provides a rationale for tapering early next year. When the ECB ends all asset purchases (middle of 2018, end of 2018? I remain agnostic on that), that is the time, according to some analysts, when we should perhaps normally expect the first rate hike in the euro area.

Under a different scenario, that is, core inflation remaining unchanged at current levels (i.e. an erosion of inflation expectations and a very flat Philips curve) in the Taylor rule framework, the pressure to taper and raise interest rates is delayed by a considerable period of time (i /2018=1.95, i /2019=2.85).

When asked at the last Governing Council meeting ten days ago about the “or lower” pledge on rates, ECB President Draghi read out a statement he made one year ago, which said that the ECB no longer expects rates to be cut further. Hence, it seems that the easing bias on rates has already been meaningless for a long time. When asked about the exit sequence, he said that the guidance of rate hikes starting “well” after the end of QE was just an “expectation”. Hence, this also makes it sound pretty meaningless, as opposed to a well-thought out and collectively-agreed strategy. Finally, Draghi emphasised that the pledge to use all instruments, if needed, was dropped in order to signal less “urgency” about downside risks. This contradicts the pledges on lower rates and additional QE.

Here are some preliminary thoughts of mine on the sequencing of the ECB’s exit strategy:

Firstly, change forward-guidance rhetoric.

Secondly, move away from negative rates.

Thirdly, start proper tapering.

It seems that there may be two alternative routes in terms of sequencing for the ECB. The first is the one followed by the US Federal Reserve, in other words, interest rates rose only when the process of QE tapering was completed. A different sequencing may be followed by the ECB for at least two reasons. First of all, the sequencing of the Fed’s exit was based on the assumption that quantitative easing was merely a continuation of the policy model with different means, given that the interest rate threshold had been achieved.

Just as the Fed’s QE was launched when the Fed funds rate had reached its lowest level in late 2008, the sequencing was also reversed during the exit phase. However, unlike the Fed, the ECB has always pointed out that its non-standard measures are a complement, rather than a substitute for its standard policy. In other words, rates may be adjusted both ways, even when non-standard measures are still in place. The ECB has cut its rates twice following the start of its quantitative easing programme. There may thus be a case for raising rates before the start of the tapering phase. This scenario is bolstered firstly by the fact that the ECB, unlike the Fed, pays negative interest on banks’ excess reserves, a policy that could well be deemed as exceptional and transitory and that an upward adjustment of negative deposit rates would make sense, thereby reducing disruptions in the banking sector.

The second reason is associated with spillovers from the expected US policy shift, following Donald Trump’s election. Early last year, the Fed’s postponement of the rate tightening cycle had led to upward pressures on the euro’s exchange rate, forcing the ECB to mix standard and non-standard tools. Besides, in the coming period, contagion risks may drastically change. If the Trump administration manages to convince Congress to implement a large fiscal stimulus package, potentially coupled with import taxes, this could trigger a tightening of monetary policy much faster, as US Treasury yields and the dollar’s exchange rate overshoot.

Against this background, the ECB will be less concerned about the euro’s exchange rate and more about the risk of excessive contagion on the long end of the US Treasury yield curve, given that the exchange rate is more vulnerable to short-term than long-term interest rates, and while the asset purchase programme is a more appropriate policy for managing the yield curve (through the term premium), which may lead to delays in QE tapering and accelerate rate hikes.

4.2 Other issues on the ECB’s exit strategy

Of course, any discussion about exit strategies cannot simply be confined to the questions of timing and sequencing. It is a more complicated issue. Exit strategies are more difficult when unconventional monetary policies (UMPs) are implemented for a more extended period. The longer UMPs stay, the more difficult exit strategies are. Delaying the exit from ‘crisis’ monetary policies beyond what the central banks’ reaction function would warrant could also entail risks to financial stability, by triggering a further build-up of the very same exposures that render exit more challenging in the current environment. In particular, a protracted period of low interest rates and ample liquidity could compromise the market mechanisms in terms of efficiently allocating resources, hence encouraging the roll-over of loans to non-profitable businesses and weakening incentives for balance sheet repair.

A typical policy rate increase, for example, could prove less contractionary than usual in the presence of substantial excess liquidity in light of expanded balance sheets. It is essential to note that these two actions are complementary in the sense that they are both contractionary. The reason is that they both contribute to increased long-term interest rates, to higher exchange rates and, most likely, lower asset prices. Increasing the policy interest rate impacts the long-time rates through the well-tested channel of expectations. This, in turn, ceteris paribus reduces asset prices and raises the exchange rate. Asset sales by the central bank directly lower their prices; by draining liquidity, they raise interest rates. However, the two instruments have different effects at a more detailed level. Given that central banks hold a variety of assets partly as collateral in the case of the ECB― they need to decide which assets are relinquished first, and which later on. If the sovereign debt crisis is not fully resolved, selling specific country government bonds ―the bulk of the Eurosystem’s asset purchases will be either impossible (if the country has not recovered market access) or pretty difficult. This means that any exit strategy will have to follow a clear ending of the sovereign crisis.

In such expanded balance sheets, central banks face a sort of a growing maturity mismatch: on the asset side, one can find long-term items like government bonds as a result of the QE programme, while, on the other, their liabilities have remained of very short maturity, typically bank reserves, currency and government deposits. For many years ahead, bonds will remain in central banks’ balance sheets. How quickly central banks reduce their bond portfolio will depend on macroeconomic financial developments over the next several years. But before I analyse further the ECBs’ potential exit strategy scheme, I will take a look at the Fed’s approach to balance-sheet normalisation.

4.2.1 The US Federal Reserve’s exit strategy

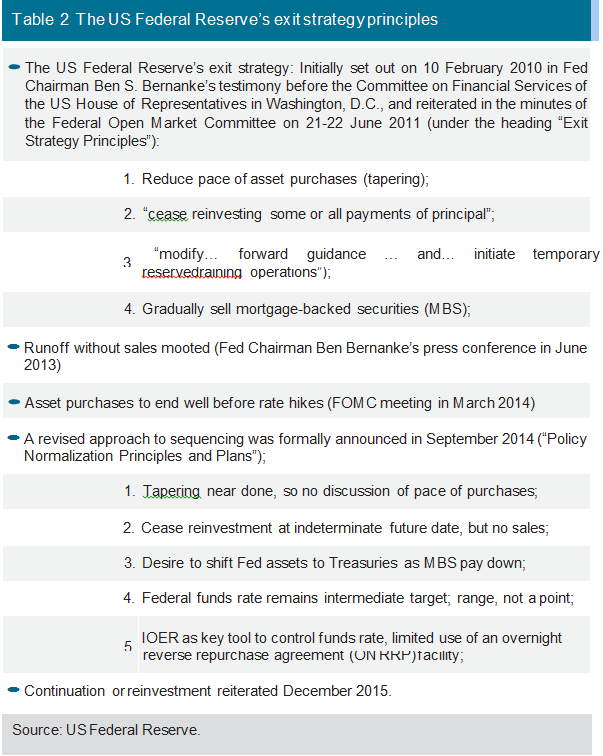

Starting in January 2014, the Fed began to reduce the pace of its bond purchases, and by October 2014, these purchases were halted completely. Currently, the Fed is continuing to reinvest coupons and principal payments, and it anticipates doing so until the normalisation in the level of the federal funds rate is well under way (e.g. 2% or more). The following table describes the Fed’s exit strategy principles.

4.2.2 Four important pending issues

Coming back to the ECB, here is an indicative list of four pending issues to be addressed when we come to the bridge (of exit strategies) and have to cross it!

First issue: Would the ECB simply be allowed to leave assets to mature, which would result in a gradual normalisation of the size of its balance sheet over several years?

The following options to this issue may then be considered:

Maturing assets not re-invested

This process will allow a gradual wind-down as assets come to maturity. In other words, when assets roll off automatically as they mature, the

central bank gradually scales back quantitative easing, signalling a gradual normalisation of its monetary policy, as long as the economy continues to record positive growth rates, moving away from the deflation risk.

Keeping expanded balance sheets as a “new normal”

Central banks may accept the new role of having an expanded balance sheet forever. This is not the best of choices, as many central bankers have openly stated that this is not their priority or role, however, if global economic conditions are consistently weak and inflation continuously undershoots the banks’ targets, this may become the new norm.

Second issue: Are central banks likely to rule out active steps to shrink their balance sheets, which does not make sense from a strategic point of view?

This option can be characterised as the active approach. Of course a central bank can actively sell assets it purchased in the course of different QE programmes. This will be most effective in circumstances of high inflation and future unanchored expectations indicating a higher inflation than the central bank’s target, or growth overheating compared with the central bank’s forecasts. From a strategic point of view, central banks will not perhaps want to rule out active steps to shrink their balance sheets. As the former Governor of the Bank of England, Sir Mervyn King, has noted, a central bank must keep the ability to sell the government bonds on its balance sheet, if needed, to maintain control of inflation (through higher interest rates).10

Third issue: If the central bank needs to sell assets, which might result in losses, how might this affect its policy credibility, independence and accountability?

Possible losses on these securities mean that there could be an erosion of capital in the central bank’s balance sheet and this could subject it to parliamentary criticism and actions that could weaken its ability to conduct monetary policy independently. In addition, this could be associated with a steepening of the yield curve as expectations of low short-term rates are reversed and central banks reduce their holdings of long-term securities, triggering a rise in volatility at the long end of the yield curve. These effects would be more pronounced if the speed of interest rate adjustment were to exceed market expectations. To preserve policy credibility and independence and ensure future policy effectiveness, it needs to clearly assume accountability in the context of exit. As far as the Bank of England is concerned, the UK government provides an indemnity to cover any losses arising from the asset purchase facility. The US Federal Reserve, meanwhile, would stop profit payments to the US Treasury, should it need to offset losses with future payments. We can only imagine the bad press that such losses resulting from balance sheet contraction could mean for the central banks on top of the criticism that the four major central banks are already subject to, as a result of their prolonged unconventional monetary policies. In short, getting central bank balance sheets back to more normal levels without surrendering monetary policy independence will require time and coordination with Finance Departments.

Fourth issue: Should the scaling back of a central bank’s balance sheet be discretionary or rules-based? Should these rules be quantity-based or price-based?

These are tough questions.

At one extreme, the central bank could seek to retain complete discretion. For reasons of forward guidance, unnecessary volatility in the capital markets and among ECB watchers etc., the central bank would still have to clarify how it would coordinate in some way with the fiscal authority. After all, no central bank would want to be seen as making the financing conditions of long-term government debt more difficult. At the other extreme, some believe that rules are more necessary when any government agency embarks on unorthodox policies. Alternatively, it could announce a fixed amount of sales to be executed over a given time period. A number of quantity-based rules can be considered. For example, the central bank could commit to stop purchasing new debt, as current bond holdings mature. Alternatively, it could announce a fixed amount of sales to be executed over a given timeframe. For instance, it might be possible to design the following scheme: the central bank could have discretion for bonds with a residual maturity of less than one year. But it could be subject to rules for longer-dated bonds.

Any quantity-based rule could also be subject to price-based constraints. For instance, the government could simply set a maximum for the benchmark yield, above which no central bank sales would be permitted. But this would deprive the yield curve of all allocative functions. So a softer version of such a rule might incorporate a range for the benchmark yield to guide the volume of sales: the central bank would enjoy complete freedom if the yield were below the rule’s lower bound, but would face progressively tighter limits as market yields rise. The central bank could be prohibited from selling bonds in volatile market conditions. This is the issue of “financial dominance”, namely, if the central bank fails to tighten policy when needed because it is anxious about the bond markets’ reaction.

In closing, the ECB has all the instruments at its disposal to ensure a smooth exit strategy. Non-standard measures are temporary and the market must have all the information to anticipate their unwinding and make adequate adjustments. Should liquidity conditions prove too lax, while central bank credit is still abundant, there are available instruments of liquidity reabsorption to tighten money market conditions. Some of these instruments have been tested successfully in the course of the crisis. Finally, a sound financial system is a necessary condition for an orderly exit from unconventional monetary policies, hence the importance of a swift implementation of the Banking Union in the euro area.

Clearly, any discussion on the ECB’s exit strategy is rather premature at the moment and the prevailing case is for caution.

1Decision (EU) 2015/774 of the European Central Bank (ECB/2015/10) established a secondary markets public sector asset purchase programme (PSPP), which expanded the Eurosystem’s existing asset purchase programmes to include public sector securities. The PSPP is part of the ECB’s expanded asset purchase programme (APP) alongside the third covered bond purchase programme, the asset-backed securities purchase programme and the forthcoming corporate sector purchase programme.

2Article 5(2) of Decision (EU) 2015/2464 of the European Central Bank of 16 December 2015 amending Decision (EU) 2015/774 on a secondary markets public sector asset purchase programme (ECB/2015/48)

3The European Central Bank’s Outright Monetary Transactions (OMT) scheme, providing for unlimited interventions in the secondary short-term bond market was unveiled by ECB President Mario Draghi on 6 September 2012 and has never been used.

4TARGET2 is the new trans-European payment system which replaced TARGET, the Trans-European Automated Real-time Gross Settlement Express Transfer System, launched in 1999 and comprising the national real-time gross settlement (RTGS) systems of EU Member States participating in the Economic and Monetary Union (EMU), the ECB payment mechanism and an interlinking mechanism.

5Letter from ECB President Mario Draghi to Members of the European Parliament Marco Valli and Marco Zanni, dated 18 January 2017 (L/MD/17/34).

6See ECB press release, Monetary Policy Decisions, 8 December 2016: “Regarding non-standard monetary policy measures, the Governing Council decided to continue its purchases under the asset purchase programme (APP) at the current monthly pace of €80 billion until the end of March 2017. From April 2017, the net asset purchases are intended to continue at a monthly pace of €60 billion until the end of December 2017, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim”.

7Introductory statement to the press conference by Mario Draghi, President of the ECB, and Vítor Constâncio, Vice-President of the ECB, Frankfurt am Main, 19 January 2017.

8See speech by Sabine Lautenschläger, Member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB, entitled “The test of progress – Europe, the euro and the future” at the Übersee-Club Hamburg, Hamburg, 24 January 2017.

9See speech by Yves Mersch, Member of the Executive Board of the ECB, Stiftung Marktwirtschaft: Expertentagung “5th Kadener Gespräch”, entitled “Behaving responsibly in a low interest rate environment: A central banker’s perspective”, Alveslohe, 10 February 2017.

10 See speech entitled “Monetary policy developments” by Sir Mervyn King, Governor of the Bank of England, to the South Wales Chamber of Commerce, Cardiff, 23 October 2012.