In Europe, alongside national instant payment solutions, including mobile payments, the work towards a pan-European scheme for instant payments in euro has focused on the Single European Payments Area (SEPA).

In Europe, alongside national instant payment solutions, including mobile payments, the work towards a pan-European scheme for instant payments in euro has focused on the Single European Payments Area (SEPA).

The design and implementation of the new scheme has required and ensured pan-European reachability and interoperability among PSPs.

Against this background and following the approval of the ERPB, the European Payments Council (EPC), representing Payments Service Providers (PSPs) announced the beginning of the PSPs' voluntary SEPA Instant Credit Transfer (SCTInst) adherence process.

A set of rules “SEPA Instant Credit Transfer Rulebook V.1.0” was issued on 30 November 2016 and entered into force on 21 November 2017.

The main difference between regular SEPA credit transfers (SCTs) and SEPA Instant credit transfers (SCTInst) is that SCTs are currently processed in batches submitted for intraday clearing and settlement, whereas SCTInst will be processed at a transaction level, in real time on any given day, within a few seconds (24/7/365).

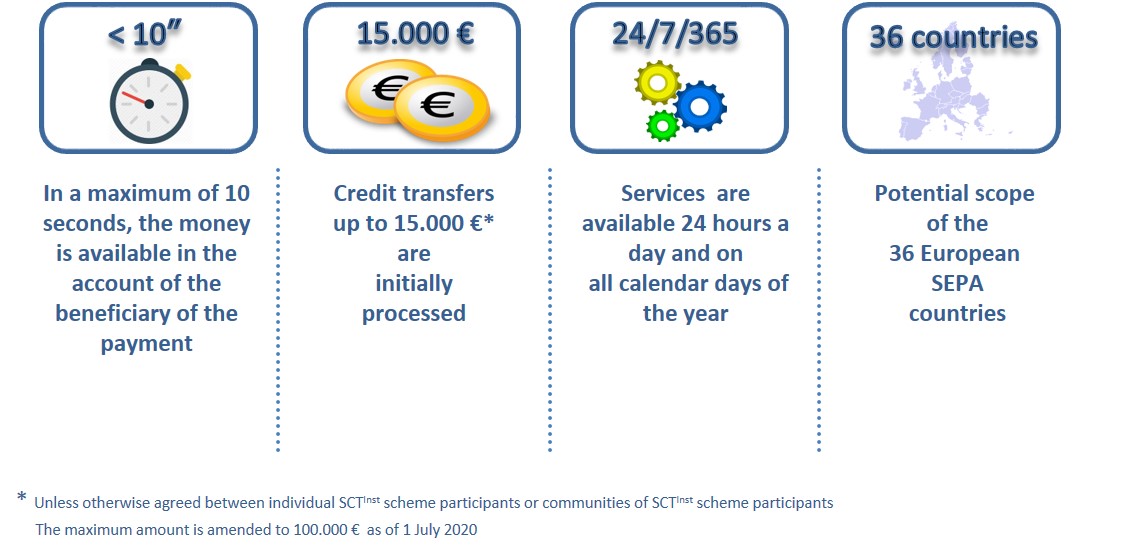

The key features of the SCTinst scheme are summarised below:

- Within a maximum of 10 seconds, the money will be available in the account of the beneficiary of the payment;

- Credit transfers up to €15,000 can initially be processed (unless otherwise agreed between SCTInst scheme participants);

- SCTInst transactions will be available on a 24/7/365 basis;

- Potential scope of the 36 European SEPA countries.