In November 2018, the Eurosystem launched the TIPS (TARGET Instant Payment Settlement) service, aiming to ensure that the growing demand for instant payments across the EU is effectively met and that the national solutions that have emerged as a response to such demand do not (re)introduce fragmentation into the European retail payments market.

This new market infrastructure service enables payment service providers (PSPs) to offer fund transfers to their customers in real time and around the clock, every day of the year. This means that, thanks to TIPS, individuals and firms can transfer money between each other within seconds, irrespective of the opening hours of PSPs. Thus, as part of its effort to promote the smooth and efficient functioning of payment systems, the Eurosystem expanded the scope of its TARGET services to support also the settlement of instant payments, offering EU-wide reachability and interoperability. TIPS, currently only settles payment transfers in euro. However, in case of demand, other currencies could be supported as well. (As of May 2022, TIPS will begin to settle instant payments in Swedish krona (SEK)).

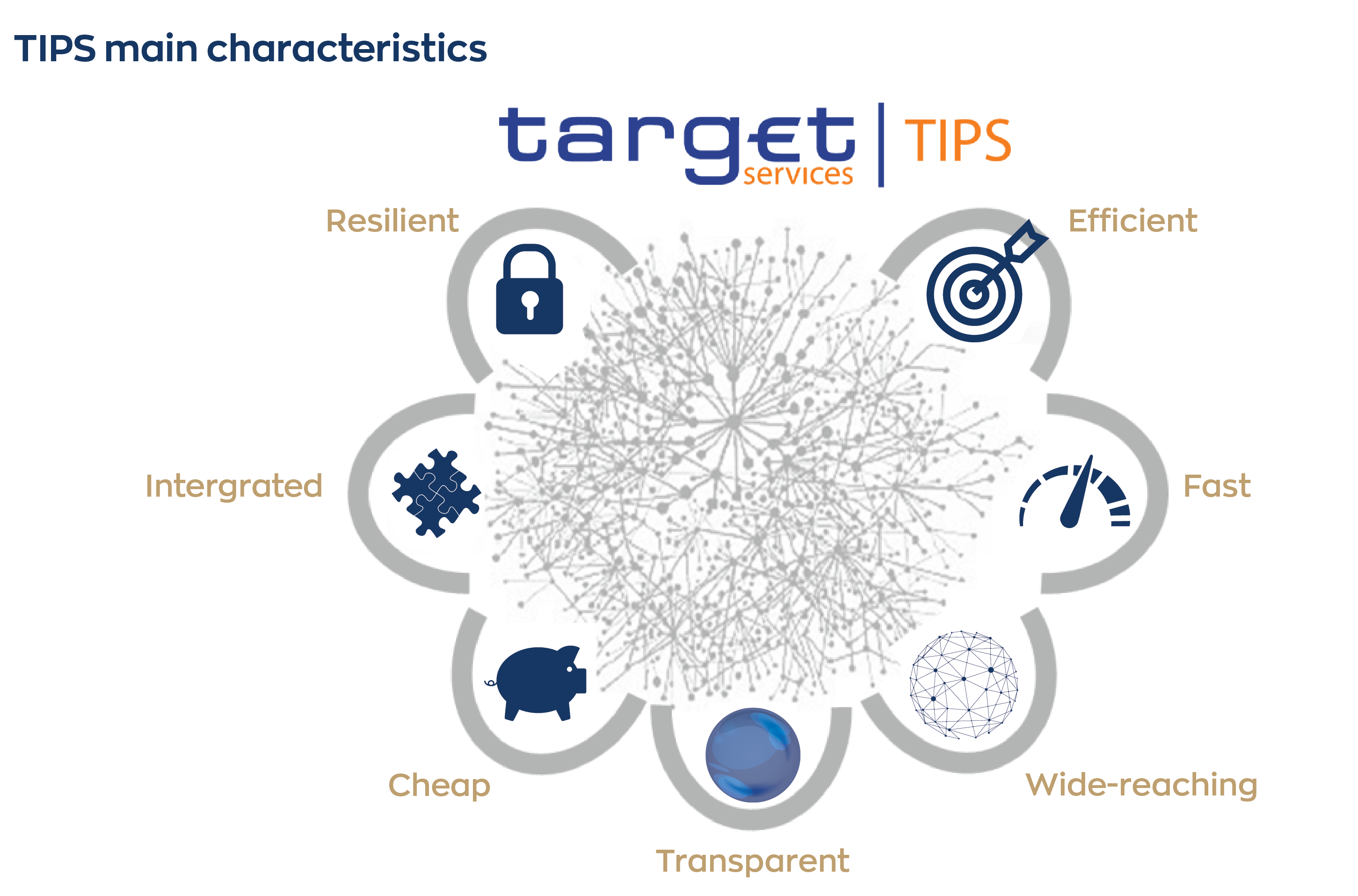

TIPS is a service based on a modern payment system architecture that successfully combines the advantages of a retail payment netting system and a large-value payment system (RTGS). As a result, it is capable of rapidly processing a large volume of payments at a relatively low cost. It is also in conformity with the strict Eurosystem oversight requirements and with CPMI-IOSCO guidance on cyber-resilience for financial market infrastructures. It is thus able to meet the settlement requirements for a pan-European instant payment solution (as specified by the European Payments Council − EPC) and to offer 100% protection against settlement risk, given that transactions are executed in central bank money.

There are two features of TIPS that will help it achieve reachability across the whole of Europe. First, TIPS is based on the SEPA Instant Credit Transfer (SCT Inst) scheme (maximum execution time end to end 10’’ and maximum amount limit per transaction is 100.000 €). Second, TIPS was developed as an extension of TARGET2, which already has an extensive network of participants across Europe. To ensure the full deployment of instant payments across the euro area by the end of 2021, on 22 July 2020, the Governing Council of the ECB decided that:

- Payment Service Providers (PSPs) which have adhered to the SEPA Instant Credit Transfer (SCT Inst) scheme and are reachable in TARGET2 should also become reachable in a TIPS central bank money liquidity account

- All Automated Clearing Houses (ACHs) offering instant payment services should migrate their technical accounts from TARGET2 to TIPS

All the relevant documentation pertaining to the onboarding procedure for current and potential TIPS participants are the following: