Statistics on Insurance Corporations: Q4 2020

03/03/2021 - Press Releases

Statistics on Insurance Corporations[1]: Q4 2020

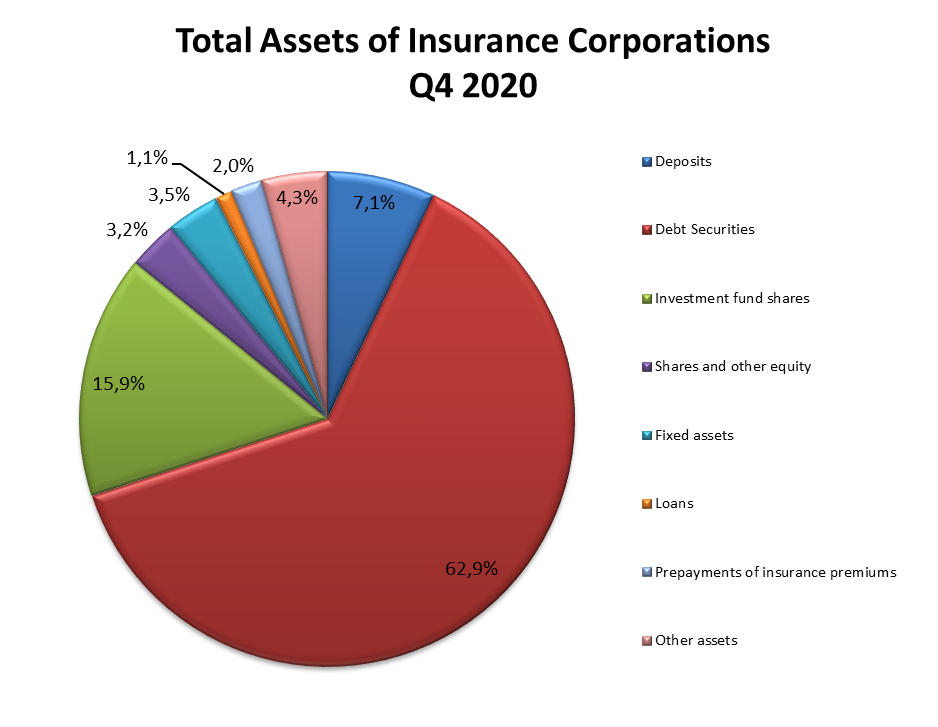

In the fourth quarter of 2020, total assets of insurance corporations increased to €19,965 million from €19,513 million in the previous quarter.

In further detail, the overall deposits of insurance corporations increased by €15 million to €1,414 million at the end of the fourth quarter of 2020. Deposits with domestic credit institutions increased by €56 million, while deposits with foreign credit institutions decreased by €41 million. Deposits accounted for 7.1% of total assets in the fourth quarter of 2020 compared with 7.2% in the previous quarter.

Total holdings of debt securities increased to €12,555 million in the fourth quarter of 2020 from €12,437 million in the previous quarter, due to the increase in prices of both domestic and foreign securities. It should be noted that during the fourth quarter of 2020 insurance corporations liquidated foreign debt securities and purchased domestic debt securities. Debt securities’ share in total assets decreased to 62.9% at the end of the fourth quarter, compared with 63.7% in the previous quarter.

Total holdings of investment fund shares increased to €3,175 million from €2,872 million in the previous quarter. Their share in total assets increased to 15.9% compared with 14.7% in the previous quarter. The increase in the value of these holdings is mainly due to net purchases of foreign investment fund shares.

Total holdings of shares and other equity excluding investment fund shares increased to €648 million in the fourth quarter of 2020 from €595 million in the previous quarter, due mainly to the increase in domestic stock prices. Their share in total assets stood at 3.2%, compared with 3.0% in the previous quarter.

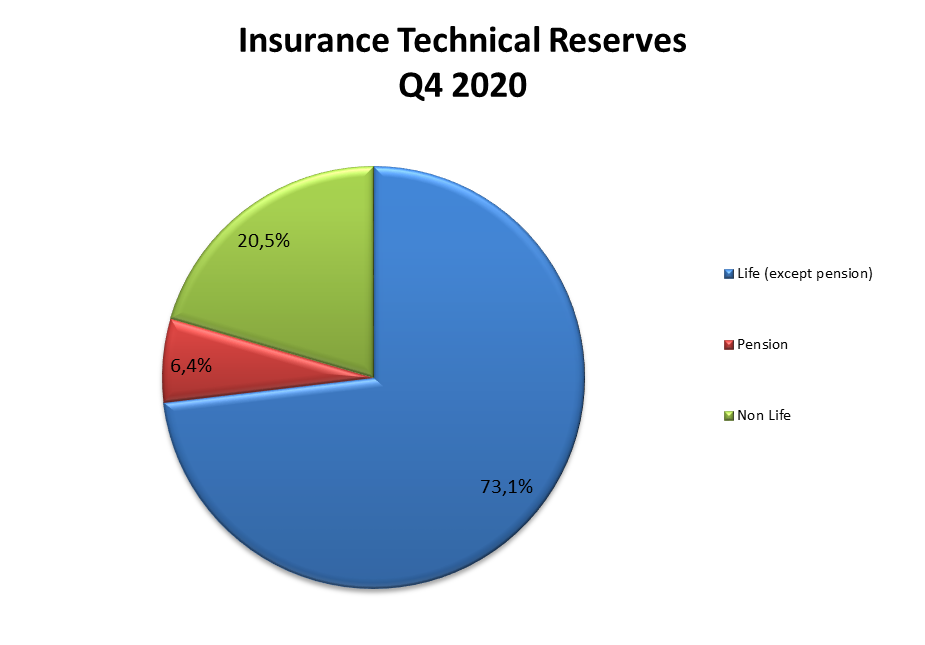

On the liabilities side, own funds increased by €180 million to €3,381 million at the end of the fourth quarter of 2020. Total insurance technical reserves increased by €280 million to €14,887 million, mainly due to the increase in life technical reserves by €332 million. Νon-life insurance technical reserves decreased by €52 million to €3,050 million. Life technical reserves (other than pension entitlements) accounted for 73.1% of total technical reserves.

Table 1: Balance Sheet of Insurance Corporations (EUR millions at the end of the period)

| Q3 2020 | Q4 2020 |

| Assets | | |

| Deposits | 1,399 | 1,414 |

| Domestic | 869 | 925 |

| Foreign | 530 | 489 |

| Debt Securities | 12,437 | 12,555 |

| Domestic | 4,899 | 5,252 |

| Foreign | 7,538 | 7,303 |

| Investment Fund Shares | 2,872 | 3,175 |

| Domestic | 885 | 980 |

| Foreign | 1,987 | 2,195 |

| Shares and other equity excluding investment fund shares | 595 | 648 |

| Domestic | 415 | 469 |

| Foreign | 180 | 179 |

| Fixed assets (net of depreciation) | 689 | 693 |

| Financial Derivatives | 10 | 5 |

| Loans | 164 | 217 |

| Prepayments of insurance premiums | 419 | 409 |

| Other Assets | 928 | 849 |

| Total Assets / Liabilities | 19,513 | 19,965 |

| Liabilities | | |

| Own Funds | 3,201 | 3,381 |

| Insurance technical reserves | 14,607 | 14,887 |

| Life insurance technical reserves | 11,505 | 11,837 |

| of which Pension entitlements | 950 | 950 |

| Non-Life insurance technical reserves | 3,102 | 3,050 |

| Loans | 132 | 130 |

| Other liabilities | 1,573 | 1,591 |

Table 2: Net flows[2] of investments of Insurance Corporations (EUR millions)

| Investments | Q3 2020 | Q4 2020 |

| Debt Securities | 184 | -26 |

| Domestic | -220 | 281 |

| Foreign | 404 | -307 |

| Investment fund shares | 162 | 169 |

| Domestic | 46 | 34 |

| Foreign | 116 | 135 |

| Shares and other equity excluding investment fund shares | 12 | 4 |

| Domestic | 7 | 9 |

| Foreign | 5 | -5 |

Chart 1

Chart 2

The complete data set of insurance corporations is published in the sub-section Aggregated balance sheet of insurance corporations on the Bank of Greece website.

Note: The next Press Release on “Statistics on Insurance Corporations” for the first quarter of 2021 will be published on 2 June 2021, according to the Advance release calendar, as published on the Bank of Greece website.

[1] Data to the Bank of Greece are submitted by the supervised insurance corporations as defined in article 1 of the Executive Committee Act 94/16.5.2016 concerning the single submission of national reports by insurance and reinsurance corporations to the Bank of Greece in the context of Solvency II for supervisory and statistical purposes.

[2] Net flows are derived from the change in the outstanding amounts of stocks corrected for revaluation and reclassification adjustments.