TARGET balances are the result of the cross-border payment flows executed through TARGET Services and are reflected in the net claims and liabilities of national central banks (NCBs) vis-à-vis the ECB.

Participants of the TARGET Services are the European Central Bank (ECB), the national central banks (NCBs) of the euro area Member States and the NCBs of Bulgaria, Denmark, Poland and Romania. In the context of a decentralised design, each NCB operates its own component of the system. TARGET-GR is the Greek component of TARGET. Participants in TARGET-GR are the Credit Institutions (CIs) operating in Greece, DIAS S.A., the Athens Clearing Office (ACO), the Hellenic Central Securities Depository (ATHEXCSD), the Athens Exchange Clearing House (ATHEXClear), the Energy Exchange Clearing House (EnExClear) and the Bank of Greece (BoG).

The payments settled via TARGET Services cover the full range of euro transactions.

TARGET Services settle:

- Eurosystem’s monetary policy operations

- net positions of other large-value and retail payment systems

- interbank transactions between NCBs and/or CIs participating in TARGET

- commercial transactions

- the cash leg of securities transactions (T2S)

- instant credit transfers (TIPS)

Each TARGET participant holds a Central Liquidity Management (CLM) account with an NCB. A TARGET payment is classified as “domestic” when it is made between two participants holding an account with the same NCB and as “cross-border” when they hold an account with different NCBs.

When a participant makes a cross-border payment via TARGET Services, the account held by the participant in its NCB is debited and the account of the counterparty held in another NCB is credited. This payment creates an equal liability of the payer NCB to the payee NCB. Accordingly, the cross-border payments via TARGET Services create corresponding claims and liabilities for the NCBs involved within the Eurosystem.

At the end of each TARGET business day (18:00 to 18:15 CET), these positions are aggregated and netted out on the basis of netting by novation. Bilateral claims and liabilities between NCBs become claims and liabilities only vis-à-vis the ECB. Therefore, the ECB substitutes all counterparty NCBs and each of them acquires a net position vis-à-vis the ECB.

To this end, special dedicated accounts - the CB ECB accounts - have been created for each NCB as well as the ECB, which record their cumulative claims/liabilities vis-à-vis the Eurosystem. As a result, all NCBs report a final cumulative position, claim or liability, vis-à-vis the Eurosystem on a daily basis. For BoG, this account is the BoG ECB account.

It should be noted that, at Eurosystem level, the sum of the balances of all NCBs' CB ECB accounts is by definition zero.

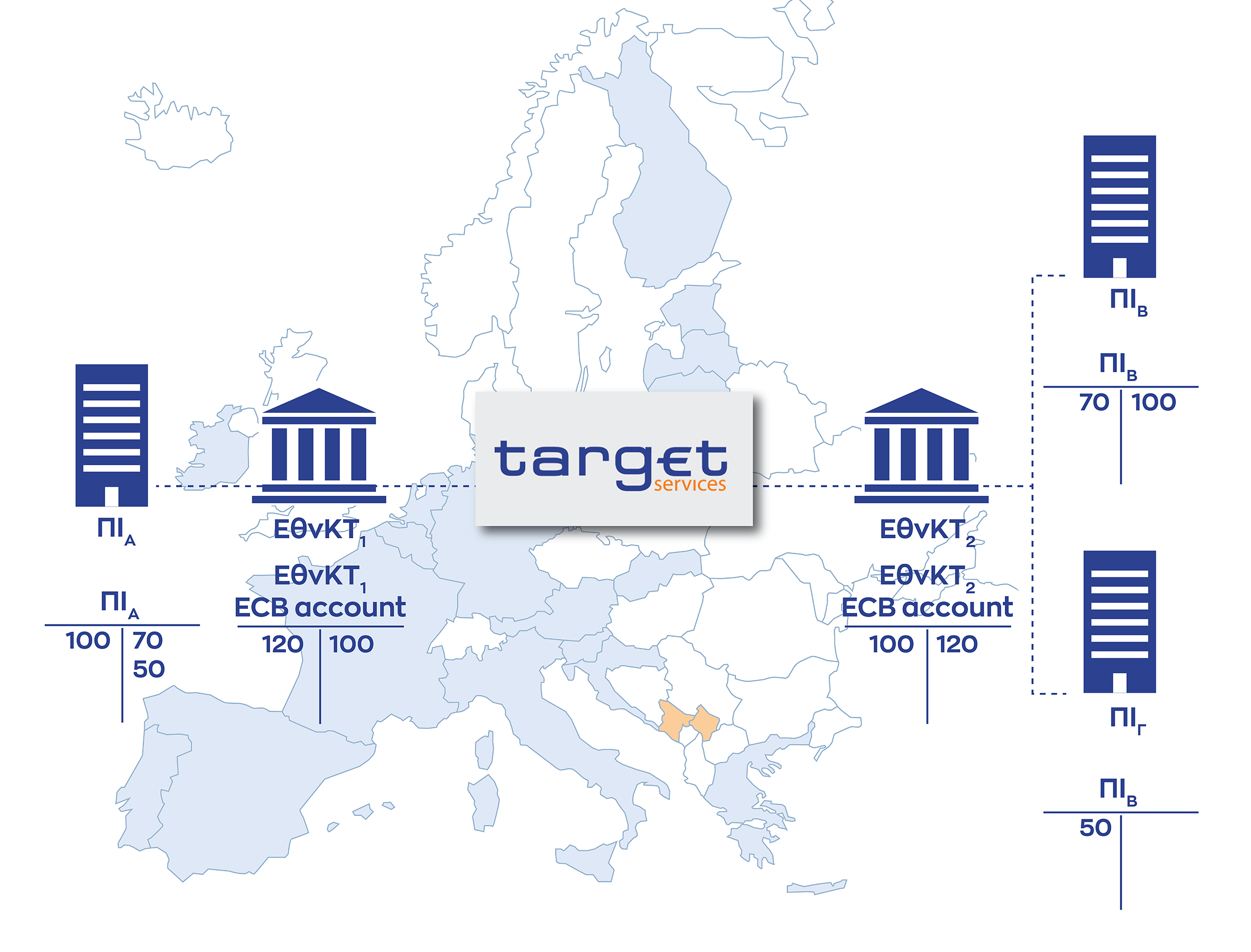

Example of a change in the balance of the CB ECB special account in TARGET

Let us take an example in which the following payments are made between CIΑ of Country1, and CIB and CIC of Country2:

- CIΑ makes a payment of € 100 to CIΒ. The account of CIΑ with NCB1 is debited, and the account of CIΒ with NCB2 is credited

- CIΒ makes a payment of € 70 to CIΑ. The account of CIB with NCB2 is debited, and the account of CIA with NCB1 is credited

- CIC makes a payment of € 50 to CIΑ. The account of CIC with NCB2 is debited, and the account of CIA with NCB1 is credited

FIGURE 1

At the end-of-day, all payments are aggregated and netted out at the Eurosystem level:

- NCB1 has a claim of € 20 vis-à-vis the ECB, as a result of the final net inflow of funds into the account of CIΑ

- NCB2 has a liability of € 20 vis-à-vis the ECB, as a result of the final net outflow of funds from the accounts of CIΒ and CIC

The following charts show the evolution over time of the balance (in € billions) of the BoG ECB account in TARGET, its maximum annual values, as well as its recent change both on an annual and a monthly basis.

FIGURE 2

_October25.png)

Notes:

The positive axis shows the balance of the BoG ECB account in TARGET in absolute terms and represents a liability to the Eurosystem. As the chart shows, the loan disbursements of the 2nd and 3rd programmes, during the periods when Greece did not have access to capital and money markets in 2012-2014 and 2015-2018, are partly reflected in the reduction of the account balance.

However, any economic interpretation of the evolution of the account warrants particular caution. For example, TARGET Services provide an ample freedom of connection choices to large banking groups operating across several Eurosystem countries, as well as the capability to manage their total liquidity from a single account. Consequently, the balances of the special accounts provide only indicative information, and in any case they do not offer a complete picture of the net financial cross border flows.