Κεντρική ομιλία του Υποδιοικητή της Τράπεζας της Ελλάδος, κ. Ιωάννη Α. Μουρμούρα, με τίτλο: “Global risks and prospects for 2019” στη Σιγκαπούρη σε συνέδριο του National University of Singapore Business School (ΑΓΓΛ)

25/01/2019 - Ομιλίες

1. Introduction

Dear Professors,

Distinguished panellists,

Ladies and Gentlemen,

I would like to thank the Centre for Asset Management Research and Investments at the National University of Singapore and OMFIF for the kind invitation and say that I am very happy to be back in Singapore. I was here in March 2016 upon an invitation from the Lee Kuan Yew School of Public Policy to discuss the role of negative interest rates in terms of the transmission of monetary policy and its impact. Today, my focus is on the main risks for the financial markets this year, which could result in heightened uncertainty across the global economy, prompting certain Cassandras to foretell a global economic downturn and even a recession.

The synchronized global expansion of 2017 gave way to a disparate growth picture in 2018. Growth in the United States has remained solid (2.9%), bolstered by fiscal stimulus. In contrast, activity in the euro area has been somewhat weaker than previously expected near 1.7%, owing to slowing net exports. In the emerging economies, growth edged down to an estimated 4.6% in 2018, as a number of countries with elevated current account deficits experienced substantial financial market pressures and appreciable slowdowns in activity. All in all, global growth is projected to moderate from 3.7% in 2018 to 3.5% in 2019, before picking up slightly to 3.6% in 2020, as economic slack dissipates, monetary policy accommodation in advanced economies is removed, and global trade gradually slows. According to IMF estimates, advanced-economy growth will gradually decelerate toward potential, falling to 2% in 2019 as monetary policy is normalized and capacity constraints become increasingly binding. Softening global trade and tighter financing conditions will result in a more challenging external environment for emerging economies with EMEs’ growth expected to tick down at 4.5% in 2019. In China, GDP growth slowed to 6.6% in 2018, its lowest annual rate since 1990. A further moderate slowdown in Chinese growth is expected this year (at 6.2%), as increased trade tensions could offset the positive effects of the stimulus package.

Before coming to the analysis of global risks for this year, which is the main topic of my lecture today, a short digression may be in order on the allegedly reduced role of globalisation.

Global inflation has generally remained contained in recent months in advanced economies (IMF estimate: 2.0% in 2018), while in emerging market economies, inflationary pressures are easing as a result of lower oil prices (IMF estimate: 4.5% in 2018).

According to World Bank and OECD national accounts data, global flows of trade in goods and services measured as a share of gross domestic product (GDP) had been on a steady rise until 2008, when they peaked at about 61% of GDP and have remained sluggish, having fallen to 56.2% in 2016.

Similarly, cross-border capital flows show that today globalisation is in retreat. Having reached their peak at 21.4% of GDP in 2007, global capital flows have been following a steady downward trend to 6.9% in 2017.

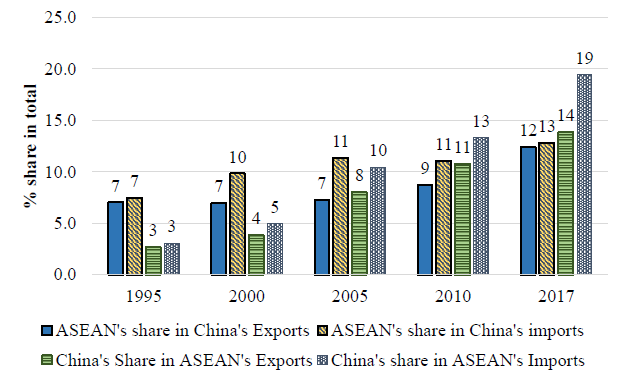

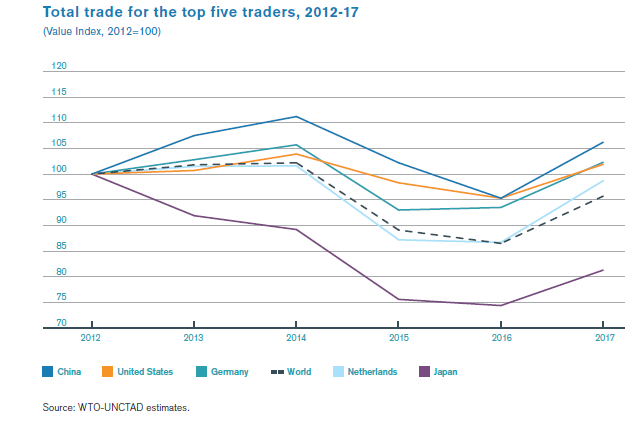

However, and this is my belief, there is a visible rise of powerful regions in economic terms, as the centre of gravity of the economy has been moving to the East, creating new regional blocs around the world’s major superpowers, e.g. China. China has already become an economic superpower and the economies comprising the Association of Southeast Asian Nations (ASEAN), now the world’s fourth largest trading bloc in terms of GDP, have significantly benefited from its rise, given that China is ASEAN’s most important trade partner. Total ASEAN trade has increased by about US$1 trillion between 2007 and 2017, with intra-ASEAN trade comprising the largest share of ASEAN’s total trade by partner (see Figure 1 for China’s rising trade share with ASEAN countries, which hit a peak in 2017).

Figure 1 China’s trade share with ASEAN and total trade for the top five countries

Source: Estimates from CEIC database.

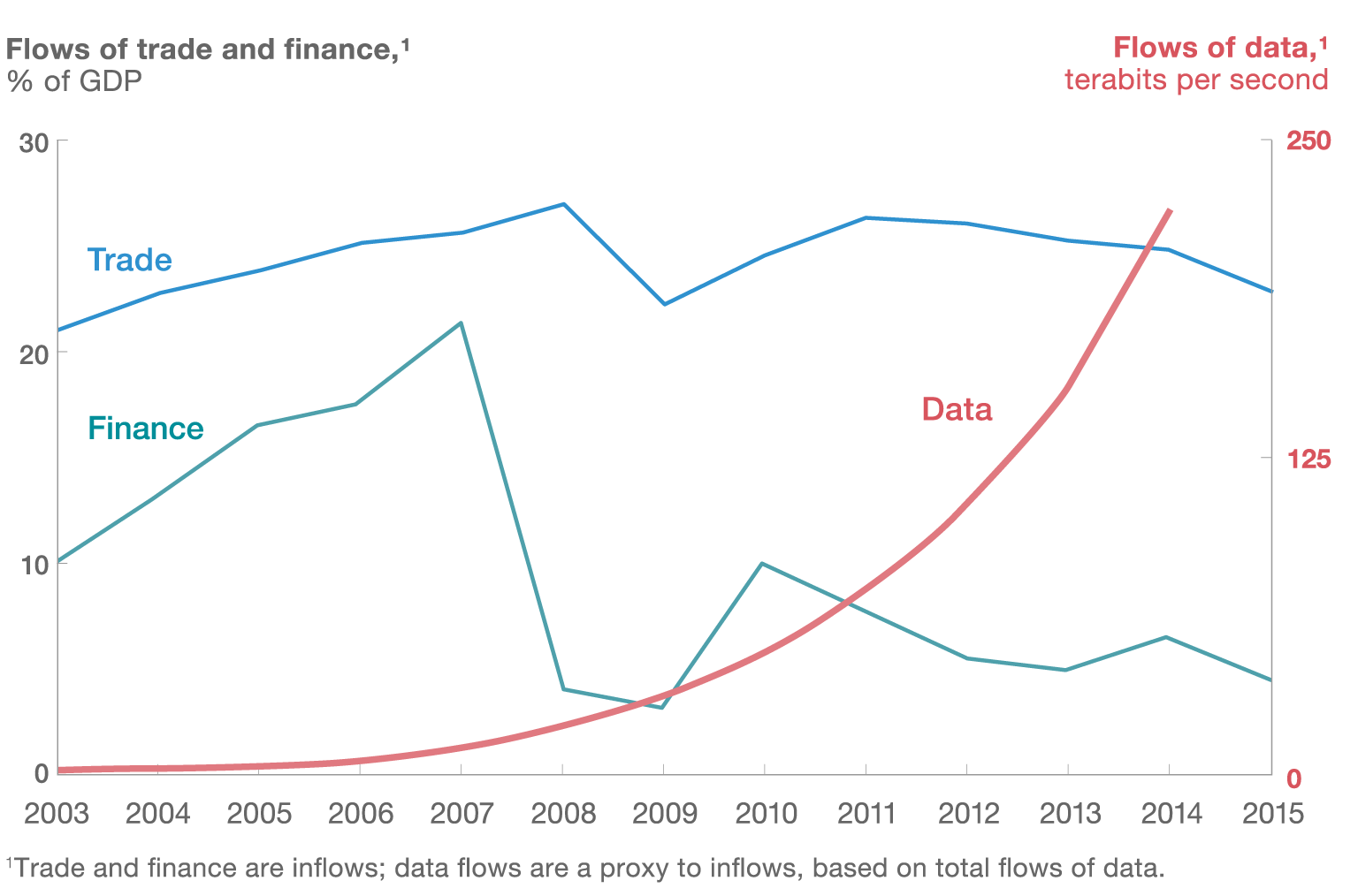

So we are not talking about a reduced role of globalisation, but a new kind or form of globalisation, on the back of the digital revolution (or the 4th industrial revolution), the emergence of blockchain in banking and financial markets and the predominance of information and communication technology, or ICT, with a significant impact of big data on trade and capital flows around the world. It is obvious from Figure 2 below, an enormous surge in big data flows, which increased seven-fold, outpaced the flows of trade and finance, which dropped since the last global financial crisis.

Figure 2 Global flows of data have outpaced traditional trade and financial flows

Source: McKinsey Quarterly - April 2017, p. 4.

2. Two major risks for 2019

2.1 Trade war: Where do we stand now?

Let me start with the trade war between the United States and China, which for many is the key risk for the year ahead (see Table 1). Even though this has not led to a significant slowdown in world trade, thanks in particular to the robustness of US demand, the negotiations are expected to remain a key topic in 2019. The latest round of actions (10% tariffs on US$200 billion of US imports from China and 5-10% tariffs on US$60 billion of China’s imports from the US) are set to make a more material economic impact than previous ones [insert Table 1].

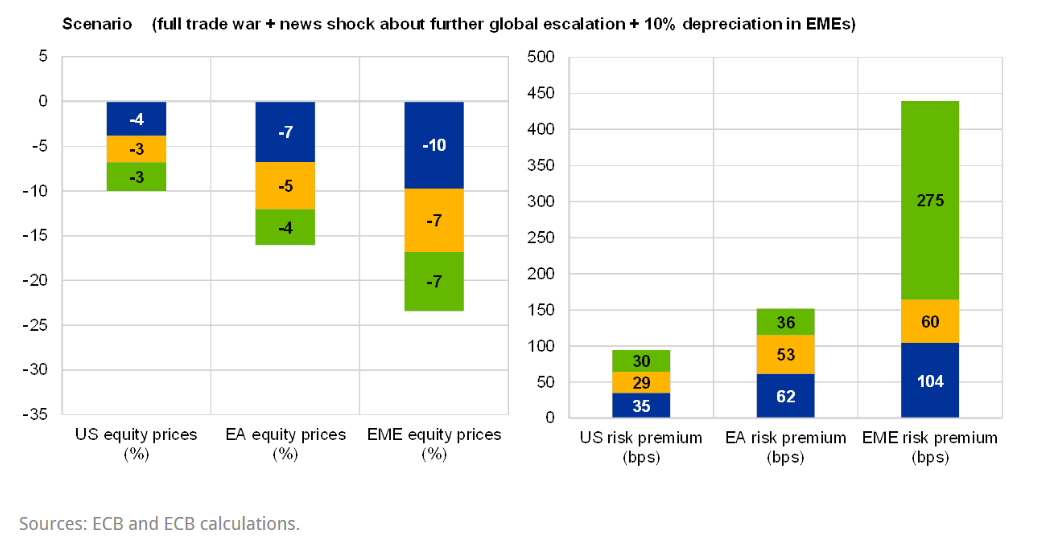

More recently, on 1 December 2018, the presidents of the US and China reached a 90-day truce on the raising of tariffs, conditional on efforts made by Beijing with regard to demands from the US. If no significant progress is made, the increase of 10% to 25% on US $200 billion of imports from China would take effect on 1 March 2019. Estimates from the Peterson Institute in Washington DC suggest that the US now has tariffs on 12% of its total imports, while the combined trading partner retaliation covers 8% of total US exports, with the latest round having a bigger impact on households as more consumer goods have become subject to tariffs. A further increase in the tariffs that the US applies to Chinese imports − from 10% to 25% in early 2019 – could negatively affect business and financial market sentiment. As a recent ECB publication (1) shows, an escalation to a more generalised trade war could lead to a significant drop in asset prices (see Figure 3).

Table 1 Timeline of trade tensions since January 2018

Source: Bloomberg.

Figure 3 Full trade war impact on asset prices across the globe

In this scenario, US equity prices would fall by about 10% and US corporate bond spreads would increase by up to 100bps in the first year. In the euro area, equity prices would fall by 15% and corporate bond spreads would increase by 150bps in the first year.

However, since the start of the year an apparent progress in the US-China negotiations has been made as the rhetoric around them has appeared to soften, but the outcome is still hard to predict.

2.2 Uncertainty over global monetary policies

Last year global monetary policy stances diverged. At one end of the spectrum was the US Federal Reserve which raised its key interest rates 4 times from 1.50% to 2.50% confirming its gradual approach to monetary tightening. At the other end, the People’s Bank of China, and the Bank of Japan continued their ultra-loose monetary policies, while European Central Bank concluded its quantitative easing via PSPP. 2019 seems to be a different story from a central bank perspective as a “risk management” approach seems to prevail. Let me give you briefly my own insights on the global policy outlook:

Starting with the Fed: After the dovish speech by the Fed Chair Jerome Powell earlier this month at the Economic Club of Washington D.C., which set the record for a data-dependent monetary policy, following the Fed’s projection for a GDP growth rate of 2.3% in 2019, the market participants no longer price in any hike in the Fed Funds rate this year. Most likely though, we might have one rate hike until the end of the 1st half of 2019.

Turning to the ECB, the ECB will continue reinvesting the principal payments from maturing securities purchased for an extended period of time, contributing to accommodative monetary policy and favourable liquidity conditions. Moreover, markets expect the ECB to extend its long-term loan programme to the banking sector (TLTRO). At yesterday’s GC meeting, the ECB left its key interest rates unchanged, while it said it intends to continue reinvesting maturing securities under its asset purchase programme for an extended period of time past the date when it starts raising the key interest rates. The ECB also left its forward guidance unchanged, but moved to describing growth risks “on the downside” and did not take any decision on TLTROs.

Regarding the BoE, monetary policy remains subject to the outcome of Brexit. The high level of uncertainty forces the status quo to prevail in the short run. Hence, the basis for the Bank’s ‘hawkish’ policy signalling seems more doubtful.

In Japan, the BoJ maintained its deposit rate at -0.10% and its 10-year target yield close to 0.00%. It also announced that it would extend this policy on a long-term basis due to low inflation, so there is no monetary tightening in sight. However, in order to pursue this exceptional policy, the BoJ has decided to grant increased flexibility for the 10-year yield compared to target.

Last but not least, the People’s Bank of China (PBoC), continues its accommodative monetary policy expanding the liquidity offered to the banking system in 2019 by strengthening the measures put in place in 2018. Furthermore, earlier this month, PBoC decreased by 100 basis points in its reserve requirement rate, bringing it to 13.5% for big banks.

One last comment for global monetary policy outlook. The lack of significant monetary tightening in large advanced economies in 2019 does not mean that liquidity will return, since global liquidity will tighten, as central banks continue in their normalisation process.

3. Other risks

3.1 The US $247 trillion global debt mountain

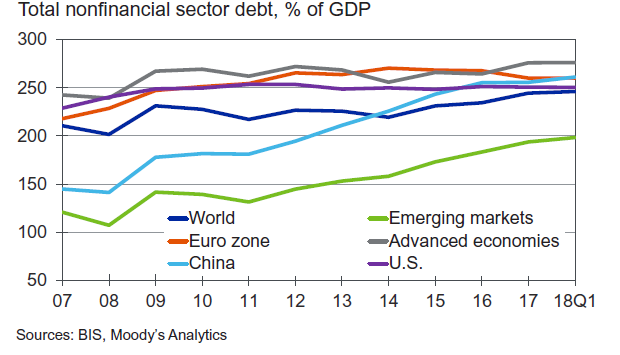

Another alarming feature for the global growth outlook is the global debt levels which have reached new records both in dollar terms and in relation to GDP. Total global debt owed by households, governments, non-financial corporates and the financial sector - reached 318% of gross domestic product, while excluding the debt of financial companies like banks, total gross world public and private debt reached a record 246% of GDP exceeding the previous record of 213% in 2009 (see Figure 4).

Figure 4 Debt rises across the globe

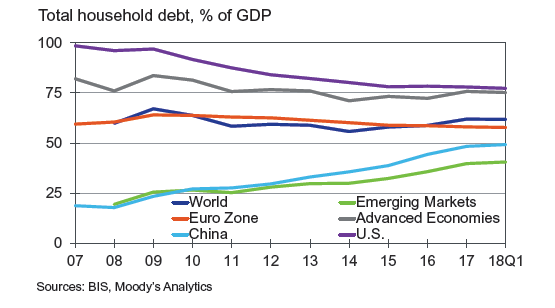

A higher proportion of the debt has accumulated in China and other emerging markets. Indeed, China’s total non-financial debt has risen over the past 10 years from 141% of GDP in 2008 to 261% in the first quarter of 2018. It has risen above the ranks of other emerging mar¬kets to exceed that of the US and match the eurozone’s. Moreover, China’s house¬hold debt hit a record high at almost 50% of GDP in the March quarter of 2018, according to the BIS (see Figure 5).

Figure 5 China’s household debt run-up

Elsewhere, Japan and the US account for more than half of that global debt, while in the euro area, government debt remains at very high levels, around 85%. Finally, public debt in the emerging markets has increased by 11% of GDP over the past five years, reaching 51% in 2018, approaching levels last seen during the 1980s debt crisis driven mainly by sizeable fiscal deficits and the domestic currency depreciations vis-à-vis the US.

3.2 Brexit

As far as Brexit is concerned, with the deadline approaching, financial services firms have no choice, but to continue preparing for the worst outcome ("no deal"), hoping for the best. The closer we get to 29 March without a deal, the more business from the City of London will be transferred and staff either hired locally or relocated. Many companies have already confirmed they are moving or adding staff and/or operations elsewhere. It has been projected that up to 7,000 jobs may relocate from the City to Dublin and Paris, and more firms will relocate to New York, so why not also to Singapore?

Following the heavy defeat of PM May’s EU Withdrawal Agreement at the House of Commons on Tuesday 15/1, there are now four possible Brexit scenarios: 1. A delayed Brexit 2. No-deal Brexit 3. A second referendum and 4. A general election.

I am probably not the ideal person to project on the final outcome, although I have lived in the UK for more than a decade. The British are probably the most sophisticated electorate in Europe, but for me as a pro-European, all I can say is that even great nations sometimes make mistakes. Having said that, I have confidence in British diplomacy and UK institutions, so no matter what, the UK will face economic hardship in the short-term, but in the medium-term the country, including the City of London as a major financial center, will not only sail through, but also thrive.

3.3 European elections

2019 is a year of multiple elections in the EU, the most significant of which is the vote for the new European Parliament, without the UK. There are three risks arising, first of all, from the electoral uncertainty and what kind of a parliamentary formation will come out of the European elections, from migration, a risk which is also linked with the general situation in terms of geopolitics in our continent and beyond and, last but not least, populism.

Next May’s elections for the new European Parliament are going to be the litmus test of populist strength. If the ruling class and mainstream political parties do not show evidence that they have truly heard the message from ordinary people on the street (who are worried about migrants and jobs), the electorate will want to “punish” the political and technocratic elites with their vote. In the event of much broader support for populist/nationalist parties at next year’s elections, the populists might be setting the agenda in European politics as an unofficial alliance against pro-European forces. Lacking the pragmatism of mainstream parties, populists risk shifting away from the pro-business, pro-market policies towards some form of “big government”.

Some other notable parliamentary elections in Member States are in Belgium in May 2019, Denmark in June 2019, Estonia in March 2019, Finland in April 2019, Portugal in October 2019 and also in my own country, Greece by October 2019 (see Table 1).

Table 2 Some European countries heading to the polls in 2019

|

Belgium

|

federal and regional election

|

|

Denmark

|

general election

|

|

Estonia

|

parliamentary election

|

|

EU

|

European Parliament election

|

|

Finland

|

parliamentary election

|

|

Greece

|

parliamentary and regional election

|

|

Lithuania

|

presidential election

|

|

Portugal

|

parliamentary election

|

4. FX and fixed income markets outlook

Both the start and end of 2018 were characterized by market turbulence due to uncertainty on the sustainability of synchronized global economic growth and accommodative monetary policies, while many of last year’s problems remaining to be addressed. Taking into account the abovementioned risks, sharp bouts of risk-off will be a recurrent theme in 2019 and could catch markets by surprise. Hence, 2019 will require investors to embrace a more prudent approach, and the sustainability of future returns will be the name of the game in 2019. In particular:

In the foreign exchange market, US dollar strength was a predominant theme in 2018, thanks to US outperformance amid a strong procyclical fiscal stimulus, especially through tax cuts. Looking forward, trade war uncertainties, risks of a no-deal Brexit and Italian debt woes may keep the dollar underpinned. But as the Fed is shifting to a much more data-dependent approach there is high probability of a monetary pause. Elsewhere, the pound sterling is in the hands of politics and the terms of the impending Brexit. Uncertainties will weigh near term, but an orderly ‘deal’ exit from the EU leaves scope for a visible rebound of sterling in the first half of the year. Finally, further escalation in the trade war will weigh on the Chinese currency.

Turning now to the fixed income markets, in 2018 the US government bond yields moved higher for much of the year, while the other global bond yields remained low. The 2-year Treasuries offered around 90% of the 10-year yield with only one-fifth of the duration risk. Looking into 2019, a further flattening of the yield curve is expected, with the long end of the curve moving up less than the short end and the US 10-year government bond yield is expected to remain within its recent trading range, moving gradually higher, near the area of 3%. Turning to the euro area, and given that the correlation between US Treasuries (USTs) and German Bunds has remained high (70%), the latter should follow USTs, but only drift slightly higher from their low levels given modest inflation expectations, the euro area’s weak economic momentum and enhanced political risks.

Thank you very much for your attention!

(1)European Central Bank, The resurgence of protectionism: potential implications for global financial stability, 27/11/2018.